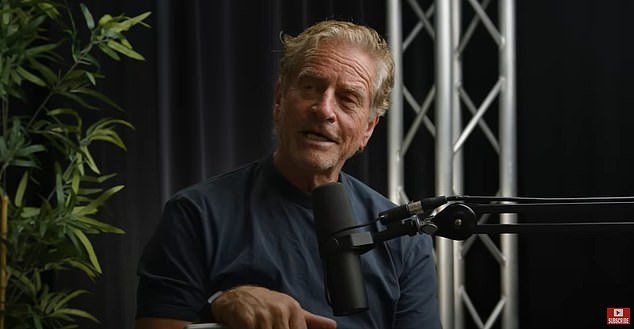

Finance guru Mark Bouris blasts Anthony Albanese’s solution to the housing crisis: ‘It’s window dressing’

Finance guru Mark Bouris has blasted ‘bull***t’ government legislation designed to ease Australia’s crippling housing shortage, saying it will achieve very little.

Under a new policy of the Albanese government, there will be a two-year temporary ban on non-citizens buying existing dwellings from April 1.

‘The way it was served up, it was ‘foreign buyers won’t be able to buy’ but it’s really just limited to established homes,’ the Wizard Home Loans founder said on his Property Insights podcast this week.

‘I don’t think it’s going to make a huge difference.

‘So it’s all bulls***t. It’s just window dressing.’

Under the new law, foreign buyers will be limited to purchasing new builds, with existing homes off limits until March 31, 2027, unless an exception applies.

Exceptions include permanent residents, New Zealand citizens and spouses of Australian citizens when the property is purchased as joint tenants.

An exception also applies to investments that significantly increase or support the availability of housing supply, and for the Pacific Australia Labour Mobility (PALM) scheme.

Finance guru and podcaster Mark Bouris (pictured) slammed new legislation passed by Labor that aims to solve Australia’s crippling housing crisis

Principal of solicitors firm NL Legal Nicole Leggat (pictured) agreed with Bouris that the new policy would do little to keep house prices down

Mr Bouris was joined by Nicole Leggat, the principal of solicitors firm NL Legal, to discuss the upcoming ban.

‘I can sort of see the reason behind the policy, allegedly it will keep prices down – I don’t think it will,’ he said.

‘We’re not talking about millions of transactions from foreigners, they’re not exactly flooding the market and buying everything are they?’

Ms Leggat agreed there was no ‘flood’ of foreign buyers in the housing market.

‘Not in my experience,’ she said.

‘But there are some [buyers], definitely within Sydney’s east.’

Mr Bouris went so far as to suggest that, without demand from foreign buyers, top-end houses that could have sold for $12million will now only sell for $10million.

‘It’s not like they are keeping a nice, young family out of a $12million home, they are further down the chain,’ he said.

Finance guru Mark Bouris (pictured) slammed the government’s temporary ban on foreign buyers in the housing market as ‘window dressing’

Ms Leggat also explained how the temporary ban could backfire on government finances.

‘There’s also the loss of the revenue to the government when you think about the foreign investment review board fees that they were getting from them as well, which is huge,’ she said.

‘I don’t think it is going to make a huge difference but I definitely think it will do something.’

After the two-year ban, the government will review the impact of the policy and decide whether to extend it.

Australia’s rental vacancy rate plunged to a record-low of one per cent in November, as an influx of international students competed with locals for somewhere to live, sending prices soaring.

That rising demand also saw house purchase prices in Sydney, Brisbane and Perth last year surge by double-digits despite the Reserve Bank raising interest rates for the 13th time in 18 months to a 12-year high of 4.35 per cent.

The ATO said it will enforce the ban by screening foreign investment proposals relating to residential properties.

The Labor government is also planning to crack down on land banking by foreign investors (pictured, a house for sale in Sydney)

When the policy was announced in February, Housing Minister Clare O’Neil released a statement with Treasurer Jim Chalmers explaining its rationale.

‘The ban will mean Australians will be able to buy homes that would have otherwise been bought by foreign investors,’ she said.

‘We’re cracking down on land banking by foreign investors to free up land to build more homes more quickly.’

Land banking is the practice of buying a greenfield area as an investment and holding for future use.

Ms O’Neill said the government will ‘take a tougher stance on compliance of foreign investment approvals’ for vacant residential land development.

The Liberals have been vocal about the need to restrict foreign buyers in the high expensive Australian housing market.

Opposition Leader Peter Dutton made a promise in his budget reply in 2024 that the Liberals would ensure a two-year ban on foreign investors and temporary residents buying existing homes.

Source link