Morningstar Inc (MORN) Posts Robust Q4 and Full-Year 2023 Financial Results

-

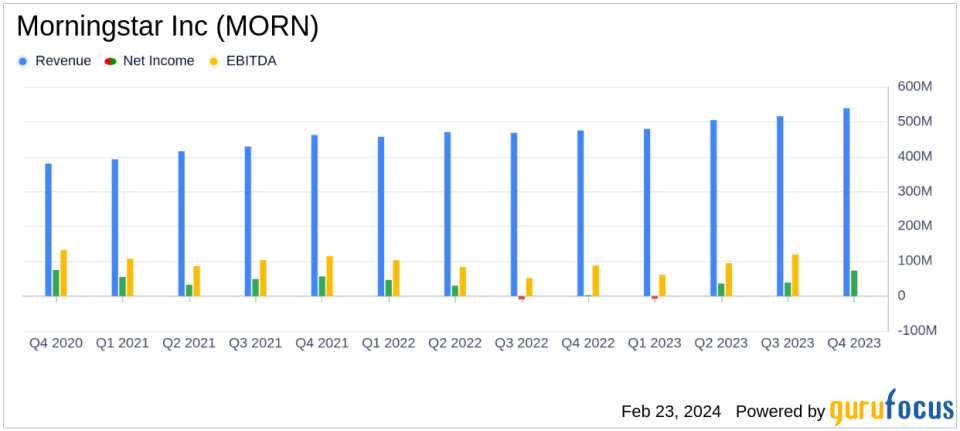

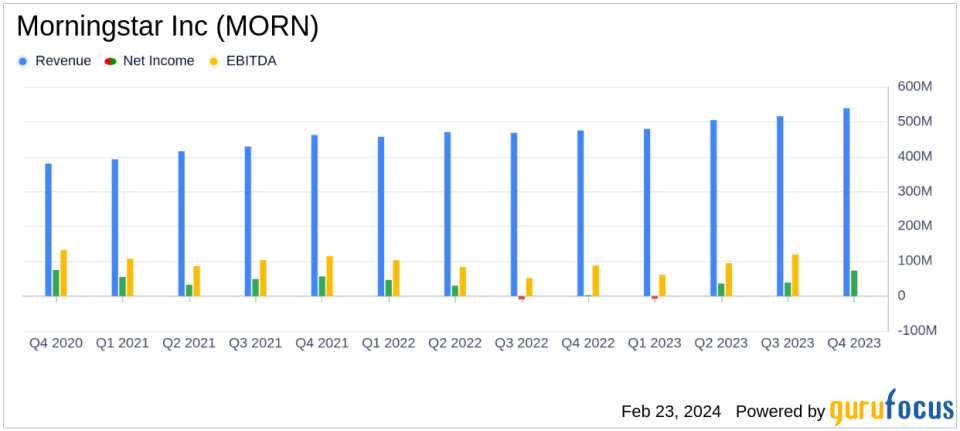

Revenue Growth: Q4 reported revenue up 13.4% to $538.7 million; full-year revenue crosses $2 billion, up 9%.

-

Operating Income Surge: Q4 operating income jumps 165.9% to $94.4 million; full-year operating income grows 37.4% to $230.6 million.

-

Earnings Per Share: Q4 diluted net income per share increases to $1.71; full-year diluted net income per share doubles to $3.29.

-

Free Cash Flow: Q4 free cash flow up 59.9% to $107.8 million; full-year free cash flow rises 17.2% to $197.3 million.

-

Product Contributions: PitchBook, Morningstar Data, and Morningstar DBRS lead revenue growth in Q4.

On February 22, 2024, Morningstar Inc (NASDAQ:MORN), a leading provider of independent investment research, released its 8-K filing, detailing a strong financial performance for both the fourth quarter and the full year of 2023. The company, known for its data and research services across various investment types, saw a significant uptick in revenue, operating income, and earnings per share, with CEO Kunal Kapoor highlighting the crossing of the $2 billion revenue threshold for the fiscal year.

Morningstar Inc (NASDAQ:MORN) operates primarily in data and research sectors, providing valuable insights to financial advisers, asset managers, and investors. The company’s comprehensive offerings include real-time market data, analyst research, and investment management services, with the United States being its largest revenue-generating region.

The company’s performance in the fourth quarter was particularly strong, with reported revenue increasing by 13.4% to $538.7 million, and organic revenue growing by 12.6%. This growth was driven by contributions from license-based products, asset-based products, and transaction-based revenue. Operating income for the quarter saw a remarkable increase of 165.9% to $94.4 million, with adjusted operating income rising by 70.2%. Diluted net income per share for the quarter was $1.71, a significant increase from the $0.08 reported in the same period of the previous year.

For the full year, Morningstar Inc (NASDAQ:MORN) reported a 9.0% increase in revenue to $2.0 billion, with organic revenue up by 7.5%. The full-year operating income grew by 37.4% to $230.6 million, and adjusted operating income increased by 9.2%. The diluted net income per share for the year doubled to $3.29, compared to $1.64 in the prior year. The company also reported a healthy cash flow, with operating activities providing $316.4 million, up 6.2%, and free cash flow increasing by 17.2% to $197.3 million.

The company’s balance sheet remained robust, with cash, cash equivalents, and investments totaling $389.0 million as of December 31, 2023. Debt was reduced to $972.4 million from $1.1 billion the previous year. The company’s capital allocation included a reduction in debt by $137.2 million, dividend payments of $63.9 million, and minor share repurchases.

Product-wise, PitchBook, Morningstar Data, and Morningstar DBRS were the top three contributors to consolidated and organic revenue growth in the fourth quarter. PitchBook’s revenue increased by 19.1%, Morningstar Data’s by 14.4%, and Morningstar DBRS’s by 21.3% compared to the prior-year period.

“We finished 2023 on a strong note, crossing $2 billion in revenue for the fiscal year and delivering meaningful increases in organic revenue, margins, and cash flow for the quarter,” said Kunal Kapoor, Morningstar’s chief executive officer.

Overall, Morningstar Inc (NASDAQ:MORN) demonstrated a solid financial performance in 2023, underpinned by growth across its product lines and strategic initiatives. The company’s focus on integrating its offerings and launching new products such as the Morningstar PitchBook Global Unicorn Industry Vertical Indexes has positioned it well for continued success in the investment research industry.

Explore the complete 8-K earnings release (here) from Morningstar Inc for further details.

This article first appeared on GuruFocus.

Source link