Surpasses Revenue Forecasts with Robust Financial …

-

Net Income: Reported $111.3 million, surpassing the estimated $86.67 million.

-

Earnings Per Share (EPS): Achieved $0.59, exceeding the estimated $0.53.

-

Total Revenue: Reached $642.8 million, significantly exceeding the estimated $318.71 million.

-

Adjusted EBITDA: Recorded at $202.8 million, with an Adjusted EBITDA Margin of 55.3%.

-

Share Buybacks: Executed $35.8 million worth, representing 2.0 million shares.

-

Dividend: Announced a quarterly cash dividend of $0.24 per share, payable on June 15, 2024.

-

Additional Share Repurchase Authorization: Board authorized an additional $500 million for share repurchases over the next two years.

Virtu Financial Inc. (NASDAQ:VIRT), a prominent technology-driven financial services provider, announced its first-quarter earnings for 2024 on April 24, 2024. The company reported a net income of $111.3 million and earnings per share (EPS) of $0.59, which notably exceeded the estimated EPS of $0.53. The detailed financial outcomes are disclosed in their recent 8-K filing.

Virtu Financial operates primarily through two segments: Market Making and Execution Services, with the majority of its revenue generated in the United States. The firm specializes in market making across various financial markets, including equities, options, fixed income, currencies, and commodities, leveraging advanced technology to provide liquidity and execute trades efficiently.

Financial Highlights and Performance Metrics

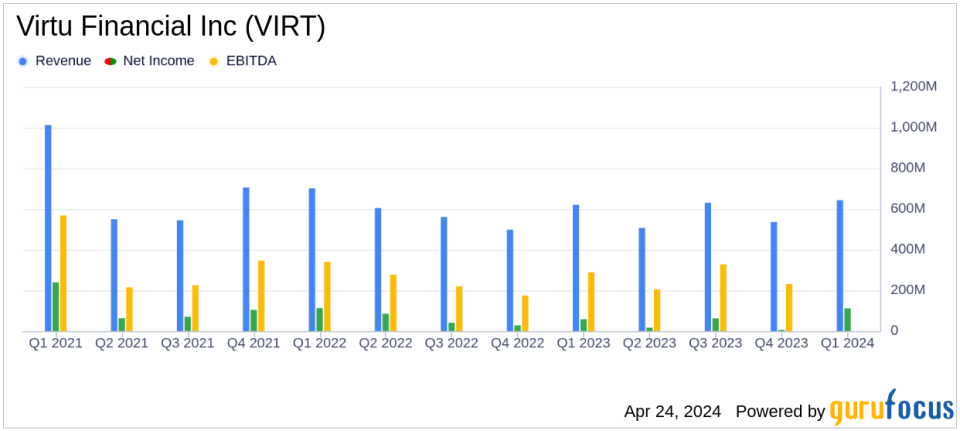

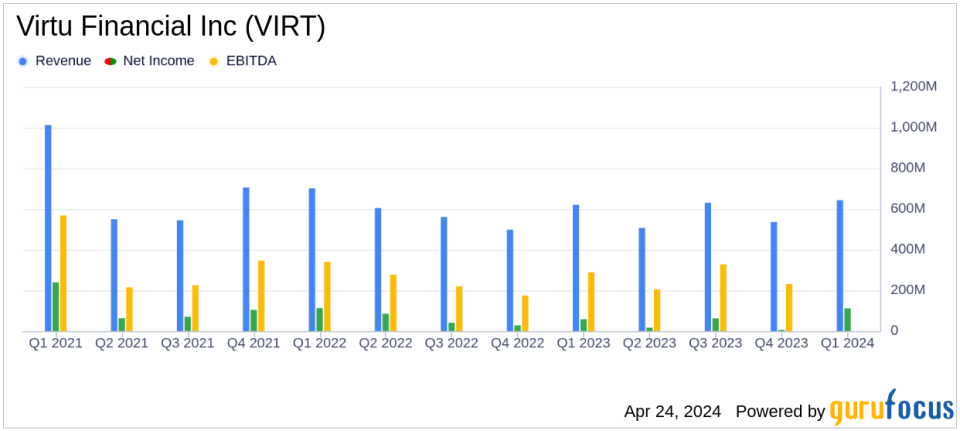

For Q1 2024, Virtu Financial reported a substantial total revenue of $642.8 million, a 3.6% increase from the previous year, surpassing the analyst’s revenue estimate of $318.71 million significantly. This increase is attributed to robust trading income, despite a slight decrease in net trading income compared to the previous year. The company’s adjusted EBITDA stood at $202.8 million with a high EBITDA margin of 55.3%, indicating efficient operational management.

The firm also announced a quarterly cash dividend of $0.24 per share, underscoring its commitment to returning value to shareholders. Additionally, the board has authorized a new $500 million share repurchase program, reflecting confidence in the company’s financial stability and future prospects.

Strategic Developments and Management Commentary

Alongside financial results, Virtu Financial disclosed a planned CFO transition, with Cindy Lee set to take the role in August 2024. This transition is part of the company’s long-term strategic planning and is expected to be seamless, with the outgoing CFO, Sean Galvin, remaining in a senior capacity to aid the transition.

Douglas A. Cifu, the CEO of Virtu Financial, praised Cindy Lee’s contributions and leadership, which have been integral to the company’s growth and operational success. He also expressed gratitude towards Sean Galvin for his long-standing service and future contributions in his continuing role.

Operational and Segment Analysis

The Market Making segment continues to be the primary revenue driver, demonstrating strong performance in trading income. However, the Execution Services segment also showed significant activity, contributing to the company’s comprehensive service offerings across global financial markets.

The company’s robust financial position is further evidenced by its substantial cash reserves and controlled long-term debt, which stands at $1,750.1 million as of March 31, 2024. These factors, combined with strategic share repurchases and dividend payments, highlight Virtu Financial’s solid balance sheet and liquidity to support ongoing and future operations.

Conclusion

Virtu Financial’s Q1 2024 results not only exceeded revenue expectations but also showcased a strategic foresight with management changes and shareholder returns. The company’s ability to adapt and thrive in the dynamic financial markets, backed by advanced technology and efficient capital management, positions it well for sustained growth. Investors and market watchers will likely keep a close eye on Virtu’s performance in the upcoming quarters, especially in light of the evolving market conditions and internal leadership changes.

For detailed insights and further information, refer to Virtu Financial’s full earnings report and additional financial disclosures on their website.

Explore the complete 8-K earnings release (here) from Virtu Financial Inc for further details.

This article first appeared on GuruFocus.

Source link