What is a Meme Stock? Is Trump Media an Example?

What is a meme stock? Northeastern experts say the concept is relatively recent, and can be traced to a bubbling, public discontent with the financial system.

When Trump Media & Technology Group, which owns Truth Social, went public this week, many were quick to declare the company a “meme” stock.

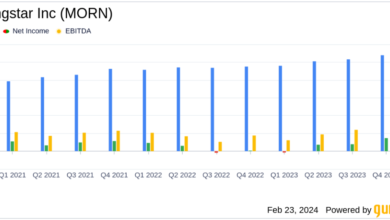

That’s because despite a nearly $8 billion valuation, the company’s main product — Truth Social — is reportedly in deep water. The social media company, which former president Donald Trump owns, has been operating at steep losses since its start in February 2022.

What is a meme stock?

Northeastern experts say the concept is relatively recent, and can be traced to a bubbling, public discontent with the financial system — at the investors and power brokers on Wall Street who drive the economy and whose big bets have occasionally plunged the U.S. into recession.

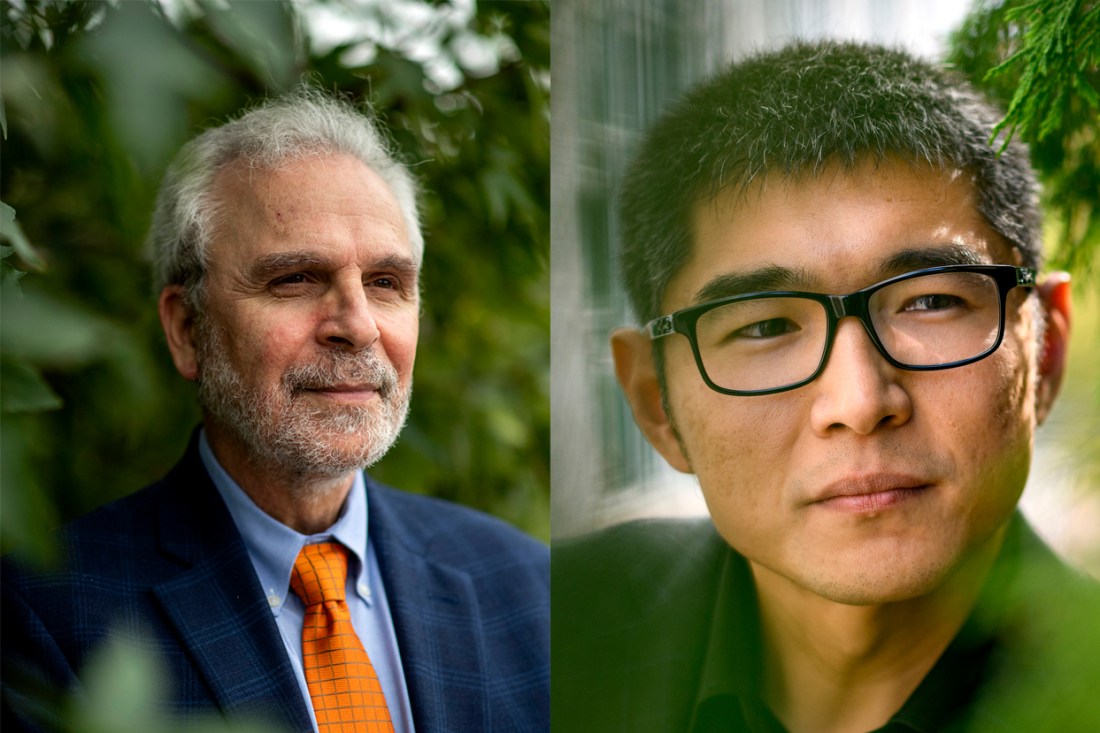

In fact, that’s how GameStop became arguably the first meme stock in January 2021, says Nikos Passas, professor of criminology and criminal justice at Northeastern University, an expert on financial fraud.

After a handful of Wall Street hedge funds tried to “short” GameStop stock, a small community on social media platform Reddit rallied to save the failing company by trading the stock higher and higher, sending its stock price north of $1,700 at one point before it all came crashing down.

“Meme stocks are shares of publicly traded companies that owe their popularity to social media and online activity,” Passas says. “GameStop is considered to be the first such stock.”

The obvious hallmark of a meme stock is a significant disparity between the company’s financial performance and its purported stock value. Other examples of meme stocks include AMC, Wendy’s Torchlight Energy, Orphazyme — a Danish company that rose more than 1,000% in a day — Bed Bath & Beyond and Robinhood Markets, among others.

On Tuesday, Trump Media & Technology Group began trading on the Nasdaq under the ticker symbol “DJT.” It initially surged 56% to $78 a share before stabilizing at around the $70 mark, then falling to $57.99, according to CNN.

The company went public after it merged with a cash-rich shell company last week, which resulted in a $3 billion bump in Trump’s net worth. This week, the stock was propped up by Trump supporters and other mom-and-pop investors looking to capitalize on its early going success.

“The sign of a true meme stock is that they exhibit certain behavior patterns that are very much disconnected from their fundamentals in terms of business performance,” says John Bai, an associate professor of finance at Northeastern, “and what happens is they will have abnormally high trading volumes of abnormally high volatility on a daily basis in terms of their prices.”

In that way, meme stocks resemble the violent market swings seen in the cryptocurrency market, Bai says.

In crypto as in meme stocks, “there’s often a few influential players in any particular market who conduct these ‘pump and dump’ schemes,” Bai says.

Analysts estimate a company’s stock price through what’s called a fundamental analysis, a financial calculus that examines everything from company management, earnings, revenue, debt and growth, to broader market competition and the state of the economy.

“When social sentiment plays a bigger role than fundamentals, analysts may also use technical analysis tools to estimate future trends and likely moves,” Passas says.

It’s no accident that meme stocks began to rise during the COVID-19 pandemic. Pandemic-era lockdowns, combined with officials pumping trillions in stimulus money into the economy, fueled a meme-investing frenzy — one notable for its “grass-roots” character.

“If you think back on what happened after the 2007-2008 financial crisis, Occupy Wall Street emerged at the grass-root level, which was really the first sign that people had grown increasingly dissatisfied with the disproportionate power that these financial institutions and entrenched entities have over ordinary people,” Bai says.

Bai says he thinks meme stocks are here to stay.

“It seems to be a zero-sum game, at this point,” Bai says.