1 Bill Ackman Artificial Intelligence (AI) Stock to Buy Hand Over Fist Before It Surges 17%, According to 1 Wall Street Analyst

One of the most closely followed investors on Wall Street is Bill Ackman, CEO of Pershing Square Capital Management. While Ackman’s portfolio has billions of dollars of investment capital, the hedge fund manager holds only seven individual stocks.

Among this small cohort is just one technology company: “Magnificent Seven” member Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Earlier this month, Jason Helfstein of Oppenheimer raised his price target on Alphabet stock to $185 — implying roughly 17% to current trading levels as of market close on April 22.

Let’s dig into why Ackman and others on Wall Street have strong convictions on Alphabet and assess whether now is a good opportunity to scoop up some shares.

Advertising is the cash cow, but…

Alphabet’s core revenue and profit drivers come from advertising. Considering the company owns internet search website Google and video-sharing platform YouTube, it’s safe to say that Alphabet has an enormous presence online.

The table below illustrates the growth trends in Alphabet’s ad business over the last several years.

|

Category |

2023 |

2022 |

2021 |

|---|---|---|---|

|

Google Search & other |

8% |

9% |

43% |

|

YouTube ads |

8% |

1% |

46% |

|

Google Network |

(4%) |

3% |

37% |

|

Total Google advertising |

6% |

7% |

43% |

Data source: Alphabet investor relations

In recent years, Alphabet has been forced to combat a number of competitors encroaching on its ad business. Meta Platforms owns a host of social media applications, including Facebook, Instagram, and WhatsApp. Moreover, the rising popularity of TikTok has also taken a toll on Alphabet’s appeal to advertisers.

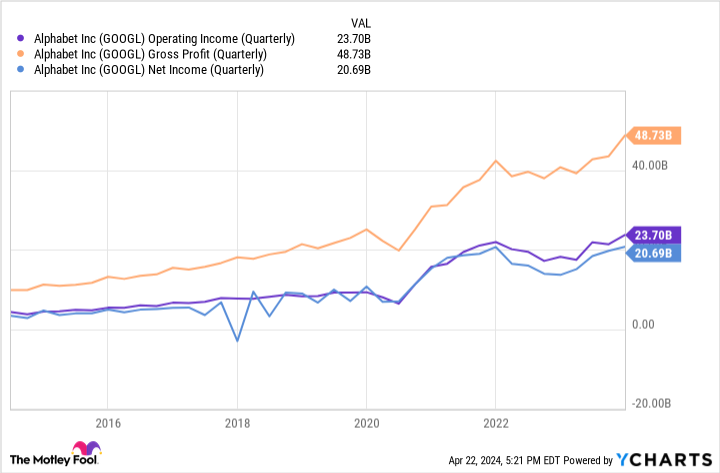

Nevertheless, even in the face of decelerating growth in its biggest business, Alphabet remains highly profitable. It’s this dynamic that I think investors are miscalculating.

Sure, the advertising segment is witnessing an existential crisis. However, Alphabet’s robust operating margins are flowing down to the bottom line. And the company is making some savvy investments in new growth drivers that are already paying off.

…artificial intelligence (AI) is the new growth driver

In addition to advertising, Alphabet has a services business and a cloud computing operation. The Services segment includes subscriptions to YouTube TV and NFL Sunday Ticket, purchases from the company’s app store, and sales from devices, such as the Google Pixel phone.

Investors should be keen to know that the Services business is highly profitable — generating $95.6 billion of operating income in 2023, up 16% year over year. Moreover, the cloud division is now consistently profitable. Last year, Alphabet’s cloud segment reported $1.7 billion in operating profit compared to a loss of $1.9 billion in 2022.

One of the primary reasons Alphabet has been able to generate consistent, robust profitability metrics across so many different areas of its business is thanks to AI.

In his 2023 shareholder letter, Ackman outlined that Alphabet’s “competitive positioning in AI overshadowed the high-quality nature of its business and strong growth prospects.” This is a nice way of alluding to some investors seeing better opportunities than Alphabet regarding AI.

However, the trends explored above undermine Ackman’s position when it comes to Alphabet’s business model. As the company continues to integrate AI throughout its ecosystem, investors should begin to see an exponential jump in the company’s revenue and profit margin profiles across the many different areas in which Alphabet operates.

Is now a good time to invest in Alphabet?

As of the time of this article, Alphabet’s price-to-earnings (P/E) ratio of 26.9 is the second-lowest among the Magnificent Seven — narrowly above Apple.

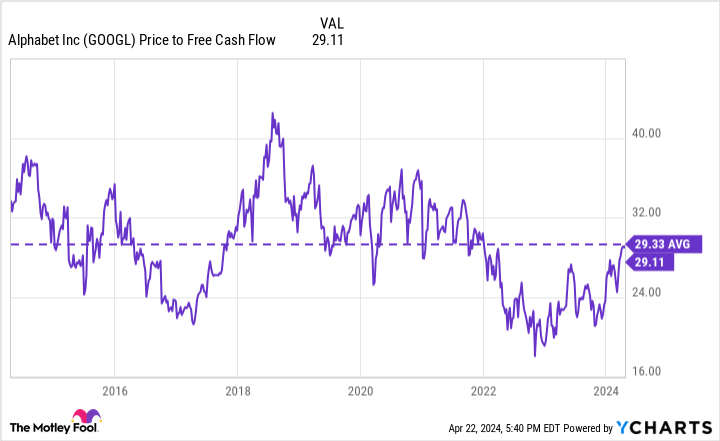

Moreover, the company’s price-to-free cash flow is essentially identical to Alphabet’s 10-year average. Considering how much Alphabet has grown over the last decade and how different the company is today compared to 10 years ago, I think investors may be steeply discounting future growth opportunities.

I think now is a lucrative chance to buy Alphabet on an underrated AI narrative. The stock looks dirt cheap relative to its peers, and with so much potential upside, it’s hard to pass on this one.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Apple, and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Apple, and Meta Platforms. The Motley Fool has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: 1 Bill Ackman Artificial Intelligence (AI) Stock to Buy Hand Over Fist Before It Surges 17%, According to 1 Wall Street Analyst was originally published by The Motley Fool

Source link