1500 Robotics Startups Have Raised $90 Billion, But Investment Just Cratered

Robotics investment is down in 2023

getty

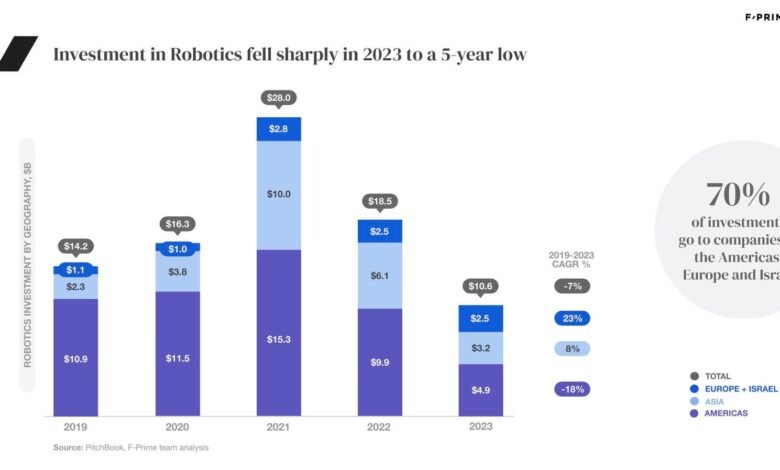

1,500 robotics startups have raised about $90 billion since 2019. and 20 of them are unicorns with valuations in excess of $1 billion. That’s the good news. The bad news is that investment in robotics fell sharply to a five-year low in 2023, and one particular category, autonomous vehicles, has plummeted from $9.7 billion in 2021 to $2.2 billion in 2023.

The data from an investment report by F-Prime, the venture capital arm of Fidelity Investments, shows that 2021 was a great year to be raising capital for a robotics startup, with $18.1 billion raised in a low-interest stimulus-for-everyone Covid environment. That dropped by a third in 2022 to $12.4 billion, and dropped yet another third last year to just $7.4 billion.

“The venture capital markets experienced a significant correction in 2023, with investments returning to levels last seen in 2020 and the depths of the pandemic,” report authors Sanjay Aggarwal and Betsy Mulé write. “Robotics was no exception, though the pullback was even more pronounced as funding in the AV [autonomous vehicle] sector—which had historically been a driver of robotics investment—continued the rapid decline we’ve seen over the last two years.”

That’s probably to be expected as post-Covid inflation hit the global economy, exacerbating existing challenges in production, supply chain, and global conflict.

The biggest sector for investment last year was vertical-specific robots, led by investments in defense and logistics. Out of a total investment of $4.1 billion, most went to logistics and security robots, with medical robots following:

- Logistics: 27%

- Defense/security: 20%

- Other: 17%

- Medical: 15%

- Manufacturing: 6%

- Agriculture: 6%

- Lab/pharma: 4%

- Food: 3%

- Construction and mining: 3%

Autonomous vehicle startups are having a tough time right now. While passenger vehicle self-driving startups have taken most of the investment to date, that’s shifting to trucking, F-Prime says, with four of the five largest funding rounds in the past two years being trucking or delivery related. Cruise, majority-owned by General Motors since 2026, is the only exception in the category, having raised a $2.1 billion round of financing.

One of the reasons AV investment is down is bad press and legislative challenges, the report suggests. Tesla promising self-driving for years without fully delivering it is probably another.

Exits in the robotics space peaked in 2021 as well, with 36 deals valued at about $44 billion. In 2022, that dropped to about $26 billion, and in 2023, robotics exits cratered to under $2 billion.

One space that is still interesting is enabling systems. All of those robots that we’re building need to see, compute, communicate, and many of them need to move. All of those functions involve entire industry segments around technologies like LiDAR, other types of sensors, chips, and motors.

The future outlook for the robotics industry has to be bright, one would imagine, as automation continues to grow in industrial settings, logistics, medical care, and gerontology. But the past year has certainly been a slowdown in investment, and IPOs were virtually nonexistent, while the short-lived SPAC (special purpose acquisition vehicle) back door to public funding has largely closed as well.

“Hype-driven investment cycles inevitably come to an end,” the report authors write. “Those focused on business fundamentals endure.”

There’s probably also some good news for western economies that have lost manufacturing capacity over the past few decades to Asian countries. Western markets, including the U.S., Europe, and Israel, were 70% of overall investment, the report says. That should be a positive for the U.S. and Europe as they retool for home-shoring industrial production.

Follow me on Twitter or LinkedIn. Check out my website or some of my other work here.