Brown in talks to invest in Fortress Investment Group, Bloomberg reports

Brown is allegedly in “advanced talks” to invest in Fortress Investment Group with Abu Dhabi sovereign wealth fund Mubadala Investment Co. and BTG Pactual, a Brazilian financial company, Bloomberg previously reported.

The reported deal comes at a time of increased scrutiny of Brown’s investments, including calls from student activists to divest from companies affiliated with Israel, as well as a continued push to distance the University from the fossil fuel industry.

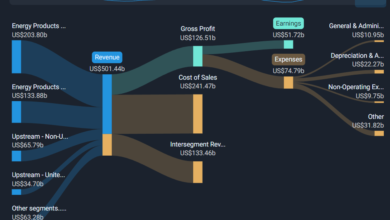

Fortress Investment Group has a majority holding in New Fortress Energy, a liquified natural gas transport company.

In 2020, President Christina Paxson P’19 P’MD’20 wrote a letter stating the University had moved away from investing in fossil fuels, writing at the time that Brown had sold 90% of its investments in fossil fuel companies and would liquidate the remaining investments “as it becomes possible to do so.”

The decision to move away from investments in the fossil fuel industry “reflects the view that, as the world shifts to sustainable energy sources, investments in fossil fuels carry too much long-term financial risk,” she added.

“We do not plan to make new investments in fossil fuel companies unless and until they make significant progress in converting themselves into providers of sustainable energy,” Paxson wrote.

The University did not respond to The Herald’s request for comment.

The Brown Investment Office considers environmental, social and governance principles to assess a company’s societal impact. These include carbon emissions, “corporate political contributions” and “diversity issues,” according to its website. Of Brown’s endowment, 25% is managed by formal ESG policy.

The University did not respond to The Herald’s request for comment about Brown’s ESG policy regarding investments in companies with a significant stake in the fossil fuel industry.

Jane Dietze, Brown’s chief investment officer, previously served as a managing director at Fortress Investment Group and is currently on the company’s Board of Directors.

Dietze did not respond to The Herald’s request for comment on her affiliation to the company. She also did not respond to questions about how the Investment Office considers conflicts of interest in the investment process.

The U.S. Committee on Foreign Investment is currently reviewing Mubadala’s acquisition of Fortress, and Mubadala has been seeking co-investors from U.S. entities to pass security checks, Bloomberg also reported.

Mubadala is a sovereign wealth fund of the Emirate of Abu Dhabi founded after a merger between International Petroleum Investment Company and Mubadala Development Company.

In May 2023, Mubadala agreed to buy 90% of the holdings in Fortress that were owned by SoftBank Group Corp., a Japanese company. SoftBank did not have control of day-to-day operations at Fortress.

Following the deal, Mubadala has sought U.S. co-investors to pass regulations and review by the U.S. Committee on Foreign Investment. Mubadala currently holds a 10% stake in Fortress.

Spokespeople from Fortress and BTG declined Bloomberg’s request for comment. Mubadala also did not respond to Bloomberg’s request.

Get The Herald delivered to your inbox daily.

Ryan Doherty is a Section Editor covering faculty, higher education and science & research. He is a sophomore concentrating in chemistry and economics who likes to partially complete crosswords in his free time.

Source link