Here’s how I’d invest to try and unlock £63,000 in annual passive income

There are a handful of proven ways to make passive income nowadays. My own choice is to regularly invest in companies through the stock market, with a focus on the long term.

The wealth-building record of stocks is well-documented. Just look at some of the world’s richest people: Warren Buffett, Elon Musk, and Mark Zuckerberg. Their rising wealth corresponds with the flying share prices of their firms: Berkshire Hathaway, Tesla, and Facebook-parent Meta Platforms, respectively.

| 5-year share price return | |

| Berkshire Hathaway | 112% |

| Tesla | 1,312% |

| Meta | 144% |

Or take Jensen Huang, founder of AI chipmaker Nvidia. His net worth has ballooned from $3bn five years ago to around $100bn today. That’s after Nvidia’s mind-boggling 2,743% share price gain in that time.

Even attaining a tiny slither of such returns could be life-changing for most investors.

The strategy

Let’s assume I invest £20,000 in dividend stocks today inside a tax-efficient Stocks and Shares ISA. If these were collectively yielding 7%, that means I could expect to receive £1,400 in passive income each year.

This presumes all my stocks continue to pay their dividends, which isn’t guaranteed. That’s why it’s important to build a diversified portfolio to offset this cancellation risk.

While £1,400 is a decent yield, I’d prefer to forgo this passive income stream in favour of a potential torrent in future. My main focus then would be on building wealth rather than taking income now.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Small-cap opportunity

Right now, I think there are lucrative opportunities in the UK small-cap space. Many of these firms derive a good chunk of their sales domestically, and as the UK economy has struggled, so has the sector.

However, the UK economic outlook is improving, with falling inflation widely expected to lead to multiple interest rate cuts by the Bank of England.

Buoyed by this, the FTSE SmallCap Index has risen almost 8% in 2024. Yet it’s still nearly 10% off its high from 2021, suggesting more might be to come.

hVIVO

One small-cap UK stock I’d add to with spare cash is hVIVO (LSE: HVO). It’s trading 20% lower than it was in April 2021, yet the firm is still growing nicely.

For those unfamiliar, this is a healthcare firm specialising in human challenge clinical trials. These involve healthy volunteers (which it recruits through its FluCamp platform) being exposed to a virus in a controlled setting to test vaccine efficacy.

The company ran the world’s first human challenge trial for Covid and today works with a growing number of large global pharmaceuticals.

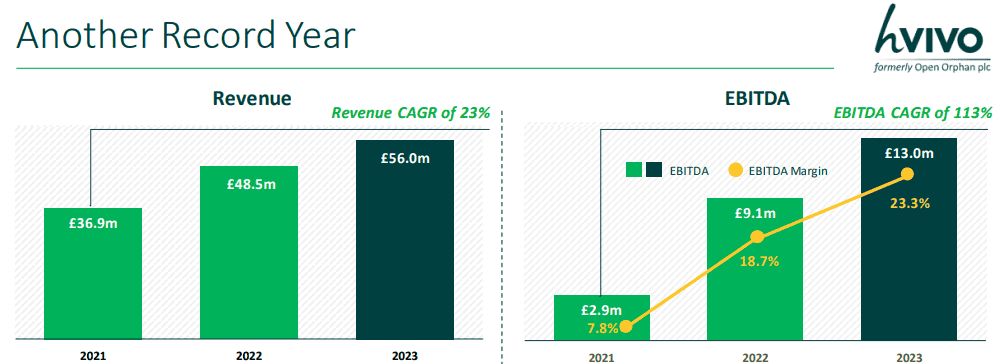

Last year, it reported record revenue of £56m, up from £48.5m in 2022, while adjusted earnings per share grew 32% to 1.27p.

One risk here would be something going wrong in a large trial, which could cause reputational damage.

Looking ahead though, things look very bright. hVIVO is aiming for annual revenue of £100m by 2028 and has even started paying a dividend, which demonstrates its improving financial situation.

The target

So, on top of my £20k, let’s say I invest £700 each month into promising stocks like this and achieve a 9% average return. In this scenario, I’d grow my portfolio to an impressive £913,000 in just under 25 years.

Then I could move into dividend stocks. If that 7% yield is maintained, these would be paying me a £63,000 annual second income.

Source link