Is Right Now a Good Time to Invest in the Stock Market? Here’s What History Says

As the stock market reaches new heights, it can be an exciting time to invest. However, while many investors are feeling optimistic about the future, others are worried that perhaps the best opportunity to buy has already passed.

Buying when stock prices are at their peaks isn’t necessarily the best financial move, though if the market continues to surge, now may be your best chance to invest before prices rise even further. That said, nobody knows for certain where the market is headed, so whether prices will continue soaring is anyone’s guess.

All of this can be confusing to investors who just want to make the most of their money. Although past performance doesn’t equate to future returns, it can be helpful to see what history says about times like these.

Is it safe to invest right now?

Stock prices have surged significantly over the past 18 months. The S&P 500 is up by 45% since it bottomed out in October 2022, while the tech-heavy Nasdaq has soared by a whopping 58% in that time. Investing now, then, means paying much higher prices than you would if you’d bought a year or two ago.

But does that mean it’s a bad time to invest? History says no.

Based on the stock market’s historic performance, there’s never necessarily a bad time to buy — as long as you keep a long-term outlook. The market can be volatile in the short term (even in strong economic times), but it has a perfect track record of seeing positive returns over many years. The key, though, is to invest sooner rather than later.

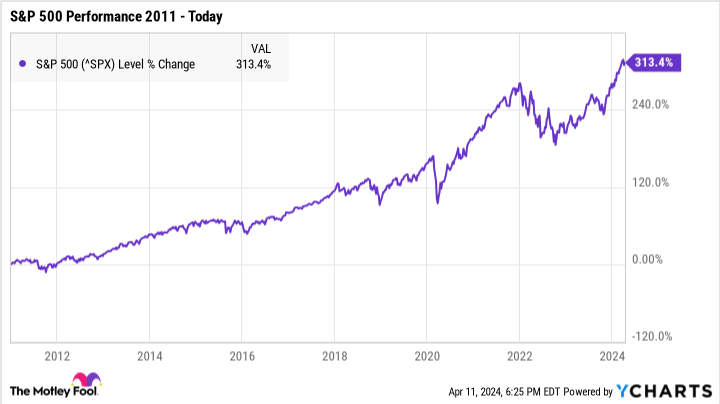

For example, say you had invested in an S&P 500 index fund in January 2011. At that point, the index was well into its bull market following the Great Recession, and it had soared by a whopping 86% from its lowest point in 2009.

At the time, it may have seemed like you’d missed the best chance to buy. Yet by today, you’d still have earned total returns of more than 313%.

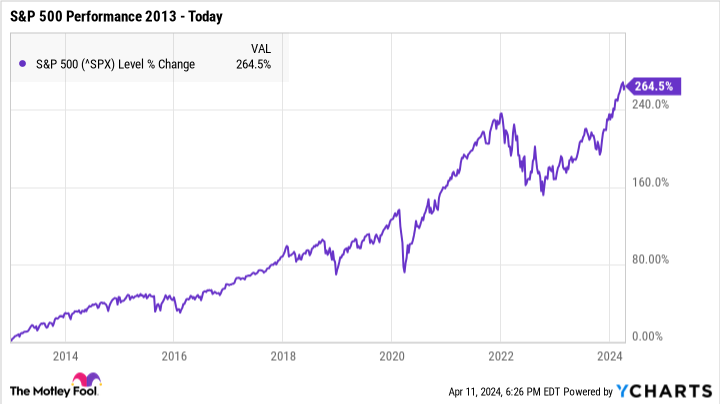

Now let’s say that instead of investing in 2011, you waited a couple of years and bought in January 2013. By today, you’d only have earned total returns of around 265%.

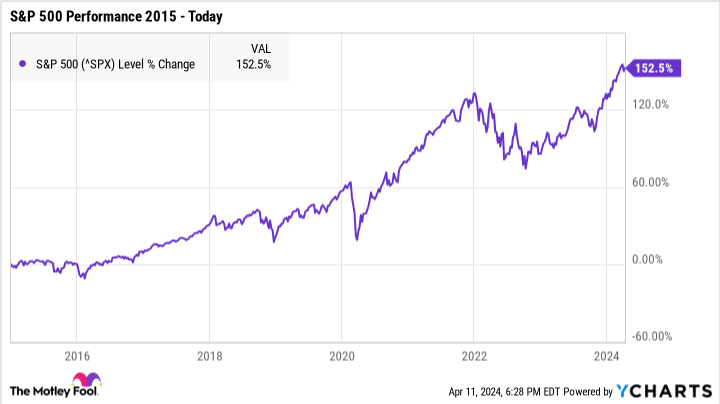

Finally, say you decided to hold off just a little longer, eventually investing in January 2015. In that scenario, your total returns by today would drop to just 153%.

Of course, the prime opportunity to buy would have been in 2009 when the S&P 500 reached its lowest point. But at the time, nobody knew that a bull market was about to begin, and investing in 2011 still would have been far more lucrative than waiting just a few more years.

Now, this doesn’t necessarily mean that the market will follow a similar path going forward. But if history shows us one thing, it’s that staying invested for the long haul is far more profitable than trying to buy at just the right moment.

The key to maximizing your earnings

Keeping a long-term outlook is critical to building wealth, but it’s equally important to choose the right investments. Strong stocks are far more likely to see consistent growth over time, and they also have a better chance of recovering from the inevitable downturns the market will face in the future.

There’s no single correct way to invest, but the strongest stocks are from companies with healthy underlying business fundamentals — including everything from solid financials to a competitive advantage to a knowledgeable leadership team.

When you have a robust portfolio full of healthy stocks, you won’t need to worry nearly as much about the future of the market. While all stocks can experience short-term volatility, strong companies are more likely to ride out the storm and see positive returns over time.

Investing can be daunting even when the stock market is thriving, but it remains one of the most effective ways to generate wealth. By getting started early and investing in the right places, you can protect your money as much as possible while still maximizing your long-term earnings potential.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,963!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $33,315!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $335,887!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of April 8, 2024

The Motley Fool has a disclosure policy.

Is Right Now a Good Time to Invest in the Stock Market? Here’s What History Says was originally published by The Motley Fool

Source link