Nvidia Invested in SoundHound AI Stock, But Should You?

Shares of SoundHound AI (NASDAQ: SOUN) have soared this year after Nvidia (NASDAQ: NVDA) revealed that it had bought shares in the company. The chip giant made a relatively small investment, spending nearly $3.7 million to take a 0.6% stake in the company. The investment was one of five that Nvidia made in tech companies related to artificial intelligence (AI) in the fourth quarter of 2023.

So what exactly does SoundHound AI do, and should investors follow in Nvidia’s footsteps and invest in the stock?

Carving a niche in voice AI

Before Nvidia’s investment in the company came to light, SoundHound AI was not exactly well-known. However, the company has relationships with a number of large automobile companies that use its technology to help power their voice assistant technologies. The company’s platform is incorporated into devices, such as automobiles, and its AI technology helps voice assistants interact with users in a more natural and conversational manner.

SoundHound AI’s platform, which it calls Houndify, achieves this in two primary ways. First, it uses speech-to-meaning technology, which processes speech in real-time so the device understands its meaning even before the user is done talking. Next, it uses deep-meaning-understanding technology to help understand a user’s intent and answer complex questions.

An example of its technology at work would be a voice assistant that is able to give hotel recommendations when given a list of variables, such as location, price ranges, amenities, and star ratings.

Making progress in the automobile and quick-service restaurant verticals

The area in which SoundHound AI has made the most progress selling into is the automotive industry. The company has relationships with over 20 auto brands, including Honda, Jeep, Hyundai, Fiat, Chrysler, and RAM, among others. In conjunction with its fourth-quarter earnings report, it said it won a deal with a prominent U.S.-based EV maker and signed another contract with a large automaker to significantly increase its unit volumes through 2037.

The company has also been making big strides in the quick-service restaurant vertical. Its SoundHound for Restaurants voice assistant will take phone orders so employees don’t have to answer calls and can instead focus on helping customers. It also has solutions for drive-thrus and kiosks.

The company has signed deals with restaurant-focused fintech companies such as Toast and Olo, as well as quick-service chains such as White Castle and Jersey Mike’s, among others.

SoundHound AI’s strength in the automobile and restaurant verticals helped it grow its revenue by 47% in 2023 to $45.9 million. Meanwhile, for 2024, it forecast revenue of between $63 million and $77 million, which is nearly 53% growth at the midpoint. It said it was looking for revenue to exceed $100 million in 2025.

While that is solid growth, SoundHound AI’s cumulative subscriptions and bookings backlog of $661 million is more interesting. This metric represents the potential revenue the company expects to generate over the duration of its signed contracts. Currently, the average duration of its contracted backlog is six and a half years, so much of the revenue from these contracts should be recognized before the end of 2031, although some contracts extend out longer.

A speculative investment

It’s easy to see why Nvidia likes SoundHound, with the company growing quickly and having a large revenue backlog. It also isn’t difficult to imagine that SoundHound AI’s technology can be applied to other industries as well, which could accelerate its growth.

The two companies also recently announced a collaboration where SoundHound AI will offer on-chip voice AI that doesn’t need internet connectivity using Nvidia’s DRIVE platform. The solution will allow users to access SoundHound AI’s Vehicle Intelligence offering, where users can ask auto-specific questions, such as what it means when a dash light is on, as well as general questions, such as finding the best place to eat nearby.

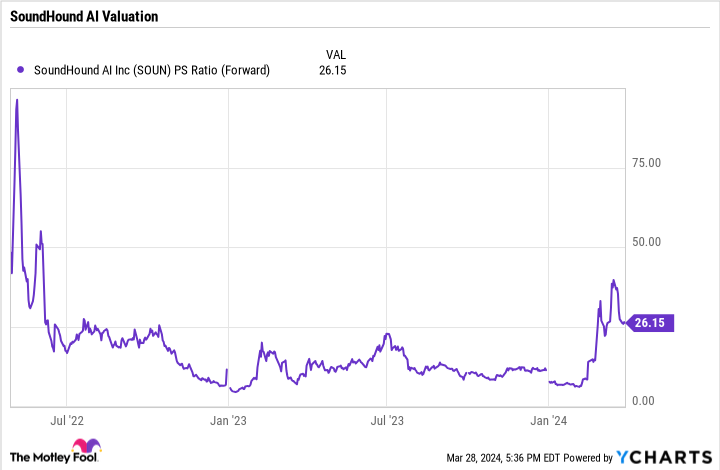

That said, with SoundHound stock trading at an over 26x price-to-sales ratio and the company currently unprofitable, the stock is very speculative at this point. Its technology looks impressive, but AI technology is evolving quickly. What could seem like cutting-edge technology today could become commoditized in the future. While its cumulative backlog is impressive, that only equates to about $100 million a year in revenue over the average duration of its contracts, so the company has a long way to grow into its current valuation.

As such, I recommend that investors keep their positions small if they want to follow Nvidia into SoundHound AI stock, as they should with Nvidia itself.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Geoffrey Seiler has positions in Toast. The Motley Fool has positions in and recommends Nvidia, Olo, and Toast. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

Nvidia Invested in SoundHound AI Stock, But Should You? was originally published by The Motley Fool

Source link