South Dakota Investment Council takes cautious approach to artificial intelligence stocks • South Dakota Searchlight

The overseers of South Dakota’s investments have put some money into companies that aim to cash in on artificial intelligence, but the explosion in public interest hasn’t changed the state’s money management strategy.

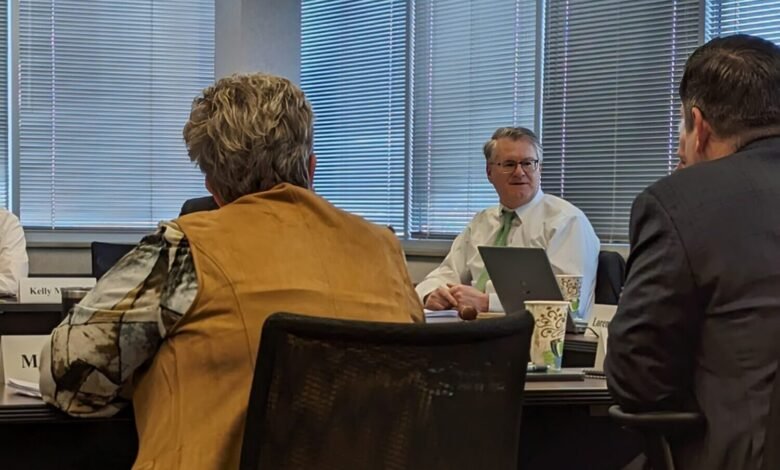

Leadership with the South Dakota Investment Council offered insights on the AI boom after prompting from its advisory board, which met in Sioux Falls on Thursday.

Matt Clark, the state’s chief investment officer, compared the current plenitude of cash-burning AI operations to companies wrapped up in the dot-com bust of 2000. That year’s crash of tech stocks left scores of companies that had hoped to find a toehold in the then-nascent world of online commerce in history’s dustbin.

As with the internet of 2000, Clark said, there’s little doubt that investments in AI will pay off for some companies. The question – one being asked and reevaluated constantly by the investment council during booms in one sector or the other, Clark said – is which ones.

“A lot of those companies that were around in 1999 did prosper, but over half of them disappeared, went bankrupt,” Clark told the council’s advisory board this week. “You can’t have 10 companies all get 30% market share. There’s going to be some disappointment.”

About the council

The council manages the assets of the South Dakota Retirement System, the Education Enhancement Trust, and the School and Public Lands Trust, among others.

The returns from investments and interest in the funds are used for a variety of purposes, such as boosting the state’s general fund and paying for scholarships. Unlike most states, the retirement system in South Dakota is fully funded for its participants, which include public employees ranging from teachers to correctional officers, state troopers and employees of the Department of Transportation.

On Thursday, council staff told board members that $13 million from the School and Public Lands Trust was transferred to schools in the month of February.

The South Dakota Retirement System returned 5.8% for the fourth quarter, underperforming compared to its benchmark. Staff told the board that quarterly underperformance was tied to a more conservative investment mix than its benchmark funds, which are more heavily influenced by the stock market.

Over the long-term, the state’s investments have grown considerably.

Today, at the 50-year mark in its history, the retirement fund is worth $14.5 billion and covers more than 33,000 recipients. When it began, there were 2,900 recipients and $50 million in the fund.

“The return over the full period has exceeded other state retirement systems across the nation,” according to the council’s 2023 annual report.

There’s a similar long-term growth trajectory for the managed assets as a whole. Day to day, week to week, and month to month, however, the funds may lose money or underperform.

Managing investments amid AI scramble

Board member questions on which sectors might be the best bets in the stock market followed a rundown of the state’s equity portfolio performance for the months of February and March. The council’s Jan Zeeck told the board that the equity portfolio moved into negative territory in February briefly before bouncing back to neutral last month, in line with a global rebound in durable goods orders.

Market volatility was an issue in the early months of 2024, Zeeck said, and the state has moved to a “defensive position” in response. The health care and pharmaceutical sectors have “taken a hit,” Zeeck said, as did consumer staples.

That comment prompted a board question on where the value might be in the market right now. Zeeck framed her response in part around the interest in AI. Pharmaceuticals and other staples, she said, are “just not exciting compared to all the talk of technology and AI.”

There are some significant differences between the 1999-2000 bubble and today, Zeeck said. The “Magnificent Seven” of the tech world – Microsoft, Alphabet (Google), Meta (Facebook), Apple, Tesla, Amazon and NVIDIA – are “bringing in a lot of cash flow, and it’s real.”

But that doesn’t mean investments in AI at companies like those will pay off in the long term, Zeeck said. NVIDIA stock has been on a roller coaster this year as the chip maker manages AI-related demand for its products.

“We don’t know what the returns will be on a lot of that,” she said. “Nobody really knows that yet.”

The state does have investments in tech firms, and Zeeck said they are “constantly evaluating” its position in those areas. In the full scope of the state’s managed assets, though, the technology sector and AI are minor factors.

“We really don’t have a big bet on tech stocks,” Clark told South Dakota Searchlight after the meeting.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX

Source link