The Starbucks CEO replacement is just the latest victory for Elliott Investment

One of the biggest stories on Wall Street this week was Starbucks poaching Chipotle’s star CEO Brian Niccol. The move came after activist investors led by the powerful Elliott Investment Management pushed for change at Starbucks, adding pressure that ultimately led to the ouster of chief executive Laxman Narasimhan, who had presided over declining sales in the past two quarters. Starbucks shares, which had fallen about 18% year-to-date during a broader stock market rally, jumped 20% on the news.

These developments came as a vindication for Elliott Investment Management and Starboard Value, which had both amassed stakes in Starbucks this year and pressed for change. Elliott is arguably the most well-known of the activist investors—a term that describes funds that acquire stakes in companies with the goal of influencing how they are run and managed. Once an activist acquires a substantial stake in a company, they will often push the businesses to restructure, or to sell off assets or to replace management.

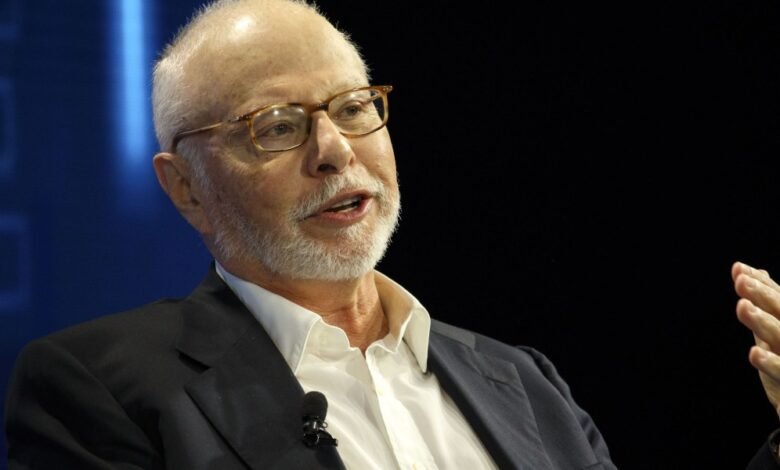

For Elliott, which was founded in 1977 by Co-CEO Paul Singer and manages about $70 billion in assets, its Starbucks coup is only the latest in a series of victories for a fund that is famous for very public fights that have led to some major changes at businesses. Here are five other high profile Elliott fights you should know about:

Elliott shakes up Twitter

One of Elliott’s most famous tussles occurred at Twitter. In November 2019, Jack Dorsey, a Twitter co-founder and then CEO, said he was moving to Africa for up to six months, causing many to wonder who would lead Square, now known as Block, and Twitter. In late February 2020, Elliott acquired a sizable stake in Twitter, nominated four executives to the company’s board while pushing to replace Dorsey as Twitter’s CEO. Twitter then reached a deal with Elliott to keep Dorsey as head of the company in March. It brought in private equity firm Silver Lake, which invested $1 billion in Twitter, and gave board seats to Elliott’s Cohn and Egon Durban, Silver co-CEO, according to the New York Times. (Dorsey decided not to move to Africa because of the Covid-19 pandemic.) Of course, this all changed when Elon Musk bought Twitter for $44 billion in October 2022.

Elliott drives out the CEO of Sensata Technologies

Earlier this year, Elliott emerged as the largest investor at Sensata Technologies, which develops, makes and sells sensors. Sensata clinched a cooperation agreement with Elliott on April 29. The same day, Jeff Cote, Sensata CEO and president, announced he would retire and that Phillip Eyler, president and CEO of Gentherm, would take a seat on its board.

Real estate giant Crown Castle succumbs to Elliott pressure

Elliott took aim at Crown Castle in 2023, amassing a $2 billion stake in the company. Elliott claimed that Crown Castle had disregarded its analysis and ignored its suggested changes. The fund called for new executive and board leadership, as well as a strategic review of Crown Castle’s fiber business, according to a November 2023 statement. A month later, in December, Crown Castle CEO Jay Brown said he would retire.

NRG Energy punished for ‘worst deal’ of the decade

Last year, Elliott invested about $1 billion for a 13% economic stake in NRG Energy. The fund pushed for a new CEO at NRG, as well as adding directors to its board and launching a business review, according to a June 2023 statement. Elliott also criticized NRG’s $2.8 billion buy of Vivint Smart Home, which it called “the single worst deal in the power and utilities sector in the past decade,” Reuters said. Months later, in November, Mauricio Gutierrez, NRG’s president and CEO, resigned from the company.

Eliott forces changes at Salesforce

Elliott made a multibillion dollar investment in Salesforce last year, the Wall Street Journal reported in January 2023. Salesforce had just laid off 10% of its workforce and reduced office space in some markets, the story said. Elliott did nominate a slate of directors to Salesforce’s board but ended up entering into an agreement, and avoiding a proxy fight, after the company reported improved results and made promises for cost cuts, Reuters said.

Source link