A happier Easter for the mortgage industry – Oldfield

It’s good to take stock after the first few months of the year and see the lay of the land.

Compared to last year, so far 2024 has been a bundle of joy for the UK mortgage industry. But it’s still been challenging and, no doubt, there are more trials ahead.

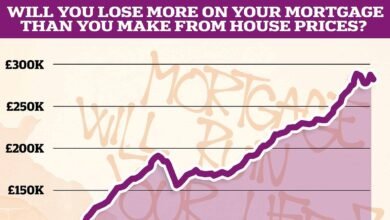

Encouragingly, we saw a continuing increase in mortgage approvals for house purchases between November and January, according to HMRC. And yet house prices are falling and rising, mortgage rates are rising, lenders are cutting rates, increasing them, cutting them again.

And swap rates were up and, at the time of writing, have come back down again after the pleasantly surprising 3.4% inflation rate announcement.

Lenders and brokers are caught somewhere in the middle of this rollercoaster of a start to 2024. For lenders, the main challenge during all this flux is managing the complexities of reaching their lending and savings targets while making sure that they’re identifying and managing vulnerable borrowers.

What happens after Easter, however, remains to be seen, with the Bank of England unlikely to drop interest rates for a while. Although there had been some chat about interest rates not dropping at all this year – despite the headline rate of inflation having just fallen alongside domestic energy prices – this no longer looks the case.

At the end of February, Bank of England Governor Andrew Bailey said that inflation doesn’t need to reach the 2% target before interest rates are cut, and that it’s “not unreasonable” for the investors to expect a rate cut this year.

He seemed optimistic about signs that Britain’s economy is picking up after falling into recession at the end of 2023, and it has now pulled itself out of it.

A timorous second half of the year for lenders?

While UK Finance and the Bank of England had envisaged a drop in lending in the second half of the year, I am more optimistic.

I think that we could easily be far enough ahead in the first half of the year to maintain momentum for the second half. And let’s not forget the million or so homeowners who are coming to the end of their fixed rate mortgage deals this year.

The downside, of course, is that indebtedness is high and rising. In January, consumer credit borrowing rose by £600m to £1.9bn. Unfortunately, we can probably expect to see an increase in arrears volumes and a continuing decrease in people’s ability to borrow more or switch lenders.

Despite this, later life lending and equity release arrangements will increase – not least because of our ageing population, but because the products available are a lot more flexible – another good outcome of Consumer Duty. Although UK Finance figures revealed a sharp decrease of 37% in loans to older borrowers in the last quarter of 2023 compared to the year before, we should expect to see a much more buoyant figure for Q1 2024, in line with general market trends.

What needs to change in the mortgage industry?

Consumer Duty 2024 driving lenders to sell back books

With the July 2024 deadline looming for lenders with back books to comply with Consumer Duty rules, lenders will need to take stock. Lenders with legacy systems, products and approaches may struggle to find and manage the data required and will possibly need to either sell their back books or outsource their books to a third party to manage.

An end-to-end property ecosystem

In 2024, we will see great strides in the property industry evolving into a more digital environment – one where the storing, accessing and sharing of data doesn’t create the barrier to efficient property buying and selling that it does today.

We’re working with the Open Property Data Association (OPDA) to help drive this so that – whether you’re a lender, a seller, a buyer, a conveyancer, intermediary or surveyor – these new open data and technology standards will be essential when making any kind of informed property decisions.