Bank of England figures show mortgage lending increasing – Industry comment

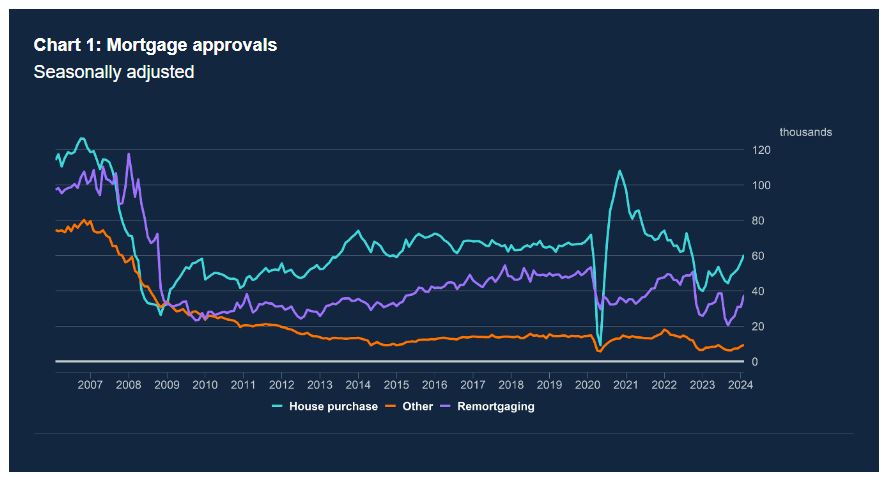

The latest ‘Money and Credit’ figures from the Bank of England offer a moderately encouraging picture of mortgage lending in February 2024 even though the volumes still have some way to go in order to recover to pre-Covid levels.

Net mortgage approvals for house purchases rose from 56,100 in January, to 60,400 in February. Net approvals for remortgaging also increased, from 30,900 to 37,700 during this period.

Gross lending rose from £17.1 billion in January to £18.0 billion in February, while gross repayments decreased from £18.5 billion to £16.7 billion over the same period.

The ‘effective’ interest rate – the actual interest paid – on newly drawn mortgages fell by 29 basis points, to 4.90% in February.

Lucian Cook, head of residential research at Savills:

“A small monthly fall in house prices in March is a reminder that, despite a stabilisation in mortgage rates, affordability pressures remain for mortgaged buyers.

“Encouragingly mortgage approvals for house purchases continued to pick up in February, rising above 60,000 for the first time since September 2022. However, they remain below their pre-pandemic norm of around 66,000 in a market where cash and equity-rich buyers still have a competitive buying advantage.

“And in a further sign, the market still remains relatively price sensitive, the number of properties seeing an adjustment in their asking prices was still 42% above a normal pre-pandemic market according to data from TwentyCI.

“That same data tells us that, where property is priced according to market conditions, it continues to sell. Even accounting for an early Easter, sales activity in March was 4% higher than in March 2023 and 2% above a normal pre-pandemic market.

“London activity levels were slightly stronger being 9% and 6% above the same two benchmarks, reflecting a focus back towards city living.”

Simon Gammon, Managing Partner at Knight Frank Finance:

“The recovery in housing market activity is taking hold despite an uncertain start to the year for mortgage rates. Hotter-than-expected inflation data in January and February prompted a few lenders to notch up mortgage rates, which knocked sentiment, but not enough to kill the market’s momentum.

“More dovish tones from the Bank of England at the March meeting will underpin more increases in lending during the months ahead, and I wouldn’t be surprised to see approvals for house purchase moving above the 70,000 mark we were seeing during 2019 a little later this year. The newspapers are full of commentary as to when the first cut to the base rate will arrive and how far it is likely to fall, which is giving borrowers the confidence to act.”

Jason Tebb, President of OnTheMarket:

“With approvals for house purchases, an indicator of future borrowing, rising to their highest level since September 2022, the pause in interest rate hikes is clearly boosting market stability and buyer confidence.

With the interest paid on newly-drawn mortgages falling by 29 basis points, these lower rates are fuelling an increase in buyer enquiries. As the Bank of England is expected to start cutting base rate at some point this year, perhaps as early as the summer, buyers are increasingly confident as to what they can commit to and afford.

Transaction numbers are more important as an indicator of the overall health of the market than house-price fluctuations. Sensible pricing by sellers should help encourage buyers to get on with their move and take advantage of better mortgage rates.”

Anthony Codling, MD of RBC Capital Markets:

“Mortgage approvals jumped up 7.7% in February to 60,383, and were 40% higher than they were one year ago. Mortgage approvals have now increased for five months in a row, further proof that life is returning to the UK housing market and that it is recovering without the need for Government intervention.

“The Bank of England also reported that average mortgage rates for new business fell below 5% for the first time since September 2023, providing a further welcome news for first time buyers seeking to get a foot on the property ladder and for homebuyers climbing up it.”

Colby Short, Co-founder and CEO of GetAgent:

“The spring surge in market activity has clearly begun early this year, with mortgage approvals climbing consistently, as the nation’s buyers look to hit the ground running following a period of inactivity caused by higher mortgage rates over the last year.

This growing market momentum is only likely to build further as we enter what is traditionally the busiest time of year for the property market and, come the summer, we can expect to see these initial green shoots of buyer activity start to blossom into an increased level of sales completions.”