Bank of England urged to cut base rate amid ‘uptick’ in mortgage rates: ‘Uneasy few weeks!’

The Bank of England is being urged to consider a cut to interest rates amid an “uptick” in mortgage rates in recent weeks.

Experts are warning of the “uneasy few weeks” for homeowners ahead of the central bank’s Monetary Policy Committee (MPC) meeting tomorrow.

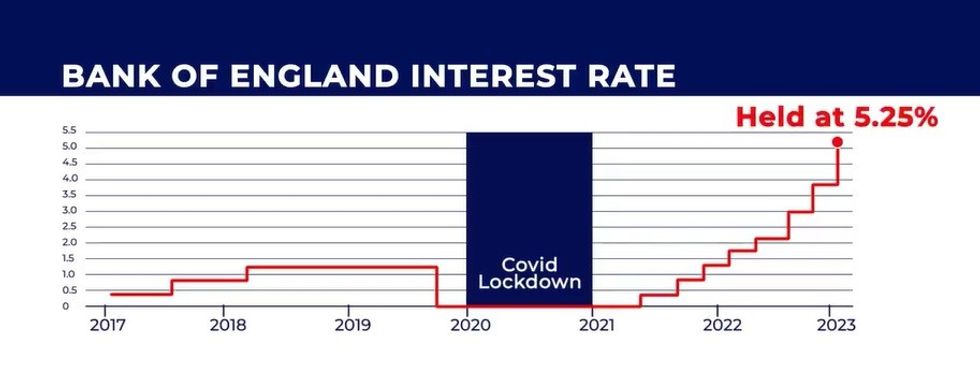

The UK’s base rate has been raised to 5.25 per cent by the bank in an attempt to ease the Consumer Price Index (CPI) rate of inflation.

It has remained at this level since August 2023 with analysts pricing in a potential rate reduction later in the year.

However, the Bank of England is being called to consider an interest rate cut sooner than expected.

Homeowners have been saddled with soaring mortgage repayment costs due to the MPC’s decision-making.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Mortgage rates have skyrocketed in recent weeks

GETTY

Among the high street lenders to raise interest rates in recent weeks include Santander, NatWest and Nationwide Building Society.

With inflation easing to 3.2 per cent, mortgage experts from RightMove highlighted the pressure the Bank faces to relieve the pressure on homeowners.

Previously, Bank of England governor Andrew Bailey shared that it was “not yet” the time to cut interest rates.

This is despite there being “further encouraging signs” that the country’s CPI rate is falling, he claims.

According to Bailey, the central bank has to ensure inflation will drop to the desired two per cent target and “stay there”.

The Bank has to be sure that inflation will reach the Government’s 2 per cent target and “stay there”, he said.

Matt Smith, Rightmove’s head of Mortgage Products, described tomorrow’s MPC meeting as “key for setting the tone” for future interest rate decisions to come.

He explained: “An uneasy few weeks for the world economy has meant that there is still a lot of uncertainty around when we might see the first interest rate cut

“Both have contributed to an uptick in average mortgage rates.

“Despite the rises, it doesn’t appear that we’re seeing the same kind of spike in rates as we did at this time last year.”

LATEST DEVELOPMENTS:

The Bank of England has held the base rate at 5.25 per cent in recent months GB NEWS

The Bank of England has held the base rate at 5.25 per cent in recent months GB NEWS

Here is a breakdown of how average mortgage have have increased, according to RightMove:

- The average five-year fixed mortgage is now 4.97 per cent, up from 4.48 per cent a year ago

- The average two-year fixed mortgage is now 5.38 per cent, up from 4.78 per cent

- The average 85 per cent LTV five-year fixed mortgage rate is now 4.90 per cent, up from 4.44 per cent

- The average 60 per cent LTV five-year fixed mortgage rate is now 4.50 per cent, up from 4.17 per cent.

Source link