First-time buyers losing out on cheaper mortgage deals

Ele Clark, from Which?, said the distribution of rate cuts is disappointing for those trying to get on to the property ladder.

She said: “Many of the market-leading deals released by banks in recent days have been exclusively available to buyers with large deposits and homeowners remortgaging with significant equity in their property.

“The wait for cheaper mortgage rates will be particularly agonising for first-time buyers with small deposits, who are often the last people to benefit from rate cuts.”

The Government has promised to permanently extend the mortgage guarantee scheme, which insures banks against borrower defaults when they take out a mortgage with only a 5pc deposit.

Sir Keir said he wanted to “turn the dream of owning a home into a reality” and help 80,000 younger buyers in this Parliament.

But with rate cuts not being passed on to first-time buyers, affordability remains out of touch for many.

For those who can get a home loan, the average first-time buyer will not pay off their mortgage until they are aged 63 years and 8 months, according to research from Mojo Mortgages.

One in five first-time buyers are also now over the age of 40, according to Santander.

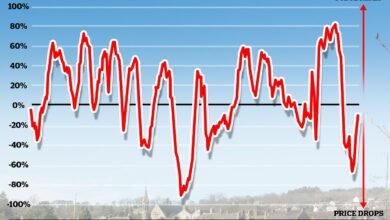

Forecasts show there is currently a 41pc likelihood that the Bank of England will cut rates for a second consecutive time next month. The Bank Rate currently stands at 5pc.

Source link