Here’s How Much Mortgage Payments in Your State Have Increased in the Past Decade

No matter the state of the economy, housing is always one of the biggest monthly expenditures that Americans face. However, the housing market at this time is especially inflated, due to factors rippling out from the pandemic such as early supply chain disruptions on building materials, low housing inventory and high mortgage rates.

Find Out: In Less Than a Decade, You Won’t Be Able To Afford Homes in These ZIP Codes

Read Next: How To Get $340 Per Year in Cash Back on Gas and Other Things You Already Buy

First-time homebuyers are struggling to buy a home, and existing homeowners are feeling the pinch in their mortgage payments.

It’s so bad that the former secretary of housing and urban development under President Barack Obama, Shaun Donovan, recently told PBS News, “I’ve been doing housing work for 30 years — the housing affordability challenge is the worst I’ve ever seen in my career.”

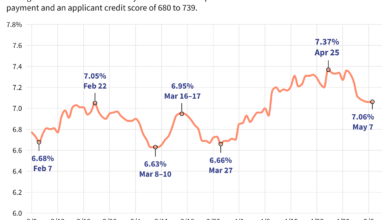

GOBankingRates set out to find out how much Americans’ mortgage payments have increased in each state over the past decade by getting the February 2024 and February 2014 home values for every state. Additionally, GOBankingRates sought the 30-year fixed rate mortgage averages from both 2014 (4.37%) and 2024 (6.94%) from Freddie Mac.

Read on to see the effect of a decade on mortgage payments.

Alabama

-

February 2014 home value: $128,167

-

February 2024 home value: $217,961

-

February 2014 average mortgage payment: $512

-

February 2024 average mortgage payment: $1,153

-

10-year % change in mortgage payment: 125.37%

Check Out: 8 States To Move to If You Don’t Want To Pay Taxes on Social Security

Be Aware: 7 Florida Cities That Could Be Headed for a Housing Crisis

Sponsored: Credit card debt keeping you up at night? Find out if you can reduce your debt with these 3 steps

Alaska

-

February 2014 home value: $260,819

-

February 2024 home value: $362,644

-

February 2014 average mortgage payment: $1,041

-

February 2024 average mortgage payment: $1,918

-

10-year % change in mortgage payment: 84.26%

Discover More: 8 Places Where Houses Are Suddenly Major Bargains

Arizona

-

February 2014 home value: $192,436

-

February 2024 home value: $436,307

-

February 2014 average mortgage payment: $768

-

February 2024 average mortgage payment: $2,308

-

10-year % change in mortgage payment: 200.47%

Arkansas

-

February 2014 home value: $117,907

-

February 2024 home value: $198,530

-

February 2014 average mortgage payment: $471

-

February 2024 average mortgage payment: $1,050

-

10-year % change in mortgage payment: 123.14%

California

-

February 2014 home value: $384,541

-

February 2024 home value: $785,294

-

February 2014 average mortgage payment: $1,535

-

February 2024 average mortgage payment: $4,154

-

10-year % change in mortgage payment: 170.63%

Colorado

-

February 2014 home value: $253,742

-

February 2024 home value: $550,989

-

February 2014 average mortgage payment: $1,013

-

February 2024 average mortgage payment: $2,915

-

10-year % change in mortgage payment: 187.77%

Read More: 5 Types of Homes That Will Plummet in Value in 2024

Connecticut

-

February 2014 home value: $247,711

-

February 2024 home value: $409,905

-

February 2014 average mortgage payment: $989

-

February 2024 average mortgage payment: $2,168

-

10-year % change in mortgage payment: 119.30%

Delaware

-

February 2014 home value: $218,301

-

February 2024 home value: $371,763

-

February 2014 average mortgage payment: $871

-

February 2024 average mortgage payment: $1,967

-

10-year % change in mortgage payment: 125.68%

Florida

-

February 2014 home value: $166,288

-

February 2024 home value: $409,638

-

February 2014 average mortgage payment: $664

-

February 2024 average mortgage payment: $2,167

-

10-year % change in mortgage payment: 226.46%

Georgia

-

February 2014 home value: $138,646

-

February 2024 home value: $323,386

-

February 2014 average mortgage payment: $553

-

February 2024 average mortgage payment: $1,711

-

10-year % change in mortgage payment: 209.10%

Explore More: The Best Place To Live on a $100,000 Salary in Every State

Hawaii

-

February 2014 home value: $536,391

-

February 2024 home value: $967,296

-

February 2014 average mortgage payment: $2,141

-

February 2024 average mortgage payment: $5,117

-

10-year % change in mortgage payment: 138.98%

Idaho

-

February 2014 home value: $170,896

-

February 2024 home value: $443,630

-

February 2014 average mortgage payment: $682

-

February 2024 average mortgage payment: $2,347

-

10-year % change in mortgage payment: 244.02%

Illinois

-

February 2014 home value: $150,696

-

February 2024 home value: $255,278

-

February 2014 average mortgage payment: $602

-

February 2024 average mortgage payment: $1,350

-

10-year % change in mortgage payment: 124.49%

Indiana

-

February 2014 home value: $115,056

-

February 2024 home value: $231,797

-

February 2014 average mortgage payment: $459

-

February 2024 average mortgage payment: $1,226

-

10-year % change in mortgage payment: 166.99%

Learn More: I’m a Real Estate Agent: These 5 Cities Are Becoming Unaffordable

Iowa

-

February 2014 home value: $126,296

-

February 2024 home value: $212,618

-

February 2014 average mortgage payment: $504

-

February 2024 average mortgage payment: $1,125

-

10-year % change in mortgage payment: 123.10%

Kansas

-

February 2014 home value: $118,509

-

February 2024 home value: $218,078

-

February 2014 average mortgage payment: $473

-

February 2024 average mortgage payment: $1,154

-

10-year % change in mortgage payment: 143.87%

Kentucky

-

February 2014 home value: $105,366

-

February 2024 home value: $196,576

-

February 2014 average mortgage payment: $421

-

February 2024 average mortgage payment: $1,040

-

10-year % change in mortgage payment: 147.24%

Louisiana

-

February 2014 home value: $152,998

-

February 2024 home value: $195,141

-

February 2014 average mortgage payment: $611

-

February 2024 average mortgage payment: $1,032

-

10-year % change in mortgage payment: 69.03%

Check Out: ChatGPT Unveils: 5 Worst Cities To Buy a House in 2024

Maine

-

February 2014 home value: $175,417

-

February 2024 home value: $379,011

-

February 2014 average mortgage payment: $700

-

February 2024 average mortgage payment: $2,005

-

10-year % change in mortgage payment:186.33%

Maryland

-

February 2014 home value: $268,462

-

February 2024 home value: $418,225

-

February 2014 average mortgage payment: $1,072

-

February 2024 average mortgage payment: $2,213

-

10-year % change in mortgage payment: 106.45%

Massachusetts

-

February 2014 home value: $322,110

-

February 2024 home value: $616,983

-

February 2014 average mortgage payment: $1,286

-

February 2024 average mortgage payment: $3,264

-

10-year % change in mortgage payment: 153.84%

Michigan

-

February 2014 home value: $111,270

-

February 2024 home value: $230,579

-

February 2014 average mortgage payment: $444

-

February 2024 average mortgage payment: $1,220

-

10-year % change in mortgage payment: 174.62%

Discover More: Why Florida’s Retirees Are Fleeing — And Where They’re Going Instead

Minnesota

-

February 2014 home value: $182,986

-

February 2024 home value: $328,696

-

February 2014 average mortgage payment: $730

-

February 2024 average mortgage payment: $1,739

-

10-year % change in mortgage payment: 138.05%

Mississippi

-

February 2014 home value: $108,191

-

February 2024 home value: $170,810

-

February 2014 average mortgage payment: $432

-

February 2024 average mortgage payment: $904

-

10-year % change in mortgage payment: 109.22%

Missouri

-

February 2014 home value: $124,287

-

February 2024 home value: $239,144

-

February 2014 average mortgage payment: $496

-

February 2024 average mortgage payment: $1,265

-

10-year % change in mortgage payment: 154.99%

Montana

-

February 2014 home value: $201,826

-

February 2024 home value: $450,517

-

February 2014 average mortgage payment: $806

-

February 2024 average mortgage payment: $2,383

-

10-year % change in mortgage payment: 195.82%

Find Out: Barbara Corcoran Says, ‘Forget About Florida,’ Move Here for Cheap Homes

Nebraska

-

February 2014 home value: $131,909

-

February 2024 home value: $251,976

-

February 2014 average mortgage payment: $527

-

February 2024 average mortgage payment: $1,333

-

10-year % change in mortgage payment: 153.15%

Nevada

-

February 2014 home value: $193,515

-

February 2024 home value: $441,950

-

February 2014 average mortgage payment: $773

-

February 2024 average mortgage payment: $2,338

-

10-year % change in mortgage payment: 202.66%

New Hampshire

-

February 2014 home value: $222,129

-

February 2024 home value: $475,398

-

February 2014 average mortgage payment: $887

-

February 2024 average mortgage payment: $2,515

-

10-year % change in mortgage payment: 183.62%

New Jersey

-

February 2014 home value: $292,407

-

February 2024 home value: $519,941

-

February 2014 average mortgage payment: $1,167

-

February 2024 average mortgage payment: $2,751

-

10-year % change in mortgage payment: 135.64%

Be Aware: A $150K Income Is ‘Lower Middle Class’ In These High-Cost Cities

New Mexico

-

February 2014 home value: $162,708

-

February 2024 home value: $293,801

-

February 2014 average mortgage payment: $650

-

February 2024 average mortgage payment: $1,554

-

10-year % change in mortgage payment: 139.30%

New York

-

February 2014 home value: $230,212

-

February 2024 home value: $428,712

-

February 2014 average mortgage payment: $919

-

February 2024 average mortgage payment: $2,268

-

10-year % change in mortgage payment: 146.79%

North Carolina

-

February 2014 home value: $153,492

-

February 2024 home value: $324,113

-

February 2014 average mortgage payment: $613

-

February 2024 average mortgage payment: $1,715

-

10-year % change in mortgage payment: 179.84%

North Dakota

-

February 2014 home value: $198,435

-

February 2024 home value: $252,455

-

February 2014 average mortgage payment: $792

-

February 2024 average mortgage payment: $1,336

-

10-year % change in mortgage payment: 68.60%

Read Next: How Much Household Income Will Be Considered Upper Middle Class in 5 Years?

Ohio

-

February 2014 home value: $114,204

-

February 2024 home value: $218,937

-

February 2014 average mortgage payment: $456

-

February 2024 average mortgage payment: $1,158

-

10-year % change in mortgage payment: 154.06%

Oklahoma

-

February 2014 home value: $112,502

-

February 2024 home value: $200,364

-

February 2014 average mortgage payment: $449

-

February 2024 average mortgage payment: $1,060

-

10-year % change in mortgage payment: 136.02%

Oregon

-

February 2014 home value: $233,107

-

February 2024 home value: $494,780

-

February 2014 average mortgage payment: $931

-

February 2024 average mortgage payment: $2,618

-

10-year % change in mortgage payment: 181.29%

Pennsylvania

-

February 2014 home value: $153,241

-

February 2024 home value: $256,822

-

February 2014 average mortgage payment: $612

-

February 2024 average mortgage payment: $1,359

-

10-year % change in mortgage payment: 122.10%

Check Out: How Far a $100,000 Salary Goes in America’s 50 Largest Cities

Rhode Island

-

February 2014 home value: $222,066

-

February 2024 home value: $448,778

-

February 2014 average mortgage payment: $886

-

February 2024 average mortgage payment: $2,374

-

10-year % change in mortgage payment: 167.82%

South Carolina

-

February 2014 home value: $144,335

-

February 2024 home value: $289,251

-

February 2014 average mortgage payment: $576

-

February 2024 average mortgage payment: $1,530

-

10-year % change in mortgage payment: 165.58%

South Dakota

-

February 2014 home value: $160,012

-

February 2024 home value: $293,085

-

February 2014 average mortgage payment: $639

-

February 2024 average mortgage payment: $1,550

-

10-year % change in mortgage payment: 142.74%

Tennessee

-

February 2014 home value: $137,693

-

February 2024 home value: $310,207

-

February 2014 average mortgage payment: $550

-

February 2024 average mortgage payment: $1,641

-

10-year % change in mortgage payment: 198.56%

Learn More: What Income Level Is Considered Middle Class in Your State?

Texas

-

February 2014 home value: $146,971

-

February 2024 home value: $299,474

-

February 2014 average mortgage payment: $587

-

February 2024 average mortgage payment: $1,584

-

10-year % change in mortgage payment: 170.03%

Utah

-

February 2014 home value: $224,197

-

February 2024 home value: $519,469

-

February 2014 average mortgage payment: $895

-

February 2024 average mortgage payment: $2,748

-

10-year % change in mortgage payment: 207.06%

Vermont

-

February 2014 home value: $216,671

-

February 2024 home value: $375,943

-

February 2014 average mortgage payment: $865

-

February 2024 average mortgage payment: $1,989

-

10-year % change in mortgage payment: 129.94%

Virginia

-

February 2014 home value: $228,844

-

February 2024 home value: $383,327

-

February 2014 average mortgage payment: $914

-

February 2024 average mortgage payment: $2,028

-

10-year % change in mortgage payment: 121.98%

Read Next: Here’s What the US Minimum Wage Was the Year You Were Born

Washington

-

February 2014 home value: $254,897

-

February 2024 home value: $589,807

-

February 2014 average mortgage payment: $1,018

-

February 2024 average mortgage payment: $3,120

-

10-year % change in mortgage payment: 206.65%

West Virginia

-

February 2014 home value: $98,985

-

February 2024 home value: $155,333

-

February 2014 average mortgage payment: $395

-

February 2024 average mortgage payment: $822

-

10-year % change in mortgage payment: 107.96%

Wisconsin

-

February 2014 home value: $153,064

-

February 2024 home value: $289,236

-

February 2014 average mortgage payment: $611

-

February 2024 average mortgage payment: $1,530

-

10-year % change in mortgage payment: 150.42%

Wyoming

-

February 2014 home value: $208,744

-

February 2024 home value: $333,745

-

February 2014 average mortgage payment: $833

-

February 2024 average mortgage payment: $1,766

-

10-year % change in mortgage payment: 111.88%

Methodology: For this piece, GOBankingRates found the February 2024 and February 2014 home values for every state as well as the Feb. 27, 2014, 30-year fixed rate mortgage average (4.37%) from Freddie Mac as well as the February 29, 2024 30-year fixed rate mortgage average (6.94%) from Freddie Mac. GOBankingRates was then able to calculate the 2024 and 2014 average mortgage payments for each state with the following assumptions: 30-year fixed rate mortgage, 20% down payment, no P&I and no HOA fees, and with property taxes excluded as a different charge. GOBankingRates then found the 10-year monetary and percent difference in average mortgage payment for every state. All data was collected and is up to date as of April 8, 2024.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Here’s How Much Mortgage Payments in Your State Have Increased in the Past Decade

Source link