High mortgage rates hang around, reaching 7.17%

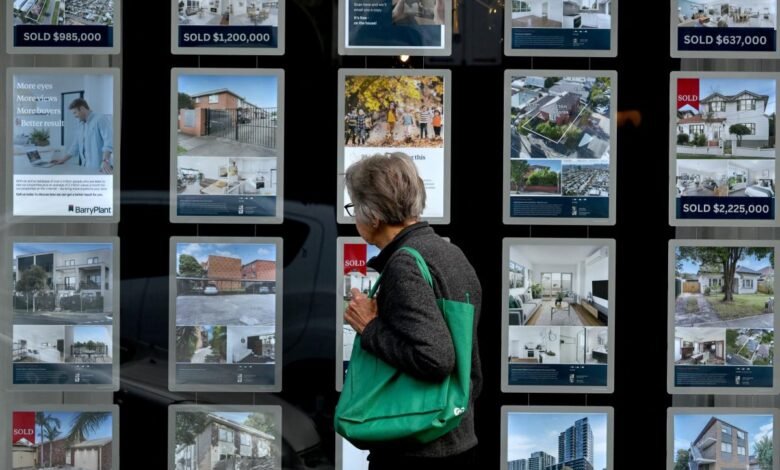

Mortgage rates continued their climb past the 7% threshold this week, sidelining price-sensitive buyers in their wake.

The rate on the 30-year fixed rate mortgage rose to 7.17% on Thursday, up from 7.1% the week prior, according to Freddie Mac. Rates surged past 7% last week for the first time this year following a government report showing inflation remained hotter than expected.

A separate measure, which tracks rate changes daily, revealed even bigger swings. The daily rate on the popular 30-year fixed loan was 7.52% on Thursday, the highest reading since November 2023, according to Mortgage News Daily.

The uptick in rates was a sour note for would-be buyers hoping to get into the spring market, forcing some first-time and repeat buyers back on the sidelines.

Any hope of seeing rates stabilize will be contingent on inflation, said Jiayu Xu, an economist at Realtor.com.

“Unfortunately, the rising mortgage rates occurred during what is typically a busy time in the housing market, potentially giving pause to prospective homebuyers as they weigh their purchasing decisions,” Xu said. “Despite the increased mortgage rates leading to higher costs, it could also suggest a less competitive market where opportunities may exist for some homebuyers.”

Read more: Mortgage rates today, April 25: Rates increase for the 4th straight week

Buyers backpedal as rates soar

Demand for mortgages slowed last week as mortgage rates hit their highest levels since late 2023.

The volume of applications to purchase a home fell 1% during the week ending April 19, according to the Mortgage Bankers Association (MBA) weekly survey of applications. Overall, applications were down 15% compared to one year ago.

Those purchasing turned to government-backed loans or adjustable-rate mortgages (ARMs), which offer slightly lower interest rates.

The ARM share of applications increased nearly 8%, the MBA noted, which was consistent with the uptick in rates as buyers searched for any measure of relief. The FHA share of applications also registered a modest uptick, rising roughly 13% for the week ending April 19.

But homebuyers weren’t the only ones halted by the uptick in mortgage rates. Refinance applications fell 6% last week, the MBA found, as homeowners lost hope of snagging a lower rate.

While mortgage rates are partially to blame for the lull in demand, the limited supply of homes on the market is a big factor. There’s still more demand than there is supply, keeping home prices from edging down.

It’s also fed the lock-in effect.

“The jump in mortgage rates has taken the wind out of the sails of the mortgage market,” said Bob Broeksmit, CEO and MBA president. “Along with weaker affordability conditions, the lock-in effect continues to suppress existing inventory levels as many homeowners remain unwilling to sell their home to buy a new one at a higher price and mortgage rate.”

Read more: Mortgage rates top 7% — is this a good time to buy a house?

A silver lining in new construction

While inventory of previously owned homes continues to hover near 30-year lows, sales of newly built homes in March surpassed expectations, seeing the largest increase since December 2022.

Sales of newly built, single-family homes in March rose nearly 9% to 693,000 on a seasonally adjusted annual rate, according to data released this week by the US Census Bureau and US Department of Housing and Urban Development.

The pace of new home sales last month was up just over 8% from a year earlier, though experts predict it may moderate.

Still, new homes represent a cushion for buyers facing low inventory on the existing home side.

New single-family home inventory in March sat at 477,000, up nearly 3% from February. That represents about 8 months of supply at the current building pace. As for existing single-family homes, data from NAR shows there were just over 3 months of supply in March — at least 5 to 6 months represent a balanced market.

Overall, the inventory of newly built homes in March was up just over 10% annually.

According to Sam Khater, Freddie Mac’s chief economist, buyers are coming to terms with higher rates, as evidenced by the recent uptick in sales for new homes.

“Despite rate increases more than half a percent since the first week of the year, purchase demand remains steady,” said Khater. “With rates staying higher for longer, many homebuyers are adjusting.”

Gabriella Cruz-Martinez is a personal finance and housing reporter at Yahoo Finance. Follow her on X @__gabriellacruz.