Home Buyers’ Strike Expands even as Mortgage Rates Drop to Lowest since May 2023. Surging Refis to Speed Up the Fed’s QT

People are waiting for rates and prices to drop, while supply keeps rising.

By Wolf Richter for WOLF STREET.

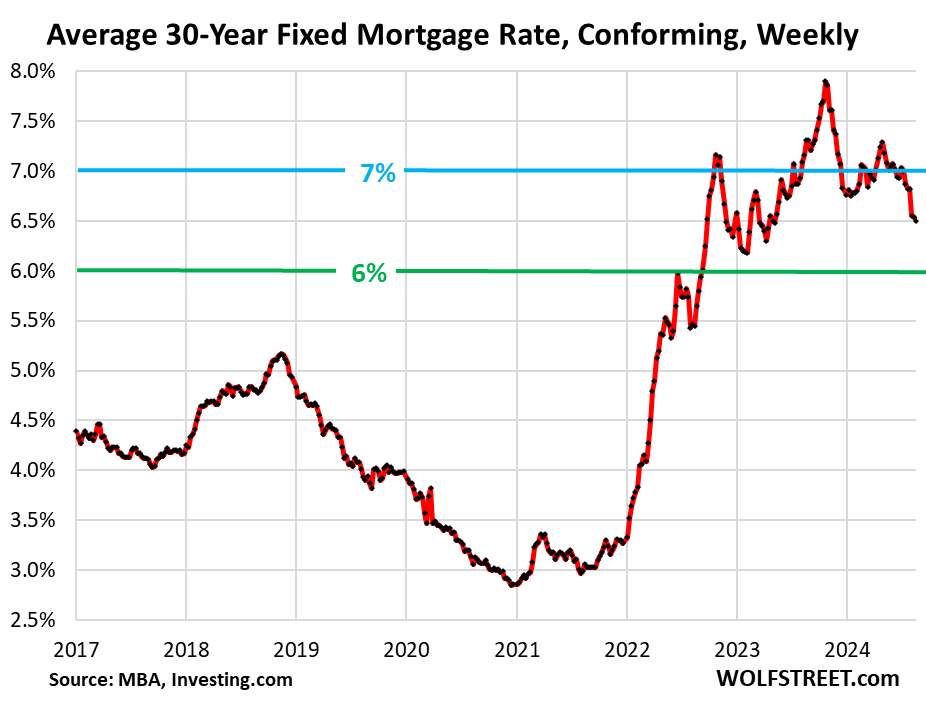

Mortgage rates dropped to 6.50%, the lowest since May 2023, according to the Mortgage Bankers Association today. But instead of re-igniting demand for homes from buyers who need mortgages, these dropping rates have caused potential buyers to wait for mortgage rates to drop further, and to wait for home prices to drop, as prices are way too high, and so demand has dropped further, with applications for mortgages to purchase a home dropping toward their historic lows.

But the lower mortgage rates have re-ignited applications to refinance existing mortgages, and refi mortgage applications have jumped in recent weeks and have doubled from the historically low levels last fall. This surge for refi applications does nothing for the housing market, but it does speed up the pace of the Fed’s QT because it causes the mortgage-backed securities (MBS) to come off the Fed’s balance sheet faster, and we’re seeing the first signs of that.

The average conforming 30-year fixed mortgage rate during the latest reporting week dipped another 4 basis points, to 6.50%, the lowest since May 2023, according to the Mortgage Bankers Association today. This measure of mortgage rates has been above 6% since September 2022.

People are on Buyers’ Strike, waiting for lower rates and lower prices.

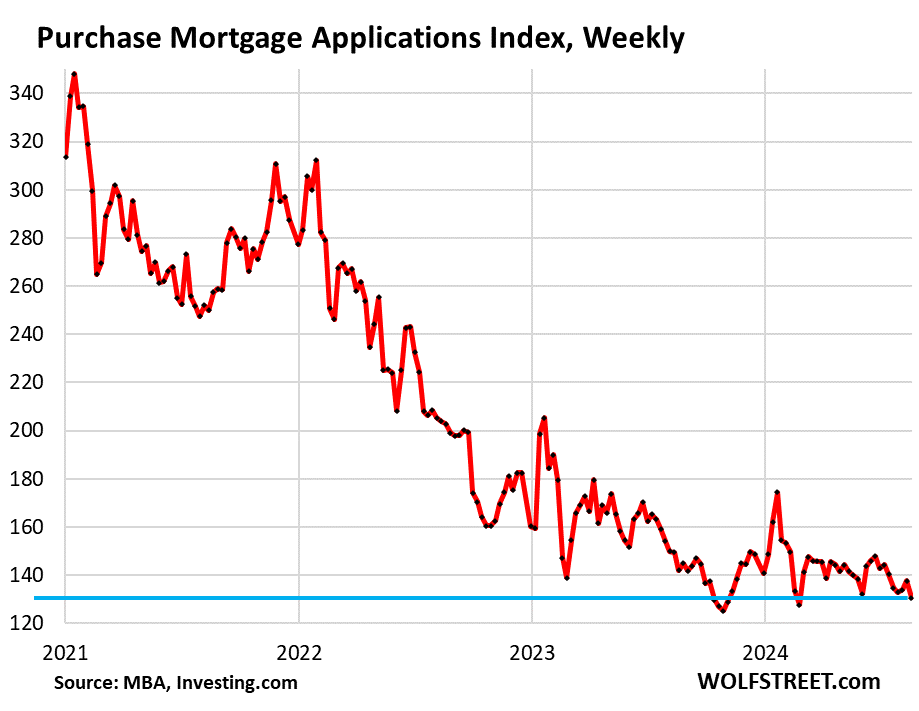

Home prices are too high even for cash buyers and institutional investors, purchases of existing homes have plunged, as supply has surged, and applications for mortgages to purchase a home have collapsed by nearly half from their pre-pandemic levels in 2019, and in the latest reporting week fell further.

The Purchase Mortgage Applications Index is now just a hair above November 2023 when they’d dropped to the lowest levels in the data going back to 1995 after mortgage rates had spiked to 7.8%.

Mortgage applications are an early indication of demand and home sales volume:

Mortgage refi applications spike will speed up the Fed’s QT.

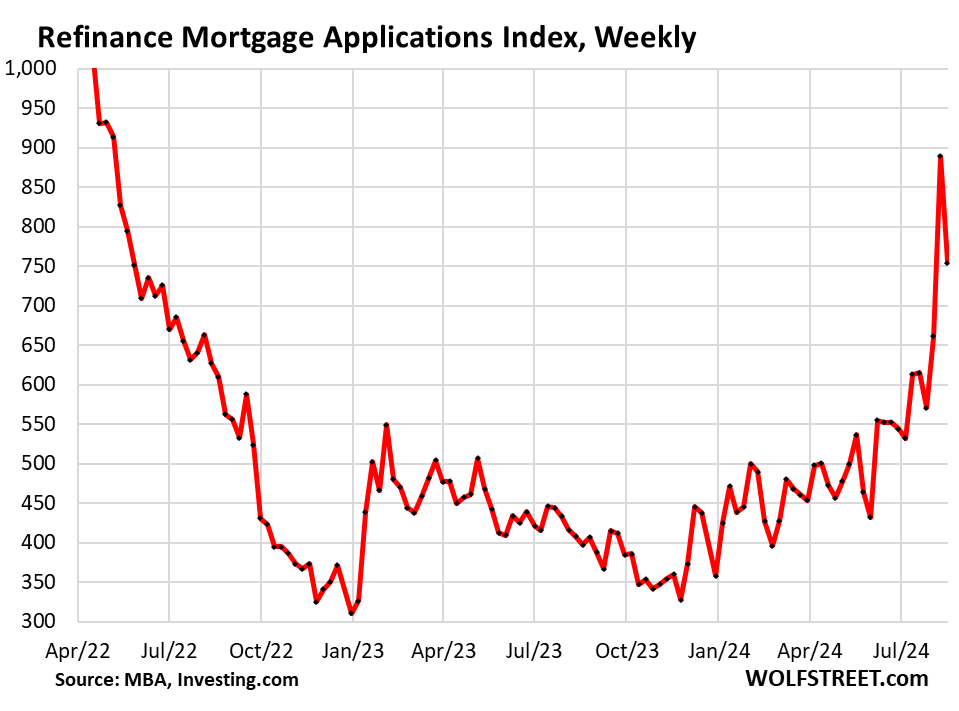

But mortgage applications to refinance a home have been rising in their zigzag manner since early 2024, from very low levels. And in early July, as mortgage rates dropped, refi applications started spiking.

Last week, the index spiked to the highest activity level since April 2022, the beginning of the rate-hike cycle. In the current week, mortgage applications backed off from that spike but were still the highest since May 2022. Since last fall, refi applications have more than doubled. Surging mortgage refis accelerate the pace of the Fed’s QT.

In terms of the Fed’s QT, mortgage-backed securities (MBS) come off the Fed’s balance sheet when the underlying mortgages are paid down via regular mortgage payments, or are paid off when the mortgaged home is sold, or when the mortgage is refinanced, and these principal payments are passed through to the MBS holders, such as the Fed.

The Fed’s monthly MBS runoff had moved along at a crawl from the beginning because mortgage rates had soared before the Fed even started QT, home purchase volume had plunged, and refi volume had collapsed. By early 2024, the pace of the MBS runoff had been running at about $14 billion a month as a result of the historic collapse in mortgage payoffs.

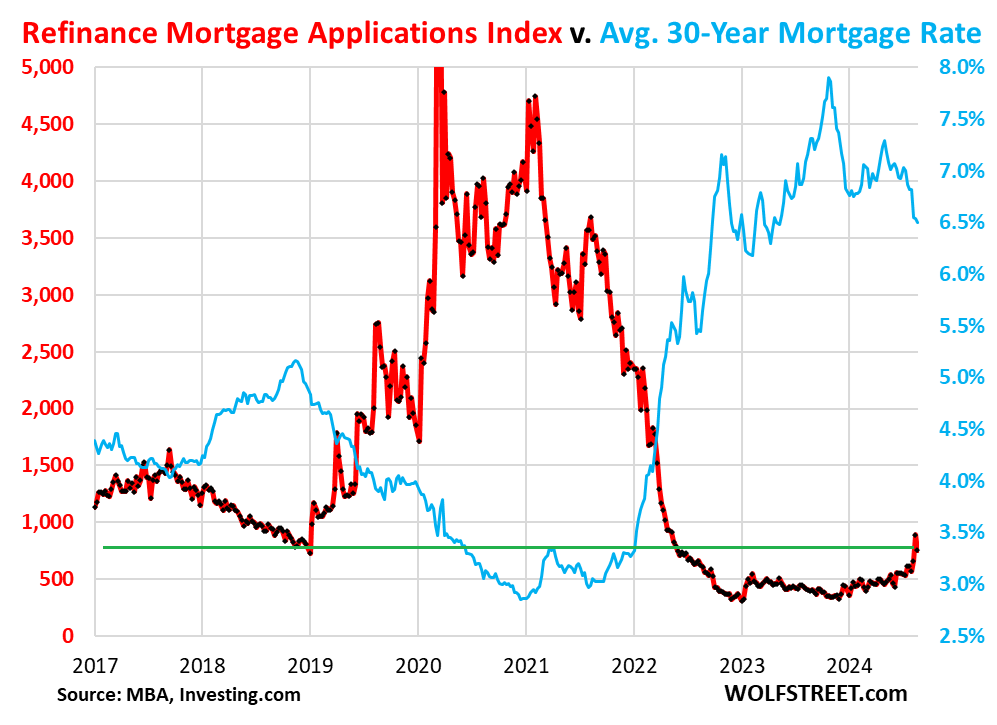

But these refis in August are the highest since the Fed started QT in the summer of 2022. The QT pace for MBS is approaching $20 billion a month, reflecting the higher refi volume this spring. The jump in refi applications since early July will speed up the pace of the Fed’s QT when the passthrough principal payments from the paid-off old mortgages actually reach the Fed.

A future increase in home sales volume, and therefore higher mortgage payoffs, will further speed up the Fed’s QT.

On this longer-view chart, which includes the historic spike in refi applications during the 3%-mortgage era, we can see how refi applications (red) have nearly doubled from the lows last November, as mortgage rates (blue) have fallen.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Source link