Housing market data suggests the most optimistic buyers during the pandemic are more likely to stop paying their mortgages

During the COVID-19 pandemic, there was a period when confidence in future housing price increases waned, despite actual prices still rising. Michaela Vatcheva – Bloomberg – Getty Images

Traditional methods for forecasting housing prices and broader economic indicators are proving insufficient. In our recent research, we explored an overlooked aspect of home buying: the significance of buyers’ expectations. We found that the anticipations of mortgage borrowers regarding future housing prices are crucial for understanding the health of the economy.

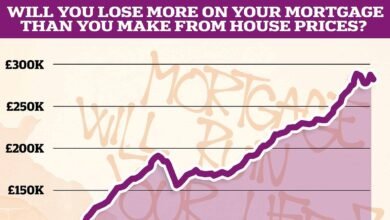

There’s a consensus that the expectations about future increases in housing prices and interest rates significantly influence housing market dynamics. The logic is straightforward: If individuals believe the value of homes will rise, they are more inclined to take on more debt. This effect is amplified in the housing market because you cannot bet against market downturns, making the positive outlooks of buyers more influential. Previous studies have indicated that this optimism can drive rapid increases in housing prices, creating “bubbles.” These bubbles often lead to inflated house prices, fueled by speculation.

What occurs, however, when housing prices remain elevated but expectations begin to decline?

Our findings indicate that expectations are critical in the decision-making processes of mortgage borrowers. During the COVID-19 pandemic, there was a period when confidence in future housing price increases waned, despite actual prices still rising.

We observed that borrowers who were initially the most optimistic about price increases were significantly more likely to request mortgage forbearance–a pause or reduction in payments–by about 50% more than the broader mortgage-borrowing population (6% versus 4% in our study) during this episode. This underscores the significant impact of borrower expectations on the housing market and economic stability.

Expectations trump reality

We began our research with data from the Federal Housing Finance Agency, specifically the National Mortgage Database, and noticed something intriguing: Before 2020, people who were positive about the future increase in house prices were more likely to pause their mortgage payments early in the COVID-19 pandemic, despite the fact that house prices were still going up. This observation led us to understand that these borrowers were reacting more to their expectations about the future than to the actual market conditions at the time. When their outlook on house prices temporarily worsened, they opted for forbearance. However, as their optimism returned towards the end of 2020 and throughout the pandemic, these same borrowers began resuming their mortgage payments.

This pattern underscores how crucial expectations are in shaping how borrowers act, which, in turn, has significant effects on the broader economy. After our study period, which ended in 2022, expectations dropped substantially heading into 2023. Our findings suggest that the wave of optimistic borrowers between 2021 and mid-2022 may be particularly vulnerable to such drops in expectations if paired with negative equity or job loss. Thankfully for the mortgage market, the economy–and house prices–remained strong throughout this most recent episode of falling expectations.

Our research serves as a warning to those involved in housing policy and finance: It’s essential to consider what borrowers are thinking and expecting, not just the usual financial indicators like interest rates, monthly payments, or how much debt they’re taking on compared to the value of their home.

Understanding people’s expectations is tricky–they’re hard to measure and introduce a challenge known as adverse selection, where borrowers have more information about their ability to pay back loans than the lenders or investors do. Discovering that something not typically tracked by mortgage investors, like borrower expectations, can have a big impact on whether loans are paid as agreed is striking and warrants more attention.

For those regulating and monitoring the housing market, grasping the relationship between what people expect and what’s actually happening can lead to better forecasts and smarter policymaking.

Christos A. Makridis, Ph.D., is an associate research professor at Arizona State University, the University of Nicosia, and the founder and CEO of Dainamic Banking.

William D. Larson, Ph.D., is a senior researcher in the U.S. Treasury’s Office of Financial Research, and a non-resident fellow at the George Washington University’s Center for Economic Research. This research was conducted while Larson was a senior economist at the Federal Housing Finance Agency (FHFA). The views presented here are those of the authors alone and not of the U.S. Treasury, FHFA, or the U.S. Government.

More must-read commentary published by Fortune:

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

Source link