June Mortgage Rates: Calm at Takeoff, Then Subject to Turbulence

Mortgage rates probably won’t vary much in the first week and a half of June. But starting June 12, it’s anyone’s guess what rates will do.

A bunch of factors influence mortgage rates. In the last two-plus years, two items have exerted an especially big impact: the monthly consumer price index, and meetings of the Federal Reserve’s monetary policy committee. And both will happen on June 12, in an uncommon kink in the calendar.

The CPI, which measures inflation, has the ability to move mortgage rates all by itself. Higher-than-expected inflation can push rates higher, and lower-than-expected inflation can nudge them lower. Decisions made at the Fed meeting can send rates up or down, too. Financial markets usually have days or weeks to digest one before reacting to the other: In May, a Fed meeting ended on the first day of the month, and the CPI report was released on the 15th.

But markets will have just five and a half hours for reflection between reports in June. First comes May’s CPI, at 8:30 a.m. Eastern time on June 12. The Fed’s monetary policy statement will be released at 2 p.m., accompanied by the central bank’s updated set of economic projections. The policy statement and economic projections will be followed a half-hour later by Fed Chair Jerome Powell’s news conference.

That’s a lot of potentially market-moving information in one day. The back-to-back events could fuel volatility in mortgage rates, pushing them abruptly in one direction or the other. But it’s equally plausible that rates won’t react much at all. It depends on whether the CPI or the Fed delivers a surprise.

A lot of uncertainty

Mortgage rates move up or down according to investors’ outlook on the economy. An unexpectedly rosy or grim economic report can reset that outlook, causing rates to jump or to plunge. Inflation gauges such as the CPI have this power. For its part, the Fed tries hard not to fluster investors. But it, too, has the capability to jolt markets — intentionally or not — when it revises its economic projections.

If surprising headlines arise on June 12, they could send mortgage rates on a wild ride. Or the day could proceed according to expectations, without mussing a hair of the mortgage market. We won’t know the day’s outcome until the end of Powell’s news conference.

Word of the month: ‘volatility’

As of the end of May, the Cleveland Fed was forecasting that the June 12 CPI report will show that core consumer prices rose about 3.6% in May, the same as April’s reading. Based on this expectation, the 30-year fixed-rate mortgage was between 7% and 7.25% as May drew to a close. The rate is likely to remain within that range through June 11 as markets await the big day.

Then June 12 rolls around, and with it, the CPI report. If core CPI drops significantly — say, to 3.4% or lower — mortgage rates could fall. If core CPI is above 3.6%, mortgage rates could rise. If core CPI is 3.5% or 3.6%, the mortgage market might yawn, without much rate movement.

Hours later, the Federal Reserve and Powell could reinforce or undercut the impact of the CPI report. Financial markets expect the Fed to reduce short-term interest rates in September or November, and investors will listen for any hint that the central bank will act sooner or later than that. Whatever happens, the events of that day might guide the trajectory of mortgage rates for weeks

“Expect more rate volatility ahead as the Fed and investors wait for more conclusive evidence of a return to low, stable and more predictable inflation,” Zillow’s senior economist, Orphe Divounguy, said in a news release.

If you’re trying to decide whether to float or lock a mortgage rate, reach out to your loan officer, who should have up-to-date information.

What other forecasters predict

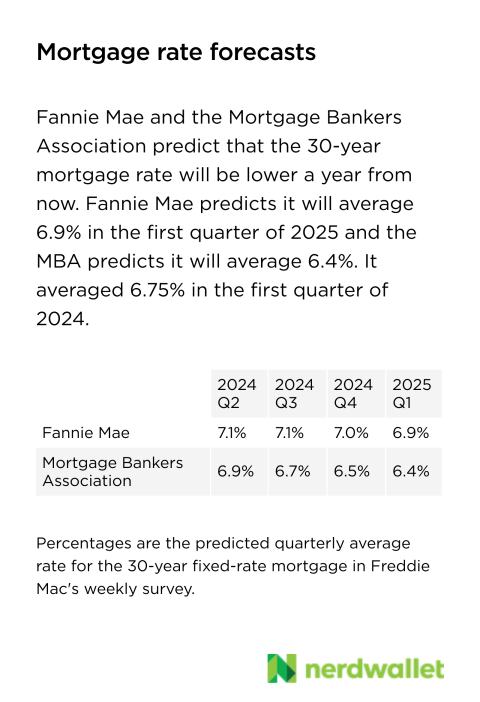

Fannie Mae and the Mortgage Bankers Association revised their mortgage rate forecasts upward in May as inflation has proved tenacious. Fannie Mae’s prediction is less optimistic than the MBA’s.

What happened in May

The average rate on the 30-year fixed-rate mortgage averaged 7.01% in May, barely down from April’s average of 7.04%. The 30-year mortgage was above 7.25% at the beginning of the month, then dropped below 7% for a couple of weeks before rebounding above 7% in the last week.

More From NerdWallet

The article June Mortgage Rates: Calm at Takeoff, Then Subject to Turbulence originally appeared on NerdWallet.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Source link