Mortgage rate update August 2024: Price cuts continue

Mortgage prices have continued to fall this week with remortgaging customers now gaining the benefit of rate cuts.

In its latest round of price cuts Nationwide unveiled a sub-4% remortgage deal which is a five-year fixed rate for those who need to borrow at 60% loan-to-value (LTV).

In its latest round of price cuts Nationwide unveiled a sub-4% remortgage deal which is a five-year fixed rate for those who need to borrow at 60% loan-to-value (LTV).

It has a rate of 3.99% and comes with a £999 fee and the LTV level means borrowers will need 40% equity to be eligible.

However, up until the point last week when Nationwide announced this deal, the only mortgages with rates below 4% were for house purchases.

Nationwide’s announcement came, therefore, as great news to all those who coming off historically low fixed-rate deals and hoping prices would fall when they came to find a new mortgage.

Nationwide also revealed it was offering a five-year fix for house purchase customers with 40% equity at 3.78%. This comes with a £1,499 fee.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “A sub-4% five-year fix is great news for those coming up to remortgage and is the first one that has been available since the end of February.

“Until now, lenders have been targeting home movers with sub-4% rates but competition among the ‘big six’ lenders is driving rates lower and now those remortgaging are also seeing the benefit.”

He added: “With markets expecting further rate cuts, we could see a 3.5% five-year fix by the time we get to Christmas, which will be a massive psychological boost for the market.”

Customers making a mortgage application should ‘stay alert’

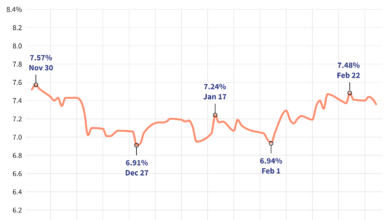

In the last week the average two-year fixed rate has fallen from 5.62% to 5.58%. Meanwhile, the five-year option has also dropped from an average of 5.25% to 5.22%, according to the latest data from Moneyfacts.

With lenders getting competitive and announcing rate cuts regularly, customers in the process of taking out a mortgage are being urged to remain alert to ensure they don’t miss on out any price reductions.

Hannah Bashford, director at Model Financial Solutions, speaking via the Newspage agency, said: “It’s now more important than ever to look at the whole of the market and make sure, if you’re purchasing or remortgaging, that you are tracking rates.

“I have made four changes to one client’s mortgage application in the past six weeks alone. If you go direct, a lender is simply not going to tell you of these changes or encourage you to adjust your rate.”