Prospect of more mortgage rate rises causing housing market ‘caution’

- Recent easing in mortgage rates ‘likely to stall’ according to Rics survey

- But estate agents also say buyer enquiries and new seller listings are picking up

- Downward trend of property prices has ‘stabilised’, survey findings claim

Suspicion that the recent easing in mortgage rates is ‘likely to stall’ has triggered ongoing ‘caution’ in the housing market, according to the Royal Institution of Chartered Surveyors (Rics).

Jitters over mortgage rates and ‘uncertainty’ about the speed and timing of Bank of England interest rate reductions is hampering the near-term outlook for the sector, it said.

However, new listings and buyer enquiries are on the up, the Rics said, claiming a ‘more positive trend’ was emerging. Property price falls also appeared to have ‘stabilised’, it added.

This week several of the UK’s biggest mortgage lenders announced plans to hike their mortgage rates, as interest on home loans continues to move upwards again.

Santander, NatWest, the Co-op Bank and Principality Building Society all announced they will be increasing rates on home loans.

Related Articles

HOW THIS IS MONEY CAN HELP

But there was also a ‘strong rise’ in new listing instructions from sellers in February, the Rics said.

It added: ‘The latest net balance of +21 per cent represents the strongest reading since October 2020, standing in stark contrast to the continuously negative picture cited throughout 2023.’

The net balance figure means that the difference between the number of Rics members that reported increasing numbers of buyer enquiries was 21 per cent higher than those reporting fewer buyer enquiries.

It added: ‘In keeping with this, average stock levels on estate agents books now sit at 42 properties, the highest since February 2021,’ though admitted that the figure remained quite low on a longer-term comparison.

House price falls ‘stabilising’

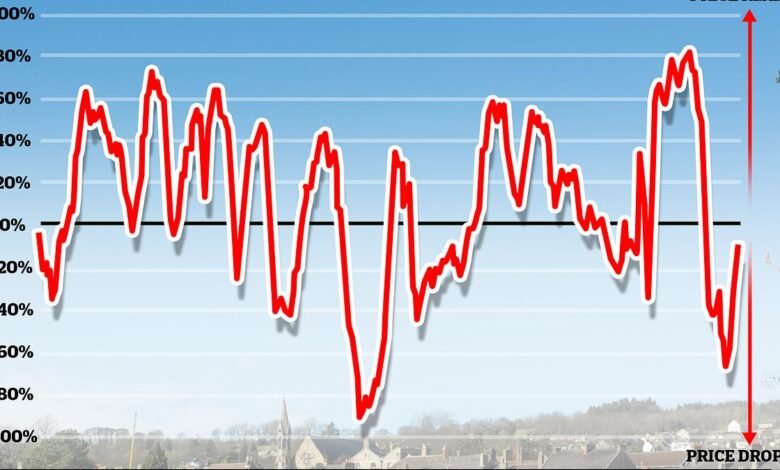

On house prices, the Rics said: ‘With respect to the survey’s gauge of headline house prices, the latest net balance of -10 per cent points to the downward trend evident over the past year more or less stabilising.

‘In fact, the February reading is the least negative figure since October 2022, having been as low as -67 per cent in September last year.’

It means 10 per cent more respondents thought house prices were falling, than the number which said they were rising.

Looking ahead, a net balance of 36 per cent of respondents across England and Wales now envisage house prices returning to growth in twelve months’ time, up from a reading of 18 per cent the previous month.

Enquiries from prospective buyers increased for the second consecutive month in February. One estate agent surveyed said they had more than 20 offers come in for a single flat in Scotland, which sold for 31 per cent more than

Grant Robertson, of Allied Surveyors Scotland in Glasgow, said it was ‘testament to a market under pressure.’

Meanwhile, Paul McSkimmings, principal of Edward Watson Associates in Newcastle Upon Tyne, said: ‘A continued lack of supply means demand for all property types is still strong. Vendors are more realistic with asking prices.’

Buyer sentiment is variable depending on location and one estate agent experienced a more muted picture in February.

Ian Williams, a chartered surveyor and estate agent at Robert Oulsnam & Co in Birmingham, said: ‘Activity in the market in B31 remains at a relatively low level with no urgency.’

The Rics said: ‘When disaggregated, most parts of the UK have seen a recovery in buyer enquiries over the past two months.’

Sales were ‘softer’ than the previous month, but well above the average for the past year.

The report added: ‘Going forward, near-term sales expectations are marginally positive, posting a net balance of +6 per cent.’ This is lower than previously forecast, but activity is expected to pick up further as the year rolls on.

Simon Rubinsohn, chief economist at the Rics, said: ‘The February Rics survey provides some grounds for encouragement around the sales market with not just buyer interest staying positive for the second successive month but also the uplift in new instructions to agents.

‘Whether the increase in stock coming back to the market will be sustained is likely to be a critical factor in explaining how things play out over the balance of the year especially with new build likely to remain constrained.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

Source link