‘The Bank of England shouldn’t wait any longer

The Bank of England should not wait any longer and take action. Now is the time to cut interest rates and slash the price of borrowing.

Many Britons have been saddled with hiked mortgages thanks to the central bank’s decision-making as of late and they should not have to suffer any longer.

Why did the Bank of England raise interest rates?

After the Covid-19 pandemic, inflation in Britain and across the world skyrocketed with the prices of everyday goods and services rising in tandem.

In response, the Bank’s Monetary Policy Committee (MPC) opted to raise the nation’s base rate in an attempt to ease the consumer price index (CPI) rate.

For months, Governor Andrew Bailey cited a target of two per cent for inflation with a potential rate cut being imminent if this was met.

For the 12 months to May 2024, this goal was finally reached with inflation remaining at this level into the following month.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The Bank of England should not wait any longer and take action

PA

Will the Bank of England now cut interest rates?

Despite the two per cent target becoming a reality, experts have warned Britons to hold off on celebrating just yet.

This is because the Bank of England looks at other contributing factors before making any decision to reduce the base rate.

Based on the latest data from the Office for National Statistics (ONS), certain parts of the economy have not bounced back as much as many would have hoped.

These industries include major sectors, including pubs and restaurants, which could postpone any action from the financial institution.

When will the Bank of England cut interest rates?

The next meeting from the central bank’s MPC is due to take place on August 1 but analysts are doubtful a reduction is on the cards.

Paresh Raja, the CEO of Market Financial Solutions, said: “Indeed, lower inflation and less economic turbulence could prompt the Bank of England to finally cut the base rate in two weeks’ time, which would be another boost for borrowers.

“However, it’s crucial to acknowledge that the base rate won’t be cut as quickly or significantly as it was hiked. Brokers will need to support borrowers and manage expectations accordingly.

“Meanwhile, lenders should focus on offering a broad range of product types that enable brokers and borrowers to choose options that best match their needs and their own predictions for what the base rate will do over the coming months and years.”

If rates are not cut at the beginning of August, the next two MPC meeting dates when a rate cut would take place would be either September 19 and November 7.

However, inflation is expected to rise slightly this year before falling again in 2025 which could give the committee’s members pause for thought.

LATEST DEVELOPMENTS:

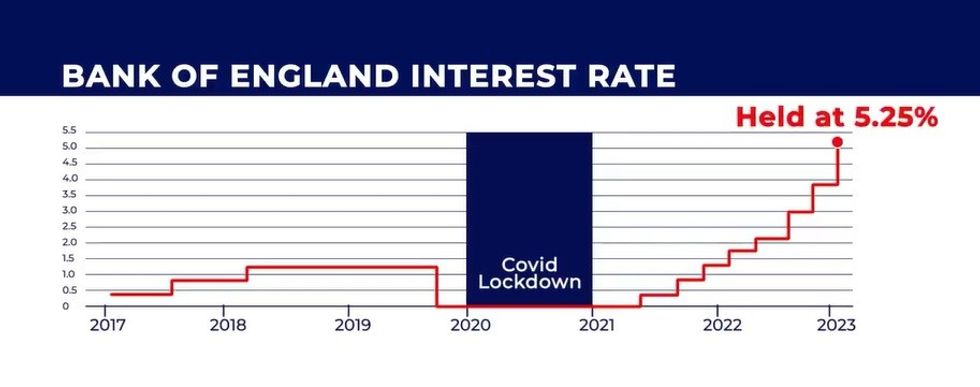

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

Why the Bank of England should cut interest rates

Britain’s homeowners have been unfairly penalised during this period of high interest with the base rate having being stuck at 5.25 per cent since August 2024.

Mortgage rates are higher for most of the last 10 years, with Moneyfacts reporting the average two-year fixed rate now is sitting under six per cent.

As a consequence, homebuyers and those looking to remortgage have to pay a lot more than if they had borrowed the same amount only a few years before.

Some 1.6 million mortgage deals are coming to an end this year, and while a cut to the base rate will likely not make an immediate effect on peoples’ finances, the Bank of England can ensure millions more are not saddled with rising costs going into next year.

Source link