What that super-long mortgage is really going to cost you

Homebuyers opting for marathon mortgages with terms of 35 years or more could end up paying tens of thousands of pounds in extra interest.

Last year one in five first-time buyers — more than 55,000 — took out long mortgage deals lasting at least 36 years, according to the trade body UK Finance. In 2022 fewer than one in ten first-time buyers opted for terms that long.

Choosing a long mortgage term helps to make repayments more affordable. At a time of high interest rates and property prices, it may be the only way that many first-time buyers can afford to get on the ladder.

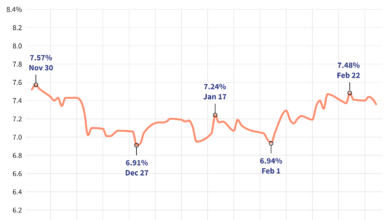

Mortgage rates were at rock bottom for more than a decade but the average two-year fix at 90 per cent

Source link