Billionaire investor issues stark warning about future of the stock market

A billionaire hedge fund manager has sounded the alarm over an impending market crash despite a soaring stock market.

Mark Spitznagel, whose Universa Investments specializes in betting on market volatility, told the Wall Street Journal that he sees the current financial outlook as like a ‘tinderbox.’

Spitznagel made his name on Wall Street by hedging his bets on calamitous moments, such as the 2008 financial crisis and the Covid-19 pandemic.

And he warned that right now, he believes ‘we’re on the way to something really, really bad.’

Spitznagel caveated that statement by adding ‘but of course I’d say that’, noting how his business strategy depends on planning for market crashes.

But his warning over an impending crisis is notable as analysts see the current US economy as strengthening.

The stock market has reached near record highs, and the Fed’s easing of rates at a time of falling inflation has many other hedge funders feeling bullish.

But while Spitznagel described the economy as going through a ‘Goldilocks phase,’ he doesn’t believe it has the foundations to last.

He told the Wall Street Journal that rate cuts can often trigger market reversals down the line, and said he is already seeing some other investors follow his lead despite the market’s current state.

‘You don’t feel like a fool for making a bearish argument,’ he added.

This is a similarly ominous outlook that former Home Depot and Chrysler CEO Bob Nardelli earlier in the year, as he told FOX Business that there is currently ‘tremendous pressure on the fault lines of our economy, and they’re about ready to crack.’

Spitznagel said that when the crash comes, he believes we will see a major selloff as stocks lose over half of their market value.

Experts point to the emergence of Artificial Intelligence as a watershed moment for the economy in the same way that the dot-com boom was at the turn of the century.

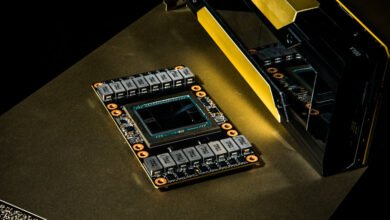

This led AI and tech firm Nvidia to become the largest company in the world by market capitalization in June, as major companies have also been riding the wave of profits.

But Spitznagel said that if his predicted crash occurs, this ‘Goldilocks phase’ may cause what the billionaire branded ‘the greatest bubble in human history.’

He branded the weak foundations of the current US economy as a ‘mega tinderbox timebomb’, an ominous analogy for how high debt levels and hidden risks have turned the economy into a tinderbox for a potential crisis.

However, while his outlook is far from a strong one, Spitznagel said that everyday investors would do best not to act on his advice.

He said the best long-term strategy is to passively invest in stocks, and Universa’s tactics of helping hedge funds through bad times are not as applicable to an individual investor.

Click here to resize this module

The looming presidential election is also making investors wary over a second Joe Biden term in the White House, due to his proposed hike on capital gains tax.

The President has outlined plans to increase the top marginal rate on long-term capital gains and qualified dividends from 23.8 percent to 44.6 percent.

Capital gains tax is paid on investments that have increased in value in the time between them being bought and sold – for example, stocks, properties or cryptocurrencies.

Ted Jenkin, CEO of oXYGen Financial, recently warned that the planned increases will go into effect at the same time critical tax cuts brought in by Trump will also expire. Jenkin explained those two factors would ‘crush’ the economy as Americans race to sell up their assets in advance.

Under the Biden proposal, eleven states would end up paying over 50 percent in capital gains levies when combined with state taxes. High tax states such as New York, California and Hawaii will be hit even harder.

Source link