Brockhaus Technologies Leads Trio Of German Growth Stocks With High Insider Ownership

As the German market experiences a robust gain with the DAX index up by 1.35%, investors are closely monitoring growth companies that demonstrate high insider ownership—a signal often interpreted as confidence from those who know the company best. In current market conditions, where transparency and alignment of interests between shareholders and management are more crucial than ever, these stocks might offer a compelling narrative for those looking to invest in Germany’s economic landscape.

Top 10 Growth Companies With High Insider Ownership In Germany

|

Name |

Insider Ownership |

Earnings Growth |

|

pferdewetten.de (XTRA:EMH) |

26.8% |

75.4% |

|

Deutsche Beteiligungs (XTRA:DBAN) |

39.3% |

34.7% |

|

YOC (XTRA:YOC) |

24.8% |

21.8% |

|

NAGA Group (XTRA:N4G) |

14.1% |

78.3% |

|

Exasol (XTRA:EXL) |

25.3% |

105.4% |

|

Alelion Energy Systems (DB:2FZ) |

37.4% |

106.6% |

|

Stratec (XTRA:SBS) |

30.9% |

21.9% |

|

elumeo (XTRA:ELB) |

25.8% |

99.1% |

|

Redcare Pharmacy (XTRA:RDC) |

17.7% |

47.4% |

|

Friedrich Vorwerk Group (XTRA:VH2) |

18% |

30.4% |

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG operates as a private equity firm with a market capitalization of approximately €313.43 million.

Operations: The company generates revenue primarily through two segments: Security Technologies, which brought in €39.43 million, and Financial Technologies, contributing €153.43 million.

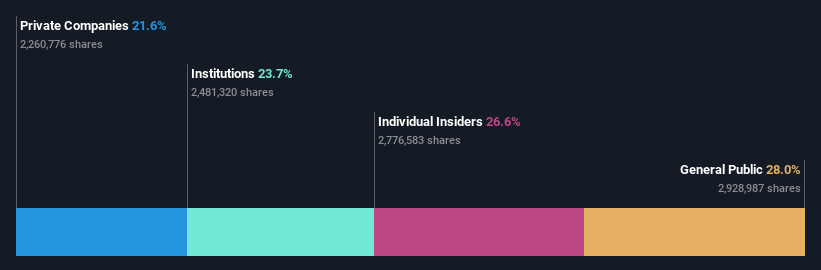

Insider Ownership: 26.6%

Earnings Growth Forecast: 74.2% p.a.

Brockhaus Technologies, a German growth company with significant insider ownership, is navigating a challenging financial landscape. Recently reporting a net loss of €1.38 million for Q1 2024, the company nonetheless showed promising revenue growth to €39.97 million from the previous year’s €33.89 million. Despite current profitability issues, Brockhaus is expected to become profitable within three years, with earnings forecasted to grow at an impressive rate annually. The firm’s revenue growth is also projected to outpace the general German market significantly.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Friedrich Vorwerk Group SE specializes in offering solutions for the transformation and transportation of energy across Germany and Europe, with a market capitalization of approximately €0.38 billion.

Operations: The company generates revenue through segments focusing on electricity (€72.07 million), natural gas (€157.60 million), clean hydrogen (€28.59 million), and adjacent opportunities (€118.73 million).

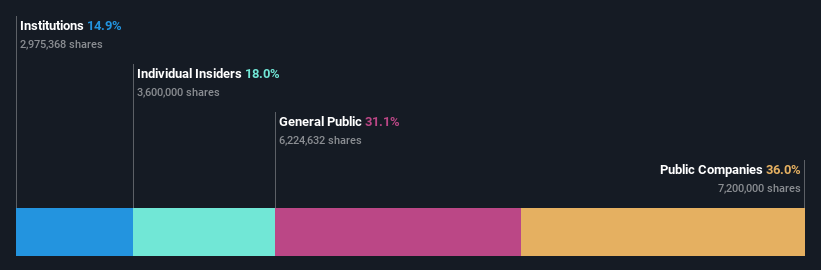

Insider Ownership: 18%

Earnings Growth Forecast: 30.4% p.a.

Friedrich Vorwerk Group SE, a German company with high insider ownership, shows robust growth prospects. Its earnings are expected to grow significantly at 30.4% annually, outpacing the broader German market’s 19.8%. However, its revenue growth is more moderate at 8.3% per year but still above the market average of 5.3%. Recent financials indicate strong performance with Q1 net income doubling to €1.56 million from €0.748 million year-over-year, although its forecasted Return on Equity remains low at 11%.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE is an online retailer specializing in fashion and lifestyle products, with a market capitalization of approximately €6.18 billion.

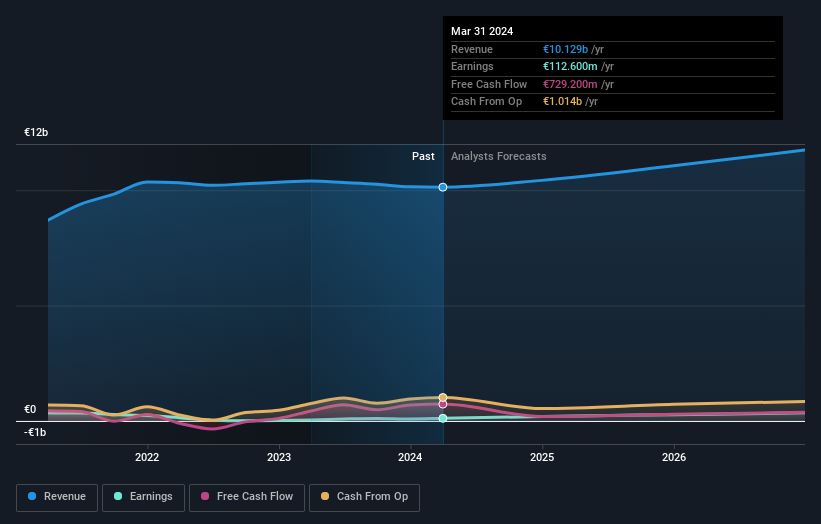

Operations: The company generates €10.40 billion in revenue through its online platform offering fashion and lifestyle products.

Insider Ownership: 10.4%

Earnings Growth Forecast: 26.5% p.a.

Zalando SE, characterized by high insider ownership, is set for substantial earnings growth, forecasted at 26.5% annually over the next three years, notably outstripping the German market’s 19.7%. While its revenue growth is slightly above the market average at 5.4%, its Return on Equity is expected to remain modest at 12.6%. The company recently projected a modest increase in sales and operating profit for 2024, reflecting cautious optimism despite a challenging economic backdrop.

Next Steps

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include XTRA:BKHT XTRA:VH2 and XTRA:ZAL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Source link