Could This Undervalued Stock Make You a Millionaire One Day?

Buying and holding great companies for a very long time is a proven strategy for making money in the stock market. This allows investors to not only make the most of secular growth trends but also helps compound their investments over time.

For instance, an investment worth $10,000 in shares of Nvidia (NASDAQ: NVDA) a decade ago is now worth $1.9 million. That translates into a whopping annual return of almost 70% over the past 10 years. During this time, Nvidia investors have benefited from the growing adoption of the company’s graphics cards in the gaming, automotive, and data center markets, illustrating just why holding a solid company for a long time could be a rewarding thing to do — even helping you become a millionaire.

However, a stock jumping 100x and turning $10,000 into nearly $2 million dollars is a rare occurrence. But at the same time, if you have that much cash available after paying off your bills, saving for tough times, and clearing high-interest debt, it may be a wise thing to put that money into an undervalued stock with terrific long-term potential.

Doing so will not only help you benefit from the power of compounding and secular growth opportunities but also allow you to construct a diversified portfolio.

Let’s look at the reasons why buying Nvidia right now as a part of a diversified portfolio could help investors become millionaires in the long run.

Here’s why Nvidia stock is undervalued

You may be wondering why I’m calling Nvidia an undervalued stock following stunning gains of more than 500% since the beginning of 2023. After all, the shares are trading at 36 times sales and 74 times trailing earnings. Both figures are significantly higher than the company’s five-year average sales multiple of 18 and trailing earnings multiple of 65.

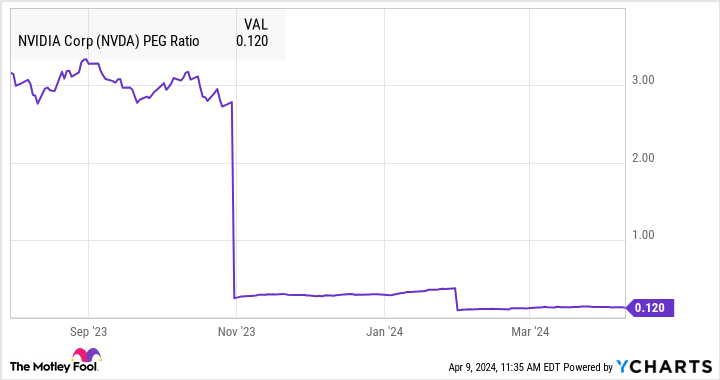

However, Nvidia stock is undervalued based on the potential growth it is forecast to deliver. This is evident from the stock’s forward price-to-earnings (P/E) ratio of 36, which is lower than the five-year average forward earnings multiple of 39. Meanwhile, Nvidia’s price/earnings-to-growth ratio (PEG ratio) is another clear indication of the stock’s undervaluation.

The PEG ratio is determined by dividing a stock’s P/E ratio by the projected annual earnings growth it is expected to deliver. In simpler words, the PEG ratio helps investors understand how expensive a stock is with respect to the growth it could deliver. A PEG ratio of less than 1 means that the stock is undervalued. As the following chart tells us, Nvidia is significantly undervalued based on the PEG ratio is concerned.

Buying Nvidia at this multiple looks like the smart thing to do considering that it is sitting on lucrative secular growth opportunities in multiple markets. Let’s take a look at them.

These solid opportunities can help Nvidia maintain its eye-popping growth

Artificial intelligence (AI) is the reason why Nvidia stock has surged so impressively in the past year or so. The good part is that the company’s share-price surge is backed by solid growth in its revenue and earnings.

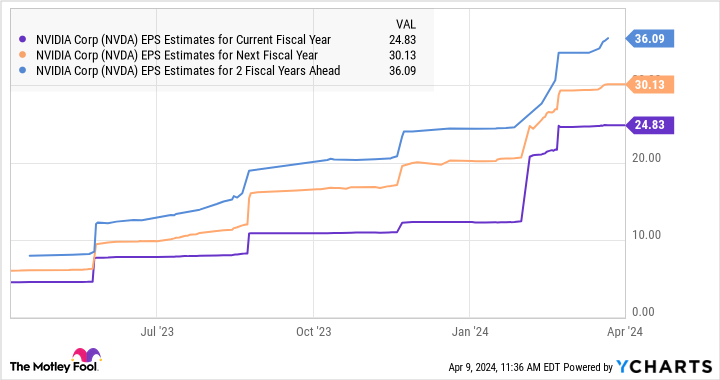

After finishing fiscal 2024 with a 126% increase in revenue to $60.9 billion and a 288% jump in adjusted earnings to $12.96 per share, analysts are expecting Nvidia to sustain its outstanding growth over the next three fiscal years.

More importantly, Wall Street is bullish about Nvidia’s long-term prospects. For instance, analyst Vijay Rakesh of Japanese investment bank Mizuho is expecting Nvidia’s data center revenue to increase to $89 billion in fiscal 2025 from last year’s $47.5 billion. By fiscal 2028, Rakesh is estimating that Nvidia could generate $280 billion from its data center business alone thanks to the terrific growth opportunity in the market for AI chips.

That won’t be surprising for a couple of reasons. First, the global AI chip market is predicted to generate $400 billion in revenue in 2027, according to Advanced Micro Devices. Second, Nvidia is leading the AI chip market by a huge margin, with an estimated market share of over 95%. The good part is that Nvidia has been taking steps to ensure that it remains the top player in this space.

From launching new AI graphics cards that are way more powerful than the existing ones at aggressive prices to making a reported move into the market for custom AI chips, there is a good chance that the company will continue to dominate this market in the long run. Meanwhile, Nvidia is also set to capitalize on new niches such as digital twins and AI personal computers (PCs).

These are multibillion-dollar opportunities for the company. For example, Nvidia management is forecasting a $150 billion addressable market for its Omniverse enterprise software, and it has started making headway. Similarly, the potential revenue opportunity for Nvidia in the AI PC market suggests that its annual gaming sales could jump by 5 times over the next four years.

All this shows that Nvidia could indeed remain a top growth stock in the long run because the market is likely to reward its healthy growth with more gains. That’s why investors looking to construct a million-dollar portfolio can consider buying it while it remains undervalued.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

Could This Undervalued Stock Make You a Millionaire One Day? was originally published by The Motley Fool

Source link