Euro Falls After Elections, Japanese Shares Rise: Markets Wrap

(Bloomberg) — Japanese shares opened higher thanks to robust economic data, while the euro fell to its weakest in nearly a month after French President Emmanuel Macron and German Chancellor Olaf Scholz suffered defeats in the European Parliament elections.

Most Read from Bloomberg

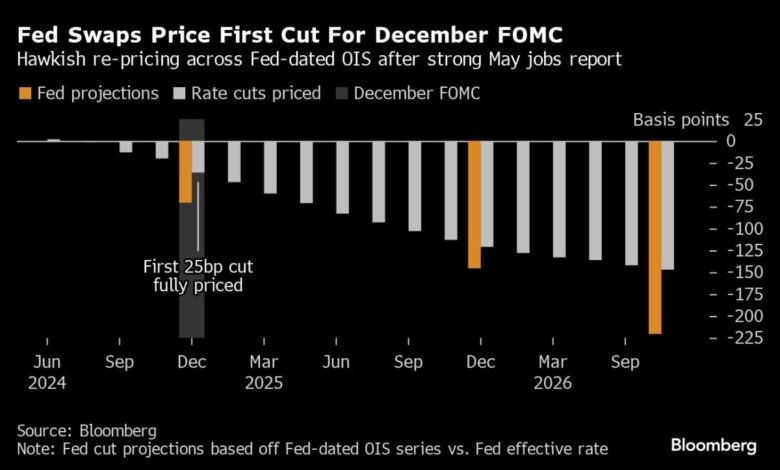

The common currency fell as much as 0.3%, underperforming major peers, with the vote outcome leading Macron to call a snap legislative ballot in France. The yield on 10-year Treasuries advanced after surging Friday, when a solid US jobs report spurred a rethink on Federal Reserve interest-rate cuts and eased concern about an economic slowdown.

Japan’s Topix rose 0.5% after data on Monday showed the country’s economy contracted less than initially estimated in the first quarter, with corporate investment figures revised to show a less dismal performance, as authorities hold out hopes for a transition to demand-led growth.

Markets in China, Hong Kong and Australia were closed Monday for holidays.

Upcoming data highlights this week also include UK wage numbers, China inflation and US consumer and producer price figures.

The latest jobs figures highlight a labor market that continues to defy expectations and blunt the impact on the economy from high interest rates and prices. That strength risks keeping inflationary pressures stubborn, which will likely reinforce the Fed’s cautious stance.

“We still expect the Fed to cut rates in September, but another set of prints like today’s would likely also take that off the table,” Seema Shah, chief global strategist at Principal Asset Management, said Friday. “The positive news, however, is that with a labor market this strong, the US economy is nowhere near recession territory.”

Economists at Citigroup Inc. and JPMorgan Chase & Co., among the few who were still predicting a Fed cut in July, changed their calls after the jobs report. Citi’s Andrew Hollenhorst now sees cuts in September, November and December. JPMorgan’s Michael Feroli predicts a Fed reduction in November.

Investors may glean more on the Fed’s resolve to ease monetary policy when US policymakers update their forecasts for interest rates Wednesday. The central bank is widely expected to hold borrowing costs steady for a seventh consecutive meeting, but there’s less certainty on officials’ rate projections.

With the Fed widely expected to stay on hold, the focus of the meeting will be the new Summary of Economic Projections. Back in March, Fed officials maintained their outlook for three rate cuts in 2024.

Some key events this week:

-

Pakistan rate decision, Monday

-

UK jobless claims, unemployment, Tuesday

-

China CPI, PPI Wednesday

-

Thailand rate decision, Wednesday

-

India CPI, industrial production, Wednesday

-

UK monthly GDP, Wednesday

-

US mortgage applications, CPI, Wednesday

-

FOMC decision, quarterly summary of economic projections, Fed Chair Jerome Powell’s press conference, Wednesday

-

Australia unemployment, Thursday

-

Eurozone industrial production, Thursday

-

US jobless claims, PPI, Thursday

-

New York Fed’s John Williams moderates discussion with US Treasury Secretary Janet Yellen, Thursday

-

Tesla annual meeting, Thursday

-

Japan rate decision, Friday

-

U. of Michigan consumer sentiment, Friday

-

Chicago Fed’s Austan Goolsbee, Fed Governor Lisa Cook, Friday

Some of the main moves in markets:

Stocks

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro fell 0.2% to $1.0779

-

The Japanese yen was little changed at 156.85 per dollar

-

The offshore yuan was little changed at 7.2653 per dollar

Cryptocurrencies

-

Bitcoin was little changed at $69,643.01

-

Ether rose 0.1% to $3,704.6

Bonds

Commodities

-

West Texas Intermediate crude fell 0.3% to $75.34 a barrel

-

Spot gold rose 0.2% to $2,298.94 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link