Nvidia dips as S&P 500, Nasdaq slip from record

US stocks were little changed on Thursday after a Big Tech-fueled winning session, with investors weighing fresh labor data amid growing hopes for interest rate cuts.

The S&P 500 (^GSPC) hovered near the flatline on the heels of a record close. The Dow Jones Industrial Average (^DJI) popped 0.2%, while the tech-heavy Nasdaq Composite (^IXIC) gave back early session to slip nearly 0.2%.

Stocks took a breather after the roaring rally that also lifted the Nasdaq to an all-time high on Wednesday. Tech stocks helped drive the gains, with Nvidia (NVDA) overtaking Apple (AAPL) as the second biggest US company.

However on Thursday Nvidia shares gave back early session gains to dip below the flatline, sending the AI chip giant’s market cap below the $3 trillion level. Other megacap techs held steady, with Apple and Meta (META) little changed.

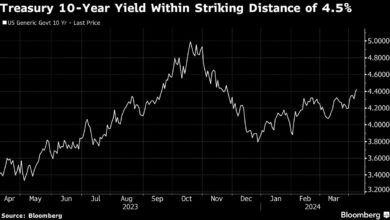

Meanwhile, Treasury yields revived from declines that bolstered the stock rally. The benchmark 10-year yield (^TNX) edged up to around 4.30%, coming off its lowest level since March hit Wednesday.

The market has greeted recent soft economic readings as a reason to put a Federal Reserve policy pivot back on the table, with the ADP private payrolls miss just the latest sign of a labor market cooldown. Traders now see a 69% chance of a September rate cut, versus around 50% a week ago, according to the CME FedWatch tool.

Across the pond, the European Central Bank cut interest rates by 25 basis points on Thursday for the first time since 2019, in a widely anticipated move.

Read more: How does the labor market affect inflation?

Weekly US jobless claims released on Thursday morning came in at 229,000 versus 220,000 expected by economists. The data gives investors another clue as to whether the Fed will nail its wished-for soft landing for the economy. But the countdown is on for the May monthly jobs report on Friday, seen as pivotal for stocks.

In individual movers, Lululemon (LULU) shares popped 4% after the athleisure wear maker boosted its profit outlook and stock buyback program.

Live8 updates

Source link