Stock market slide: 12% crash in 4 months leaves investors shaken | Business News

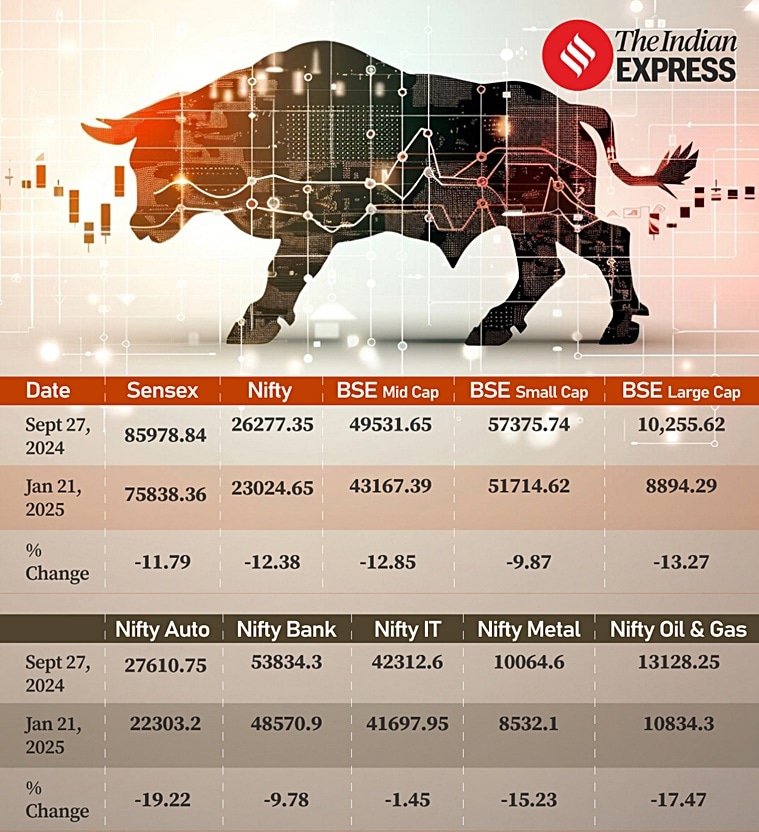

The Indian stock market has witnessed a drastic fall since the Sensex touched an all-time high of Rs 85,978.84 on September 27 last year with large-cap stocks leading the downslide. The benchmark index has plummeted by a whopping 10,000 points, or 11.79 per cent, over the past four months, marking a stark reversal of fortunes and leaving investors shaken and grappling with substantial losses. The NSE Nifty Index has also taken a hit, falling by 12.38 per cent during the same period. Large cap stocks took the maximum hit as foreign investors sold heavily, leading to a 13.27 per cent fall in NSE large-cap index in four months.

The sell-off has been widespread, affecting large, medium, and small capital companies across the board — the NSE Mid-cap index has dropped by 12.85 per cent, while the small-cap index has tanked by 9.87 per cent. While IT shares remained largely unaffected, capital intensive sectors like automobile and oil & gas suffered badly.

The reasons for this bloodbath are not far to seek. The economic landscape has undergone significant changes, with India’s GDP growth slowing down and high-frequency indicators moderating throughout 2024. Although these indicators show signs of bottoming out, the market faces additional headwinds. Food inflation remains high and sticky, while high US bond yields have strengthened the dollar against most currencies, including the rupee. Commodity prices have also started to rise, diminishing the prospects of a rate cut by the Reserve Bank of India.

The aftermath of the US presidential election has further exacerbated the situation, with investors increasingly favouring dollar assets. Foreign Portfolio Investors (FPIs) have sold off most emerging market equities, including those in India.

Mutual fund holdings of investors have suffered badly with net asset values of schemes plunging across the board. “XIRR (extended internal rate of return) of my investments in a mid- and small-cap scheme has fallen by 21 per cent in the last couple of months. Still experts advise me to keep on investing through SIPs (systematic investment plan) despite the sell-off in the market. I’m a little worried but hopeful of a recovery as the past track record of recoveries in the market,” said Jacob Cyriac, a software engineer now based in the US.

XIRR is a parameter used to calculate the returns on a mutual fund investment. It’s useful for investments with irregular cash flows, such as those made through an SIP. Despite the sell-off, equity funds saw a 14.5 per cent rise in inflows to Rs 41,156 crore in December.

When valuations are very high, some unexpected negative triggers can cause sharp corrections. In September, valuations were very high and the economy was in a sweet spot because the GDP growth was high and corporate earnings were robust. “Suddenly the situation changed with the Q2 GDP numbers, which came worse-than-expected. It was the beginning. The decline in the GDP growth was reinforced by the Q2 corporate results which were also lower-than-expected,” said V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

The country’s GDP growth slumped to a seven-quarter low of 5.4 per cent in the second quarter of FY2025. Key high-frequency indicators such as banking credit growth, personal loans growth, GST collections and rail and port traffic have slowed over the last one year, which is reflecting in the slowing GDP growth, global investment bank BNP Paribas said.

The Trump factor then contributed to the havoc. “We saw Donald Trump’s victory which led to a rise in the US dollar. The 10-year US bond yield also rose by 100 basis points (bps) even after Trump’s victory. When the 10-year US bond is yielding 4.7 percent, there is no logic for foreign investors to invest in emerging markets, particularly when the valuations are high. This led to a relentless selling by FPIs,” Vijaykumar said.

FPIs sold Rs 94,017 crore of equities in October and Rs 21,612 crore in November. After buying Rs 15,446 crore worth of equities in December, they resumed selling in the first month of 2025, offloading Rs 51,748 crore till January 21, according to the National Securities Depository Ltd (NSDL) data.

Mid and small-cap correction may not be over

In the large cap, corrections are almost done but that may not be the case for mid- and small-cap stocks. “However, we can see another 3-4 per cent correction in adverse circumstances. In mid and small caps, there is more room for correction,” Vijaykumar said.

“The market has corrected from high. It is down 13-14 per cent from the peak. Nifty was around 26,000 and now it is at 23,000. If it (the fall) is more than 20 per cent, we can say that we are crashing. In the past also whenever we have seen corrections it was to the tune of around 15 per cent,” said Shrikant Chouhan, Head Equity Research, Kotak Securities.

Over the last four years, the rally in Indian equities has been supported by strong earnings growth besides domestic flows. However, the situation has changed now in the industrial sector. “The Nifty 50 EPS more than doubled over FY20-24, recovering from a low base. However, in the last six months, we have seen broad-based earnings estimate cuts. Initial trends for the December 2024 quarter, as highlighted in business updates by the companies, do not seem very encouraging,” said Kunal Vora, Head of India Equity Research, BNP Paribas.

Market capitalisation, or the total value of all listed shares, of the BSE-listed firms declined by Rs 53.86 lakh crore since September 27, 2024 to Rs 438.79 lakh crore on January 21, 2025. The loss is across the board with mutual funds and retail investors taking the hit. The unique registered investor base on the NSE crossed the 11-crore mark this week, NSE said on Wednesday.

Many high performing sectors fared badly in the last four months. Automobile shares were hit hard with the NSE Auto Index plunging 19.22 per cent and oil & gas plunging 17.47 per cent. Metal shares also lost ground with sector index falling 15.23 per cent. However, IT shares managed to stay afloat despite the immense selling pressure but lost only 1.45 per cent.

Future guidance

What’s the way ahead? “We expect 2025 to be another year of single-digit returns for the markets. Indian GDP growth has slowed and high-frequency indicators have moderated through the course of 2024 and while these are showing signs of bottoming out,” Vora said. In the interim, strong domestic inflows continue to support the Indian equity market and we do not see any major risk to this. Overall, we see low likelihood of valuation multiples rerating in 2025 and expect market returns to track or slightly lag earnings growth, he said.

Further, Trump’s policies in the US are expected to influence the direction of the global markets and economy in the coming months.

FPI holdings have reduced to 16 per cent in 2024 after peaking at 20 per cent during FY14-20. While India’s dependence on FPI inflows has reduced due to its strong domestic flows, FIIs continue to hold $800 billion in Indian equities and their continued selling remains a risk for the market, BNP Paribas said.

Discover the Benefits of Our Subscription!

Stay informed with access to our award-winning journalism.

Avoid misinformation with trusted, accurate reporting.

Make smarter decisions with insights that matter.

Choose your subscription package