Stock Rout Takes Breather as Dollar Halts Ascent: Markets Wrap

(Bloomberg) — Asian stocks traded in narrow ranges following a rout that pushed a key benchmark close to erasing the year’s advance. Currencies were in focus once again as traders braced for higher-for-longer interest rates in the US.

Most Read from Bloomberg

The dollar edged lower versus most of its major peers Wednesday after seeing its best five-day gain since October 2022. The greenback’s resilience is exerting pressure on global emerging-market currencies and prompting authorities to ramp up defense against rapid depreciation.

The won rebounded after breaching a key level in the previous session. South Korean officials said they discussed currency concerns with Japanese counterparts. The Philippine peso weakened past 57-per-dollar for the first time since late 2022, while Indonesia’s rupiah extended a selloff despite the central bank’s intervention Tuesday.

After recent strong US data, the market is now pricing in 25-to-50 basis point reductions in the Federal Reserve rate this year starting July or September, said Kieran Calder, head of equity research for Asia at Union Bancaire Privée in Singapore. “The resulting stronger dollar is a headwind for most Asia markets and for Japan, pushing the yen towards the increasingly uncomfortable 155 per dollar level.”

MSCI’s Asia Pacific Index climbed slightly after earlier dropping as much as 0.4% amid worries about higher rates and geopolitical tensions.

Equity benchmarks fell in Japan and South Korea. Shares in mainland China gained as the securities regulator tried to allay concerns about new stock exchange rules following a rout in small-cap shares.

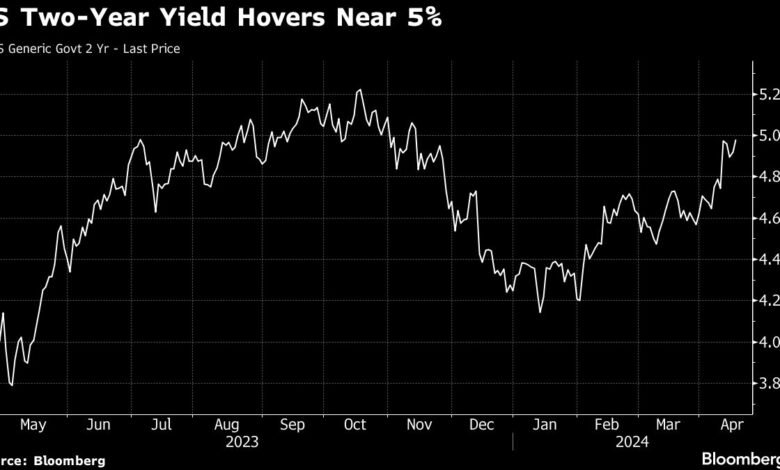

Treasury yields traded in a narrow range after climbing to fresh 2024 highs Tuesday when Federal Reserve chief Jerome Powell said it will likely take longer to have confidence that inflation is headed toward the central bank’s target. The remarks represented a shift in his message after a key measure of inflation exceeded forecasts for a third month.

Rate-Cut Delay

After starting the year by pricing in as many as six rate cuts in 2024, or 1.5 percentage points of easing, traders are now doubtful there will even be a half point of reductions. Market-implied expectations for Fed rate cuts — which have collapsed in the past two weeks — declined further after Powell’s comment on inflation.

On Tuesday, Fed Vice Chair Philip Jefferson said he expects inflation will continue to moderate with interest rates at their current level but persistent price pressures would warrant holding borrowing costs high for longer. Richmond Fed President Thomas Barkin said some recent data, including the consumer price index, has not “been supportive” of a soft landing.

Elsewhere, New Zealand home-grown price pressures persisted in the first quarter even as headline inflation slowed to its weakest in almost three years. The yield on the country’s two-year government bonds rose while the kiwi climbed after the report.

Oil edged lower as traders wait to see how Israel would respond to Iran’s weekend attack. Gold held near a record-high.

Key events this week:

-

Eurozone CPI, Wednesday

-

Fed issues its Beige Book, Wednesday

-

Cleveland Fed President Loretta Mester speaks, Wednesday

-

Fed Governor Michelle Bowman speaks, Wednesday

-

BOE Governor Andrew Bailey speaks, Wednesday

-

Taiwan Semiconductor earnings, Thursday

-

US Conf. Board leading index, existing home sales, initial jobless claims, Thursday

-

Fed Governor Michelle Bowman speaks, Thursday

-

New York Fed President John Williams speaks, Thursday

-

Atlanta Fed President Raphael Bostic speaks, Thursday

-

BOE Deputy Governor Dave Ramsden and ECB Governing Council member Joachim Nagel speak, Friday

-

Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.2% as of 11:39 a.m. Tokyo time

-

Japan’s Topix fell 0.6%

-

Australia’s S&P/ASX 200 rose 0.3%

-

Hong Kong’s Hang Seng was little changed

-

The Shanghai Composite rose 1.1%

-

Euro Stoxx 50 futures rose 0.6%

-

Nasdaq 100 futures rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1%

-

The euro rose 0.1% to $1.0633

-

The Japanese yen was little changed at 154.65 per dollar

-

The offshore yuan was little changed at 7.2598 per dollar

-

The Australian dollar rose 0.3% to $0.6423

Cryptocurrencies

-

Bitcoin rose 1.4% to $63,897.54

-

Ether rose 0.3% to $3,079.92

Bonds

-

The yield on 10-year Treasuries declined one basis point to 4.66%

-

Japan’s 10-year yield was little changed at 0.870%

-

Australia’s 10-year yield advanced four basis points to 4.37%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Abhishek Vishnoi and Rob Verdonck.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link