Bitcoin halving, spot ETF approval set stage for next crypto bull run — TradingView News

History has shown that bear markets don’t last forever. People who’ve been in crypto for a long time have seen the space evolving in cycles, alternating between periods of high activity and “crypto winters.”

Today, we may find ourselves at the outset of one such historic period that could mark the beginning of another bullish market. If so, this bull run could be one of the most significant in the history of crypto.

Against the backdrop of the burgeoning participation of Indian investors, bringing in fresh perspectives and enthusiasm, the upcoming bull run appears to hold unparalleled promise.

While each bull run may have its unique catalysts and market dynamics, several common elements tend to underpin and characterise these periods. A crypto bull run is typically marked by positive market sentiment, rising prices, heightened trading activity, technical signals, institutional adoption, macroeconomic factors, and market cycle dynamics.

During these times, investor behavior is often influenced by FOMO (fear of missing out). While individual bull runs may vary in duration and intensity, these key factors collectively define and shape periods of bullish market activity in the crypto ecosystem.

Identifying patterns and signals

Recognising distinct patterns and signals is key to identifying a potential shift towards a bull market. With a keen eye on two and a half bull-run cycles, certain events have emerged, sparking significant optimism in the market in recent months. Of particular significance is the convergence of several major events within a short timeframe.

The catalyst can be traced back to the recent approval of a Bitcoin exchange-traded fund (ETF) by Wall Street giant BlackRock. This is a watershed moment, symbolising the entry of institutional and retail investors into the crypto market with unprecedented ease.

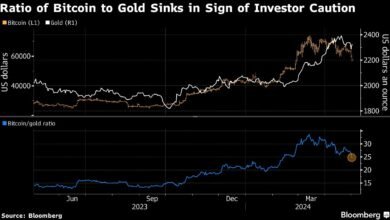

The projected influx of billions of dollars into Bitcoin ETFs upon their initial trading is expected to exert substantial upward pressure on prices, solidifying Bitcoin’s position as a legitimate asset class and laying the groundwork for increased demand.

Furthermore, Franklin Templeton, often perceived as “old-fashioned,” has submitted an application for a spot Ethereum ETF, as evidenced by a filing with the US Securities and Exchange Commission. Previously, eight other entities have expressed interest in introducing similar products to the market.

A spot crypto ETF tracks the market price of the underlying digital asset, offering investors exposure to the token without the necessity of direct acquisition.

Also read | New crypto exchange Pi42 avoids flat 30% tax — but is it safe?

Awaited catalyst

The second eagerly anticipated signal is the upcoming Bitcoin halving, slated for around April. Historically, this event has catalysed substantial price appreciation in Bitcoin and other tokens.

The halving, which lowers the rate of new Bitcoin issuance, effectively reduces the supply entering the market. Combined with escalating demand, this scarcity has historically translated into exponential price surges. Past halving events have witnessed Bitcoin’s price increasing.

Bitcoin’s previous halving events provide compelling evidence of the potential impact on prices. The first halving occurred in November 2012, precipitating a meteoric rise in Bitcoin’s price from around $12 to over $1,000 within a year—a staggering 83-fold increase.

The second halving, in July 2016, triggered a similar phenomenon, with Bitcoin’s price soaring from approximately $650 to a peak of around $20,000 within 18 months—a 30-fold increase.

The most recent halving, in May 2020, while yielding a less immediate price impact, saw Bitcoin’s steady ascent to new all-time highs by early 2021, surpassing $60,000.

Anticipation among Indian investors

In India, crypto investing represents a relatively nascent frontier, with investors joining in later than their Western counterparts. Yet, the landscape is rapidly evolving, with a significant demographic shift in investor profiles across all types of investments.

For instance, in online trading for the equity market, recent BSE data shows a striking surge in the number of accounts held by individuals aged 18-20 years. As of September 30, 2023, this figure stood at 16.1 million, a substantial increase from 3.4 million in March 2021.

The proliferation of easy-to-use online investment platforms such as Groww and Zerodha has helped a tech-savvy generation acclimatise to online trading—a trend that bodes well for crypto adoption.

Similarly, crypto exchanges have addressed accessibility challenges for Indian investors with their user-friendly interfaces. Exchanges now offer a diverse array of investment products to cater to varying investor preferences.

Moreover, the majority of Indian exchanges are now compliant with Financial Intelligence Unit (FIU) regulations, providing investors with an additional layer of comfort and confidence.

Also read | CBDC: Has RBI monetary policy injected a new life into the digital currency?

Looking ahead

With these factors driving optimism for an impending bull run, one thing remains certain: the crypto revolution is only in its nascent stages, and the opportunities it presents are boundless.What excites me is the curiosity among investors to understand Bitcoin and other crypto assets and the changing narrative around these emerging assets.

Source link