Cashless: Is Digital Currency the Future of Finance?

Finance experts like Darrell Duffie see digital currency as an inevitability. “It’s hard to imagine that 100 years from now, people will be reaching into their pockets and pulling out grubby bits of paper,” he says.

As the Adams Distinguished Professor of Management and Professor of Finance at Stanford Graduate School of Business, Duffie’s research centers on banking, financial market infrastructure, and fintech payments. And with digitization already transforming the way money moves around the world, Duffie is particularly interested in how digital currency, whether developed privately or issued by governments, promises to revolutionize finance even further. In this episode of If/Then: Business, Leadership, Society, he explores how it could even expand economic opportunity for people left out of the current financial system.

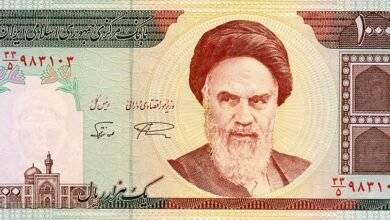

Duffie’s research has tracked countries’ development and rollout of central bank digital currencies (CBDCs). In contrast to cryptocurrencies like Bitcoin, a CBDC is backed by a central bank and is essentially a digital version of a country’s fiat currency. “Virtually all countries are exploring a central bank digital currency for potential use,” he says, and some, like China and the Bahamas, have already implemented them. This shift, Duffie believes, could offer significant benefits over the current financial system by sidestepping the high fees and inefficient timelines associated with moving money, particularly across borders.

Duffie notes that a well-designed CBDC could also address the issue of financial inclusion. “Millions of Americans do not have a bank account. They’re off the grid in terms of payments,” he says. “Maybe this technology would allow many underprivileged Americans to get access to the payment system.”

Despite the political challenges of transitioning away from traditional currencies, Duffie believes digital currencies are on the horizon. The challenge, he says, is striking the right regulatory balance between fostering innovation and mitigating risks. As this episode of If/Then explores, if the U.S. wants to future-proof banking, then a digital dollar could be a solution.

Source link