Dollar finds support ahead of US initial jobless claims, PMIs – United States

Written by Convera’s Market Insights team

Biggest downward payrolls revision since 2009

George Vessey – Lead FX Strategist

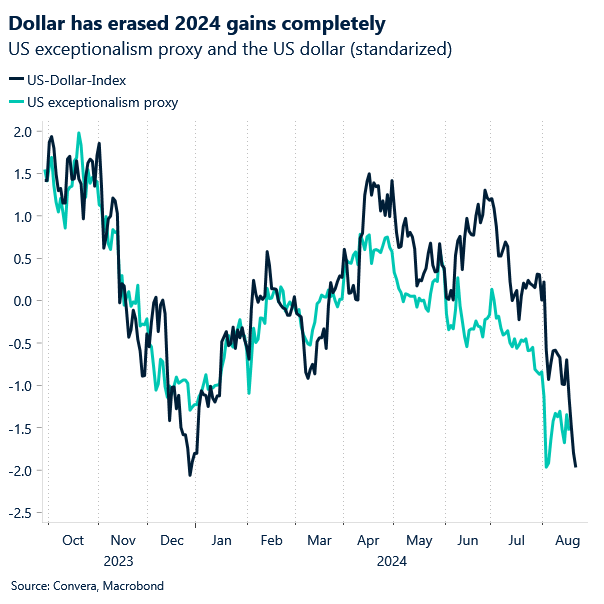

US job growth was most likely far less robust in the year through March than previously reported, according to data published by the Bureau of Labor Statistics (BLS) yesterday. While the payroll revision was fairly in line with expectations, it was the largest downward revision since 2009. As a result, US yields slipped, and the US dollar weakened further on concerns that the Federal Reserve (Fed) might be behind the curve in lowering interest rates.

Benchmark revisions are done every year and are rarely market moving, but particular attention is being put on them now as investors try to gauge the pace of monetary easing by the Fed now that inflation appears under control. Initial payrolls figures indicated employers added 2.9mln total jobs in the year through March, but this is likely to be revised down by 818,000 according to the first revision. The final figures are due early next year. The change isn’t a shocking one though as it still indicates a healthy rate of hiring and that the labour market is cooling in a moderate way. Thus, the prospect of a 50-basis point rate cut by the Fed next month is further diminishing. However, the Fed’s minutes from its July meeting suggests a September cut is virtually a done deal and four 25 basis point cuts are fully priced in by year-end. US 2-year yields have fallen back under 4% to suffer four daily declines on the bounce, weighing on the buck.

The US dollar index has slumped to its lowest point this year just atop the 101 level. In the short-term, downward momentum could gather steam with a lot of focus on the key psychological handle of 100, which it has only been below for five days out of the past two years.

PMIs further support sterling

George Vessey – Lead FX Strategist

The British pound continues to stretch higher against most peers thanks to the risk on climate. Investors are cheering the rising prospect of more monetary easing by the Fed after dovish Fed minutes yesterday. Better-than-expected flash PMIs across both services and manufacturing continue to show that the UK economy continues to fare well in 2024.

GBP/USD is trading at its highest level in over a year and the tone remains bullish given the sustained break above its 200-week moving average. The currency pair has climbed for 10 days out of the past 11 trading sessions, and is lingering near $1.31 – a level it has only spent four days above of the past 522 trading days. According to FX options pricing, the implied probability of GBP/USD being above $1.32 by the end of the year is around 40% versus a 25% probability of it being below $1.28. But in the short-term, the relative strength index (RSI) is in overbought territory, meaning we might see a pullback or period of consolidation soon.

Rate differentials continue to support the pound though, with money markets pricing in less than two rate cuts by the Bank of England by year-end versus the Fed’s four and the ECB’s three. The Jackon Hole symposium, which kicks off today, will provide more details on the monetary policy outlook from all key regions as traders scrutinise upcoming speeches by central bankers.

Euro run out of steam

Ruta Prieskienyte – Lead FX Strategist

EUR/USD advanced to a one-year high as expectations for a Fed rate cut continued to pressure the dollar. After a brief pause on Tuesday, European stocks resumed their upward climb, reaching a three-week high. The Bund yield curve bull steepened, with yields on the front and belly segments of the curve continuing to fall, while long-end yields ticked marginally higher. The narrowing front-end rate spread between the US and Germany also supported the euro.

Tuesday’s domestic data was light, keeping market attention focused on the annual US labour market revisions leading up to the Jackson Hole Symposium, which begins later today. In the face of an over 800k downward revision to US payrolls, the euro maintained its advance, as the data strengthens the case for Fed rate cuts in September. However, the daily RSI indicator is now firmly flashing overbought, and the pair appears to be losing momentum in its ascent. From a technical perspective, there is a good chance of a minor pullback in the euro ahead of Friday’s speech by Powell at the Jackson Hole Symposium.

More prominently, today’s macro releases clear the path for the ECB to resume its easing cycle. On the growth front, the composite PMI increased from 50.2 in July to 51.2 in August, largely driven by a surge in French services activity. However, the underlying data remains weak. The boost to the headline Eurozone number, inspired by the Olympic spirit, is unlikely to persist in France beyond the summer weeks. Meanwhile, output in Germany, Europe’s largest economy, continues to decline faster than expected.

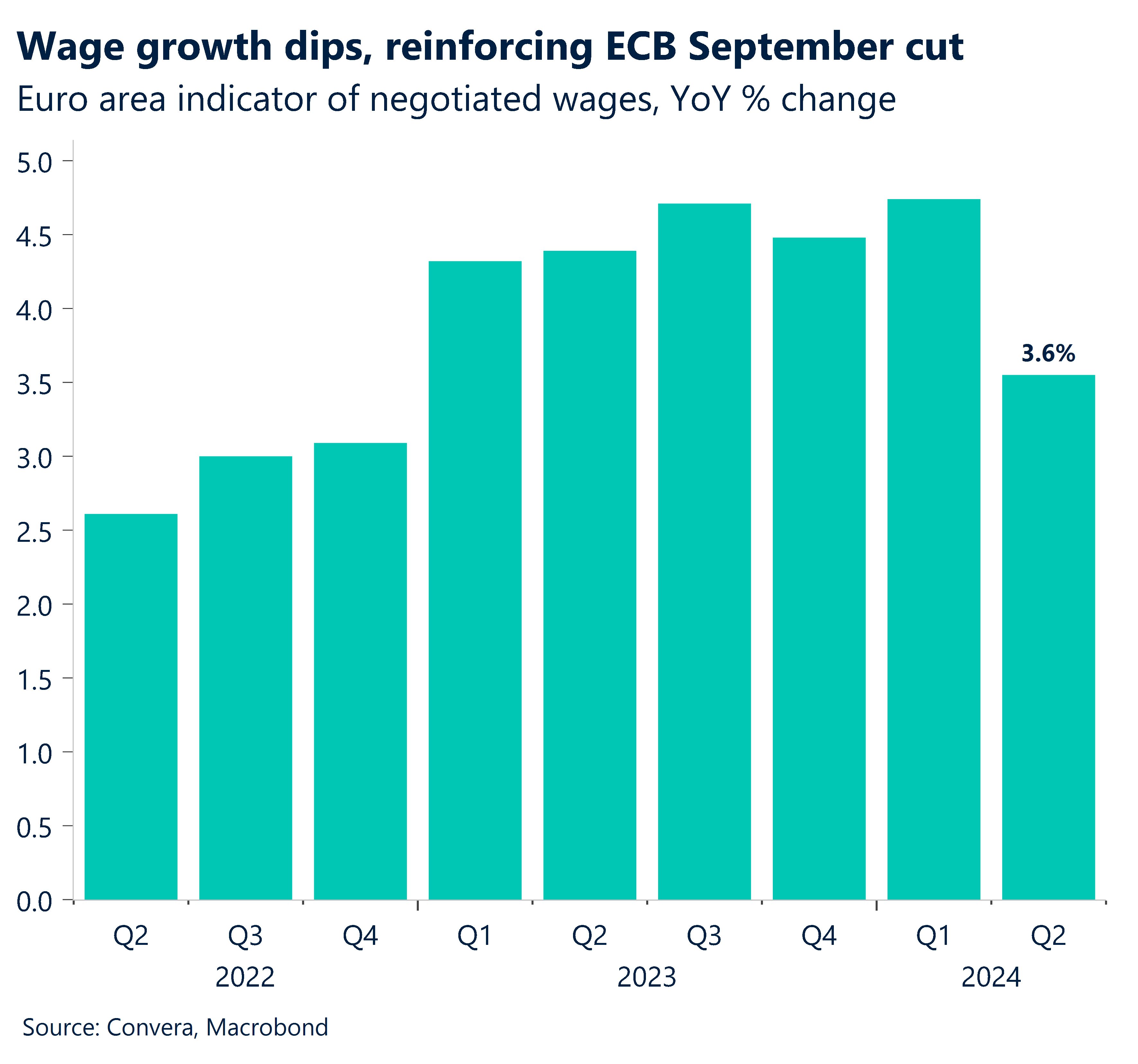

On the inflation front, which is of greater concern to the market at the moment, Eurozone Q2 negotiated wage growth eased to 3.6% year-on-year, down from the 4.7% year-on-year increase observed in Q1. Beyond the slowdown in wage gains, the ECB’s inflation outlook hinges on corporate profit margins absorbing some of the rise in labour costs and on improvements in productivity. However, the latter has disappointed recently, raising concerns that the ECB may be overly optimistic. ECB officials won’t have to wait long to assess a broader measure of workers’ pay, with data due on 6 September, less than a week before the next rate decision.

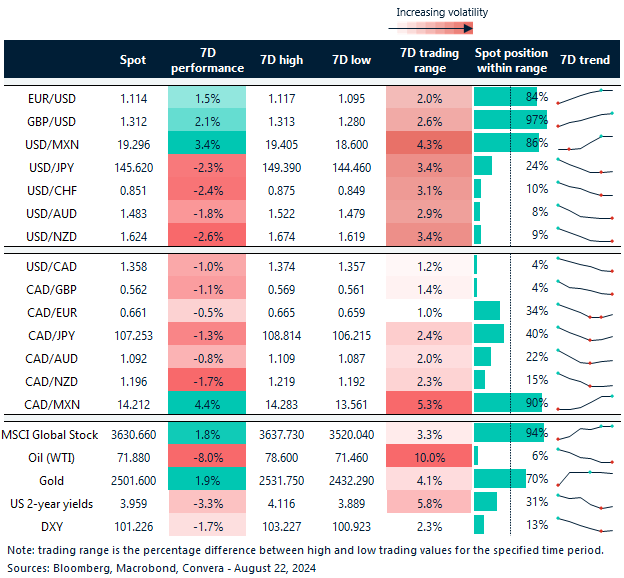

GBP/USD up almost 2% since last week

Table: 7-day currency trends and trading ranges

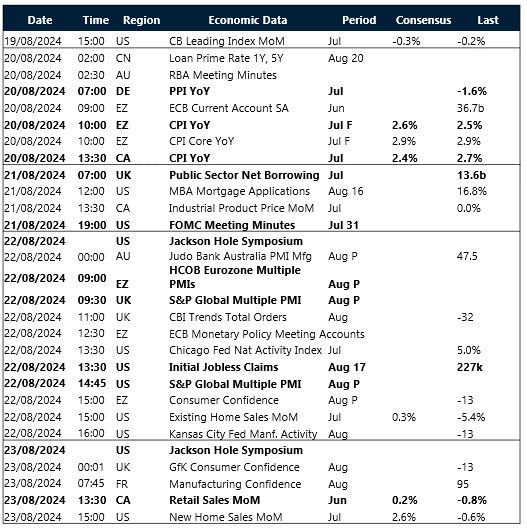

Key global risk events

Calendar: August 19-23

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Source link