100 years of history shows today’s tech-heavy stock market still has room to run, Goldman says

-

History shows the tech-heavy stock market still has room to run higher, Goldman Sachs said.

-

In five out of seven peaks in market concentration going back 100 years, stocks have kept rising.

-

Just 10 stocks account for 33% of the S&P 500 market cap and 25% of the index’s earnings.

A century of history has a message for everyone fretting over tech concentration in the stock market: don’t sweat it.

Looking at the past 100 years, the S&P 500 has continued rising in the year after market concentration peaked, according to Goldman Sachs.

“While investors usually think of elevated concentration as a sign of downside risk, during the 12 months after past episodes of peak concentration the S&P 500 rallied more often than it declined,” analysts led by Ben Snider wrote in a note on Friday.

That’s because in every episode, the laggards in the market tended to rise when the frontrunners started to lose momentum, propping the index higher.

“This supports our view that a ‘catch up’ by laggards is more likely to interrupt the ongoing Momentum rally than a ‘catch down’ by the recent market leaders,” Snider said.

Observers have been rightly pointing out that concentration is looking extreme. With 10 stocks accounting for 33% of the S&P 500 market cap and 25% of the index’s earnings, market concentration is at a multi-decade high, the note added.

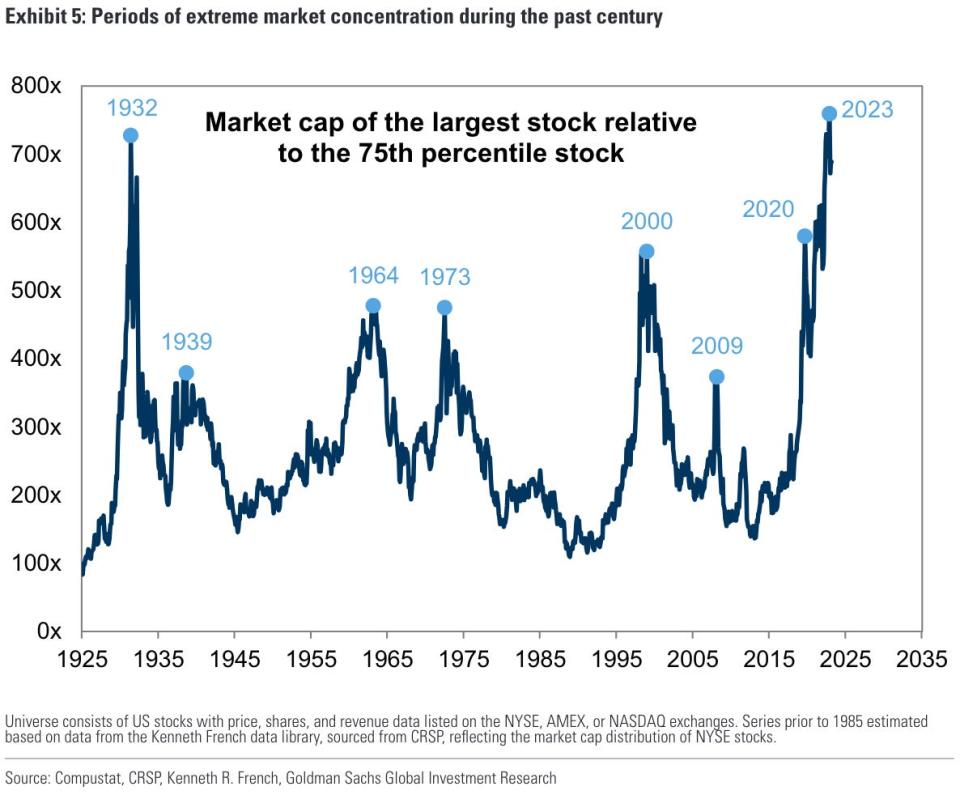

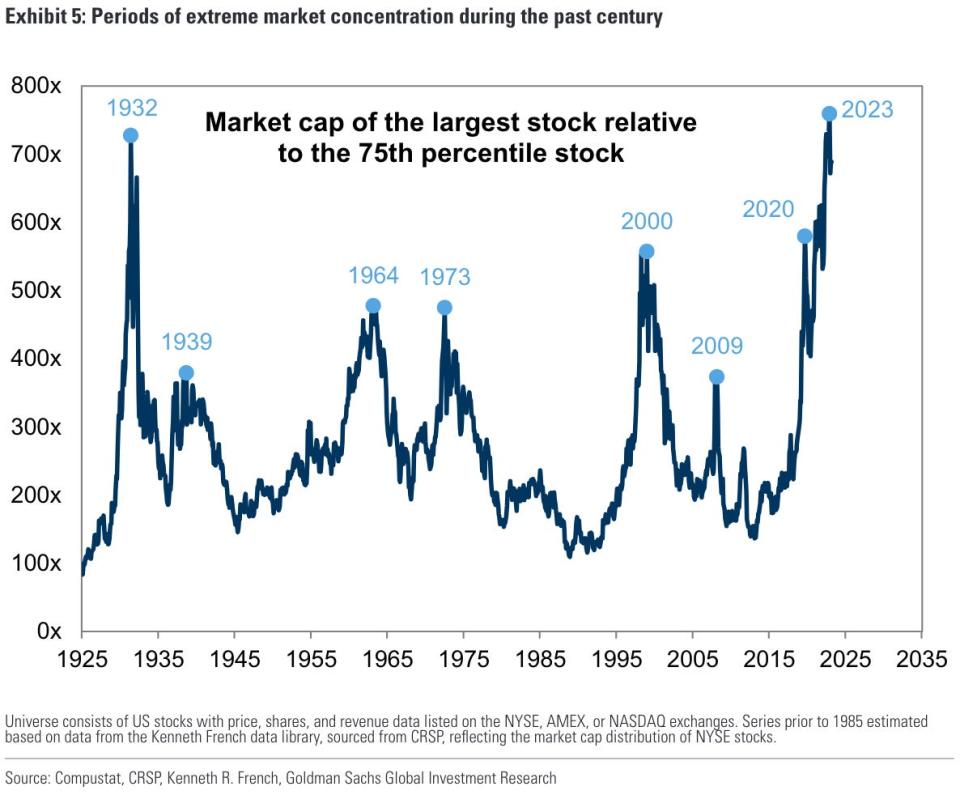

There are seven times markets have been intensely concentrated in the last 100 years. In five out of those seven episodes, which include the year after the 2008 crash and the COVID-19 recession, stocks have continued to rally after concentration peaked.

The exceptions to that trend are in the years 1973 during the Nifty-Fifty bubble and 2000 during the dot-com bubble, when stocks slipped into a prolonged bear market.

The behavior of the market today has elicited many comparisons to those two eras. Many of the top 10 stocks in the S&P 500 are tech stocks that are part of the Magnificent Seven cohort, like Microsoft, Apple, and Nvidia. Tech mania has given investors major dot-com déjà vu, with some experts comparing Nvidia’s ascent to that of Cisco’s in 1999.

But Snider said that other episodes when markets didn’t end up crashing bear similarities to 2024’s set-up as well.

“Although investors have focused on the comparison between today and the markets in 1973 and 2000, there have been several other examples of extreme equity market concentration during the past century,” he said.

One example is 1964, when the macroeconomic backdrop was similar to today (and the dot-com and Nifty-Fifty periods), but the bull market stayed intact after market concentration peaked.

“Like in 1973 and 2000, the peak of equity market concentration in 1964 coincided with low unemployment and a strong equity market backdrop,” Snider said. “But after market concentration peaked in 1964, both share prices and the US economy remained healthy for an extended period.”

Read the original article on Business Insider

Source link