Pound Sterling gears up for big week ahead

- The Pound Sterling faced rejection once again above 1.2800 against the US Dollar.

- GBP/USD buyers look to UK inflation and BoE policy decision for fresh impetus.

- The Pound Sterling yearns for a weekly close above 1.2800 to refuel the uptrend.

The Pound Sterling (GBP) rebounded firmly against the US Dollar (USD) this week, propelling GBP/USD to a new three-month top, but sellers once again lurked above the 1.2800 mark.

Pound Sterling struggled to stay resilient against US Dollar

Following a bullish start to the week, GBP/USD turned south in the second half of the week after failing to recapture the 1.2800 level.

The pair extended its previous week’s decline at the start of the week on Monday, as the US Dollar stretched its robust Nonfarm Payrolls data-inspired uptrend. Further, the Greenback also capitalized on the EUR/USD sell-off, as the Euro was undermined by the Euro area political jitters after French President Emmanuel Macron announced snap elections on Sunday, dissolving parliament after exit polls showed his alliance suffered a heavy defeat in European elections to Marine Le Pen’s far-right National Rally (RN) party.

In lieu of this, GBP/USD touched a weekly low at 1.2688 on Monday. Thereafter, the Pound Sterling staged a comeback and extended the renewed upside into early Wednesday, as the US Dollar paused its uptrend ahead of the critical US Consumer Price Index (CPI) data.

The US CPI data came in softer than expected and bolstered expectations of Federal Reserve (Fed) interest rate cuts this year. Increased dovish Fed bets smashed the US Dollar alongside the US Treasury bond yields across the curve, driving GBP/USD to the highest level in three months at 1.2861.

The headline CPI was flat over the month in May, below expectations for a 0.1% gain. Core CPI rose 0.2%, which is below estimates for a 0.3% increase. The annual figures also came in softer than the market consensus.

However, the pair failed to sustain at higher levels, as sellers quickly jumped back into the game on the Fed policy announcements. Fed held policy rates steady in the range of 5.25%-5.50%, following the June policy meeting. The revised Summary of Economic Projections, the so-called dot-plot, indicated the policymakers expect to cut rates only once in 2024, against a projection of three rate cuts in the March forecasts and down from two rate cuts widely anticipated.

Fed Chair Jerome Powell delivered hawkish comments during his post-policy meeting press conference, further allowing the US Dollar buyers to recover lost ground. GBP/USD reversed sharply in the Fed aftermath and gave up the 1.2800 threshold once again.

The Fed’s signal that it is eyeing only one rate cut this year continued to fuel the US Dollar recovery momentum, exerting additional downside pressure on the Pound Sterling in the second half of the week and dragging GBP/USD to multi-week lows below 1.2700 on Friday. Markets are now pricing in about a 58% chance of a 25 basis points (bps) Fed rate cut in September, compared to a 47% probability of such a reduction seen a week ago, CME Group’s FedWatch tool showed.

Meanwhile, the UK employment data released on Tuesday failed to have any significant impact on the Pound Sterling. With all the public appearances from the Bank of England (BoE) policymakers canceled ahead of the July 4 general elections in the UK, the pair remained at the mercy of the US Dollar dynamics.

Week ahead: UK inflation and BoE decision on tap

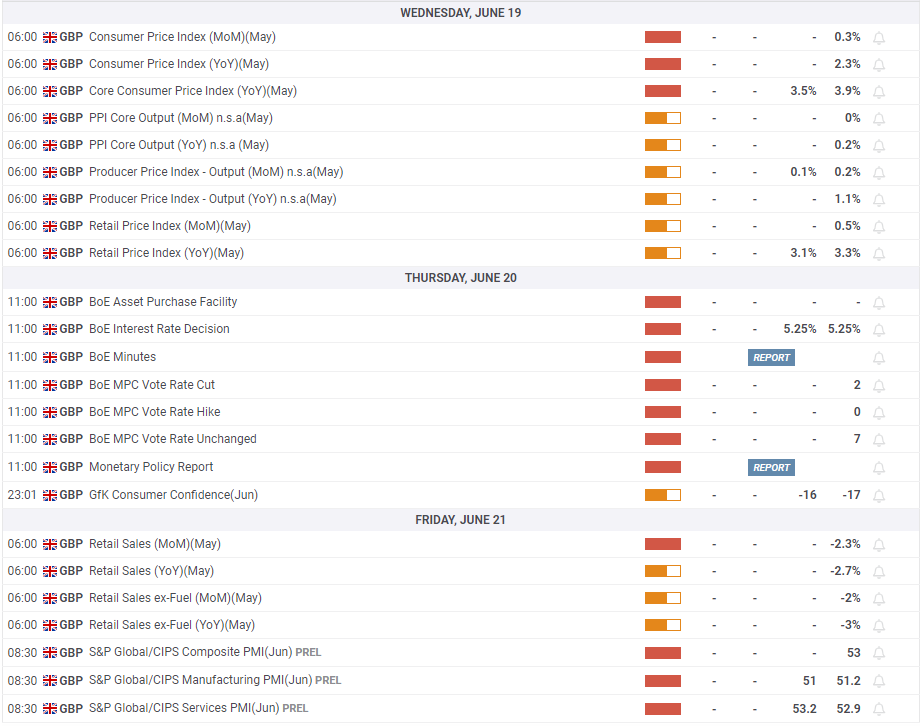

With the US CPI data and Fed policy announcements out of the way, the focus now shifts toward the inflation report from the UK and the Bank of England (BoE) interest rate decision in the week ahead.

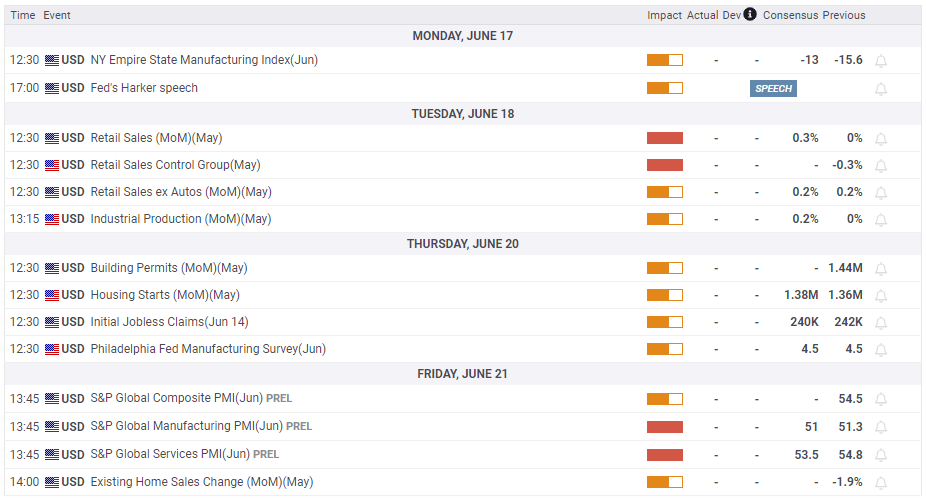

There are no relevant economic statistics due from both sides of the Atlantic on Monday, but China’s activity numbers could keep traders entertained.

Tuesday will feature the US Retail Sales report, followed by Industrial Production and other minor data. The UK CPI data for May will be published on Wednesday, ahead of the BoE policy verdict on Thursday. The US weekly Jobless Claims and Building Permits data will be released the same day.

On Friday, the UK Retail Sales data will drop, followed by the S&P Global Preliminary Manufacturing and Services PMI reports from the UK and the US.

Speeches from the Fed policymakers will be closely scrutinized during the week for fresh insights on the Fed’s interest rate path.

GBP/USD: Technical Outlook

As observed on the daily chart, GBP/USD continued to face rejection above the 1.2800 threshold.

Therefore, buyers yearn for a weekly candlestick close above that level for the Pound Sterling to accelerate the uptrend.

Acceptance above the latter would open the door for a test of the March 8 high of 1.2894. The next relevant resistance is seen at the 1.2950 psychological level.

The 14-day Relative Strength Index (RSI) dropped below 50 for the first time since early May, suggesting a buildup of bearish pressure. Additionally, GBP/USD made a daily close below the 21-day Simple Moving Average (SMA), currently located at 1.2744, for the first time since April 30 and dropped below the rising trendline support at 1.2725.

If GBP/USD fails to reclaim the above-mentioned levels, sell-off could be extended toward the confluence zone of the 100-day SMA and the 50-day SMA at around 1.2630.

The 200-day SMA at 1.2551 will be the last line of defense for Pound Sterling buyers.

Economic Indicator

BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Last release: Thu May 09, 2024 11:00

Frequency: Irregular

Actual: 5.25%

Consensus: 5.25%

Previous: 5.25%

Source: Bank of England

Source link