US Dollar Walks Proud, Stands Tall Despite Local Currency Threats

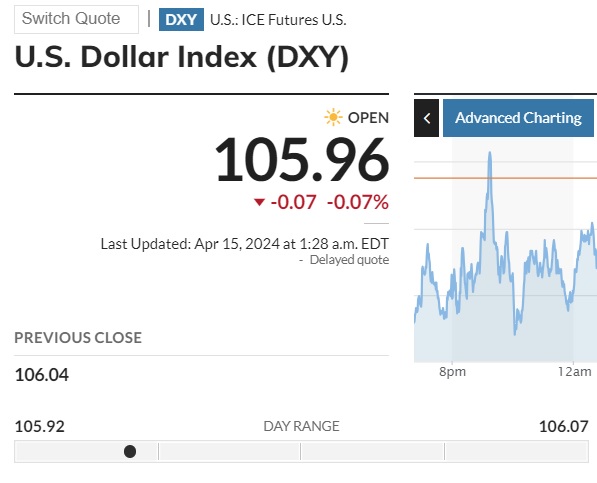

The US dollar is trampling all local currencies around the world this month in April 2024. The DXY index, which measures the performance of the US dollar shows it proudly hovering around the 105.96 mark. It had touched a day’s high of 106.07 before briefly retracing in price on Monday.

Also Read: Chinese Yuan Officially Outperforms the USD

Local currencies are bearing the brunt of the rising US dollar despite threatening to uproot it from the global reserve status. A handful of developing countries are looking to cut ties with the USD and promote their respective local currencies for trade.

However, the rising US dollar is dampening their dreams as local currencies are dipping in the charts against the USD. The development is making their import and export sectors suffer the consequences of a steep price rise. The threats to topple the US dollar as the world’s reserve is not playing out as local currencies remain on the losing side of the charts.

Also Read: USD Continues To Lose Purchasing Power Against Mexican Peso

US Dollar Outperforms the Indian Rupee, Chinese Yuan, & Japanese Yen

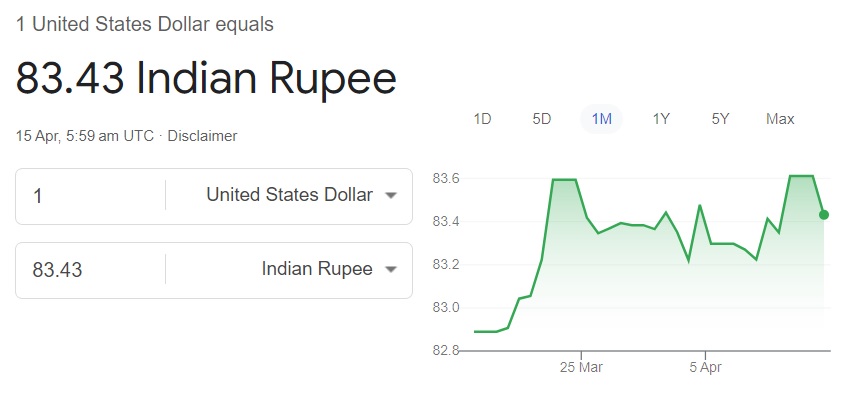

The US dollar outperformed local currencies this month including the Indian rupee, Chinese yuan, and the Japanese yen. All leading local currencies in Asia fell to all-time lows against the US dollar in April 2024. The Indian rupee fell to 83.61 on Friday’s closing bell but briefly recovered to 83.43 on Monday’s opening bell.

Also Read: US Reacts to Middle East Countries Joining BRICS

The rising US dollar is making Asian import and export firms shell out extra millions to stay relevant in business. Not just Asian currencies, the US dollar is dominating the European markets this month. The Sterling (Pound) fell to a five-month low at $1.2426 during Friday’s closing bell.

Also Read: Kenyan Shilling and East African Currencies Outperform the USD

The British inflation data will be out on Wednesday, and if the numbers are high, the GBP could dip further. In addition, currency investors have been buying the US dollar at every dip this year cementing its resistance level. In conclusion, the US dollar could climb further in the charts this year leaving local currencies far behind with empty threats.

Source link