Number of fixed rate increases gains pace: Moneyfacts – Mortgage Strategy

Fixed rate increases were more prevalent within the mortgage market this week, with only a couple of lenders reducing some deals.

There were also a few building societies launching new fixed rate deals onto the market. These movements led to a rise in the overall two- and five-year fixed mortgage rates.

Moneyfacts finance expert Rachel Springall explains that the prominent brands to increase fixed rates this week included HSBC by up to 0.45%, Santander by up to 0.34%, TSB by up to 0.30%, NatWest by up to 0.15% and RBS by up to 0.20% and Virgin Money by up to 0.10%.

Building societies were notably active too, making several fixed rate increases. Those lenders to make cuts to selected fixed rates included Coventry Building Society by up to 0.33%, Principality Building Society by up to 0.30%, Yorkshire Building Society by up to 0.30%, Furness Building Society by up to 0.30% (local area mortgages), Tipton & Coseley Building Society by up to 0.29%, Newcastle Building Society by up to 0.24%, Skipton Building Society by up to 0.22%, Nottingham Building Society by up to 0.20% and West Brom BS by up to 0.14%.

Fixed rate increases continued with Foundation Homeloans by up to 0.45%, Digital Mortgages by Atom Bank by up to 0.20%. Vida Homeloans increased by up to 0.45% but also reduced some rates by 0.05%, Gen H reduced rates by up to 0.10% and reduced selected homebuying bundle rates by up to 0.08% or increased them by up to 0.05%. Finally, The Mortgage Lender stood out by reducing selected fixed rates by up to 0.71%.

Springall namechecked some eye-catching deals which surfaced this week, including a five-year fixed deal from Coventry Building Society, priced at 4.36% and available at 65% loan-to-value for house purchase customers, it includes a free valuation and charges a £999 product fee.

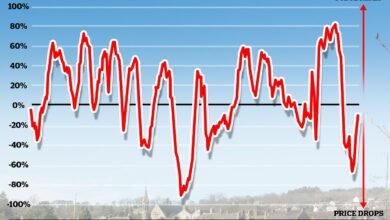

“A selection of mortgage lenders reviewed their fixed rate pricing this week, with some citing the volatile swap rate market over the past few weeks as a contributing factor for increasing their fixed rates. It’s likely lenders will continue their cautious approach around repricing for the next few weeks, but this should not deter borrowers from seeking out a new deal”.

She added: “Lenders can pull deals if they have an influx of applications, so speed to grab an attractive package is essential. As always, its vital borrowers seek advice of a mortgage broker to review the options available to them.”

Source link