Surprise inflation drop could mean cheaper mortgages for home owners by the summer

UK inflation has fallen back to 3.4 per cent, the lowest level in more than two and a half years, boosting hopes that the Bank of England could look to cut interest rates in the summer.

The larger-than-forecast decline is a significant boon for Rishi Sunak, who made reducing inflation one of his key economic pledges. Getting inflation down to 2 per cent is also a key target for the Bank.

The figures released by the Office for National Statistics (ONS) on Wednesday morning showed that inflation was 3.4 per cent in February, which is slightly lower than the 3.5 per cent predicted by economists.

This is the lowest level inflation has been at since September 2021. Despite inflation falling it does not mean that prices are falling, only that they are rising at a slower pace.

In other developments:

- Renters were hammered by increased costs that have accelerated at the fastest rate on record

- Economists predicted that the BoE will start cutting interest rates in the summer and they could reach as low as 3 per cent by next year

- Jeremy Hunt piled the pressure on the BoE to cut rates by saying the positive inflation figures “open the door” for interest rate reductions to help under-pressure homeowners

- The inflation news prompted NatWest to cut rates on a number of mortgage deals prior to the BoE’s decision on interest rates

The latest figures are moving gradually closer to the Bank of England’s 2 per cent inflation target and come ahead of the next interest rate decision on Thursday.

Financial markets overwhelmingly think that policymakers will keep interest rates on hold at 5.25 per cent, but the fall in inflation today increases the chances of them being cut in the summer, in what would be a welcome boost to homeowners with borrowings.

Mr Hunt said the inflation figure “opens the door” for the BoE to bring interest rates down.

He said: “Families today will heave a sigh of relief that we are firmly on track to bring inflation down to its target of 2 per cent. This is the lowest headline rate for two and a half years.

The latest figures are moving gradually closer to the Bank of England’s 2 per cent inflation target and comes ahead of the interest rate decision on Thursday

(PA)

“But most encouragingly food inflation, which was nearly 20 per cent a year ago, is now just 5 per cent.”

Mr Hunt added: “What I’m really saying is that as inflation gets closer to its target, that opens the door for the Bank of England to consider bringing down interest rates, that brings down mortgage rates, that makes a very big difference.”

Food price inflation fell back to 5 per cent in February, down from 7 per cent the previous month. Compared to January, food inflation lifted by 0.2 per cent – far lower than the steep rises seen a year earlier.

Paul Dales, chief UK economist at Capital Economics, said: “The second bigger-than-expected fall in CPI inflation in as many months, from 4 per cent in January to 3.4 per cent in February, probably won’t make the BoE sound any more doveish when it leaves interest rates at 5.25 per cent tomorrow.

“But our view that inflation will fall below 2 per cent in April and then ease towards 1 per cent suggests the BoE may have to start cutting rates in the summer and reduce them to 3 per cent next year.”

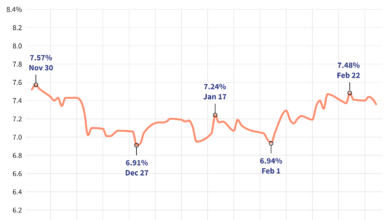

The pattern of inflation over the last decade

(ONS)

As a rough illustration, for a borrower with a £200,000 mortgage for 25 years paying 5.25 per cent, the average monthly payment will be around £1,200. If the BoE drops rates to 3 per cent this year the monthly payment would fall to around £950, saving mortgage holders around £250 a month.

The savings mortgage holders could be set to make over the next year is in stark contrast to renters. Their costs have increased at the fastest rate on record as the housing market continues to be impacted by constricted supply and higher interest rates.

The average UK rent increased by 9 per cent in the 12 months to February, up from 8.5 per cent in January, the Office for National Statistics (ONS) said.

It is the highest annual percentage change since the UK data series began in January 2015. Ben Twomey, chief executive of Generation Rent, said the latest rental figures were “shocking but not surprising”.

He added: “We’ve been feeling the impact of sky-high rents and unaffordable rent increases since 2021 and we have reached the very end of what we can afford.

“As the cost of living crisis apparently eases, the cost of renting crisis is continuing at pace.”

Speaking on the prospects for cheaper borrowing, Paula Bejarano Carbo, economist at the National Institute of Economic and Social Research, said lower inflation “possibly signals that the MPC can start to cut interest rates in the coming months – though we don’t expect any change at tomorrow’s meeting”.

Yael Selfin, Chief Economist at KPMG UK, said: “The Bank of England could opt for a wait-and-see approach at the next meeting, particularly with risks still skewed to the upside. More data and further easing of underlying inflationary pressures could give the policymakers confidence that inflation is sustainably back on target for the long term.

“Nonetheless, we expect inflation to undershoot the 2 per cent target for much of the second half of the year. This should allow the Bank to begin gradually cutting interest rates from the summer onwards, with overall cuts of 100 basis points this year.”

The ONS added that it was not seeing any sign yet of an impact on consumer prices from the Red Sea disruption, following attacks from Houthi rebels on cargo ships going through the trade route in recent months.

Grant Fitzner, chief economist at the ONS, said: “Food prices were the main driver of the fall, with prices almost unchanged this year compared with a large rise last year, while restaurant and cafe price rises also slowed.

“These falls were only partially offset by price rises at the pump and a further increase in rental costs.”

Source link