Renting or owning a property – which is cheaper for first-time buyers?

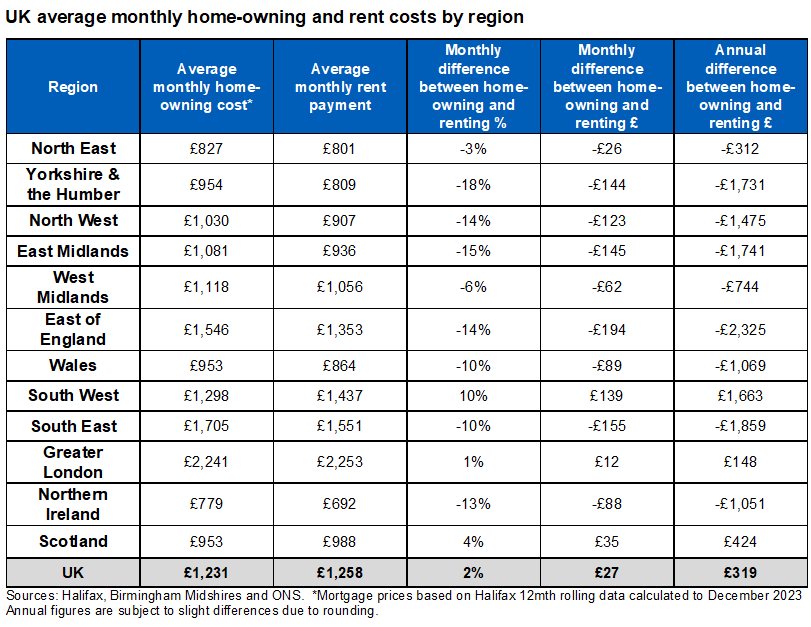

“Our latest analysis shows that, in nearly all regions across the UK, first-time buyers are better off renting than owning a similar home,” said Kim Kinnaird (pictured), mortgages director at Halifax. “In fact, the only regions where it’s cheaper to own rather than rent are the South West, London and Scotland.

“We know home ownership can offer long term financial and living stability, and that’s why we believe it’s an important step to take. Our customers want to create a secure future, so it’s a big priority for us to help people get there.

“However, elevated borrowing costs, alongside a lack of available homes to buy, is pushing ownership further out of reach for would-be first-time buyers in many parts of the country. This is why we’re major participants and big supporters of the government’s affordable home ownership schemes, such as shared ownership and the mortgage guarantee scheme, and we’re committed to helping first-time buyers fulfil their dreams of having a place to call their own.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.